07.20.2020

CGLytics CEO, Aniel Mahabier, discusses the increase in activist investor activity with CNBC Street Signs. New research from CGLytics reveals the growth in the number of activist campaigns and how activist investors are broadening their focus.

Increase in activism

The CGLytics report Activist Investors Broaden their Focus analyzes the number of activist campaigns carried out over the previous four years and deep dives into the increasing areas that are attracting activism.

During the interview with CNBC, Aniel notes that shareholders are beginning to focus on areas such as diversity and performance. And, even though there has been an overall increase in the number of activist campaigns this year, not all of them have been successful.

The changes we are seeing during the pandemic, are that activists are focused on improving corporate performance. Having the right board composition and board diversity are the areas activists have been focusing on. Culture is another area where we have seen activists putting more focus on to improve corporate performance. – Aniel Mahabier, CEO of CGLytics

Regional shift in activism

The research report notes that now activist investors are finding a lot of opportunity in APAC, but not so much in continental Europe. The question is, do we expect this trend to change, and if so, when?

Social, cultural, and economic factors play a big role, along with the European market being highly regulated. This doesn’t provide a lot of opportunity for activists to play a role. I expect to see a marginal change taking place over time. – Aniel Mahabier, CEO of CGLytics

Executive pay

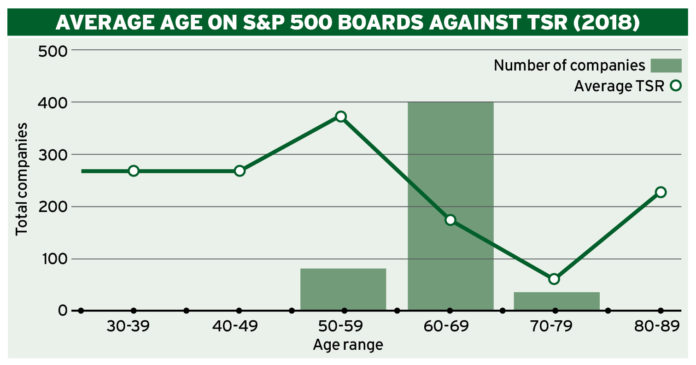

On this topic of executive pay, CNBC recalls that there has been a lot of focus from activists. Shareholder have objected to senior salaries in the past, even so companies have continued to pay out. During the pandemic, these senior salaries have been cut, and in some cases, granted in stock options. What are activists going to do with compensation?

A focus area of activists is to make sure executive pay is in line with the company performance. The median of CEO pay has risen, regardless of companies’ CEOs and Directors taking a pay cut. This is on both the S&P 500 and FTSE 100. We expect to see more focus on CEO pay in the upcoming proxy season. When it comes time for the AGMs in 2021, reflecting the 2020 performance year. – Aniel Mahabier, CEO of CGLytics

Source: CNBC Street Signs Europe

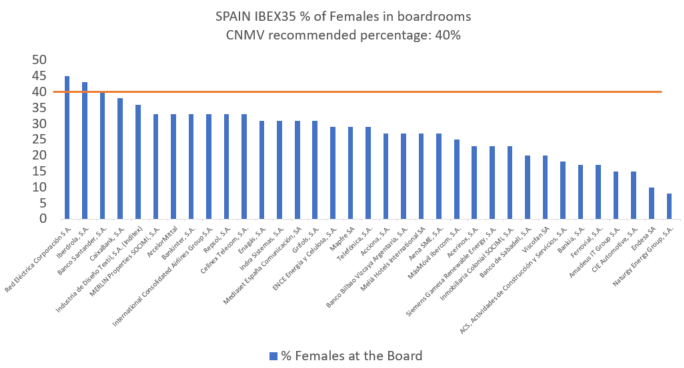

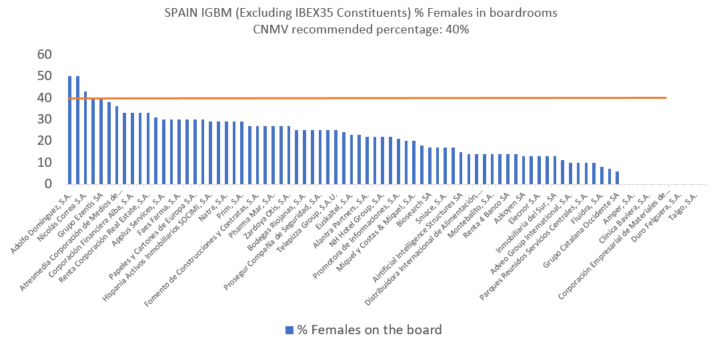

Board diversity

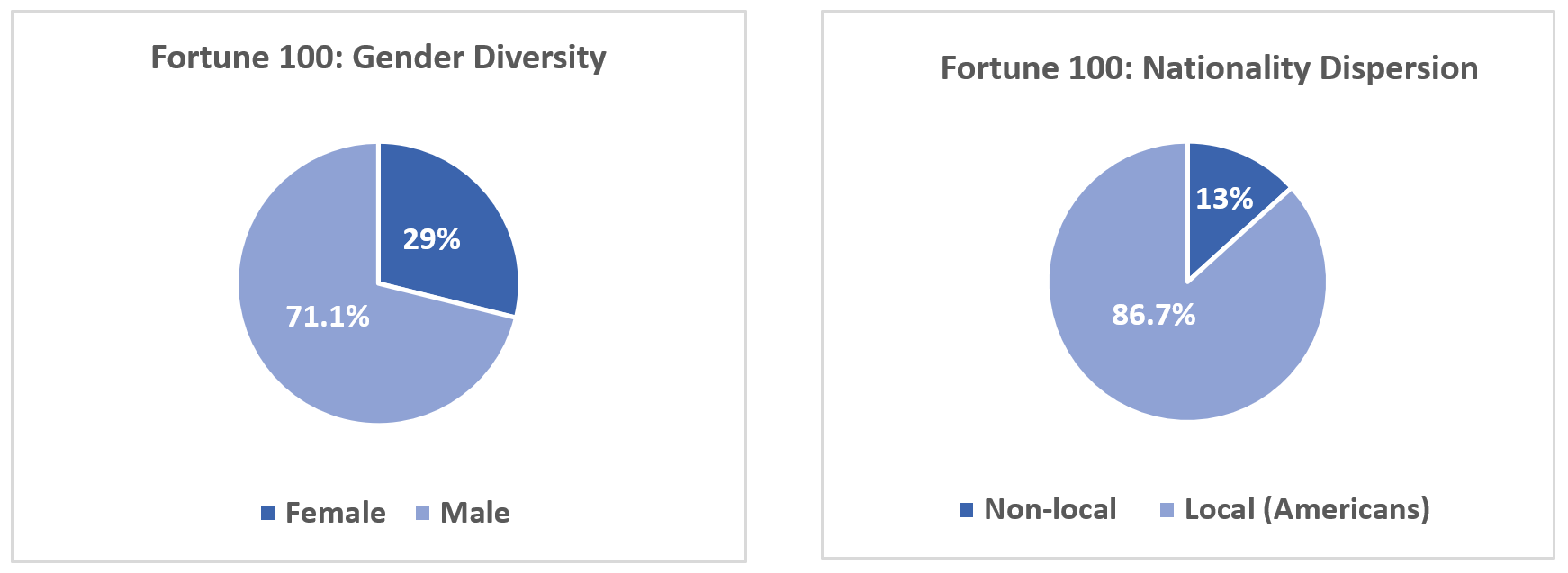

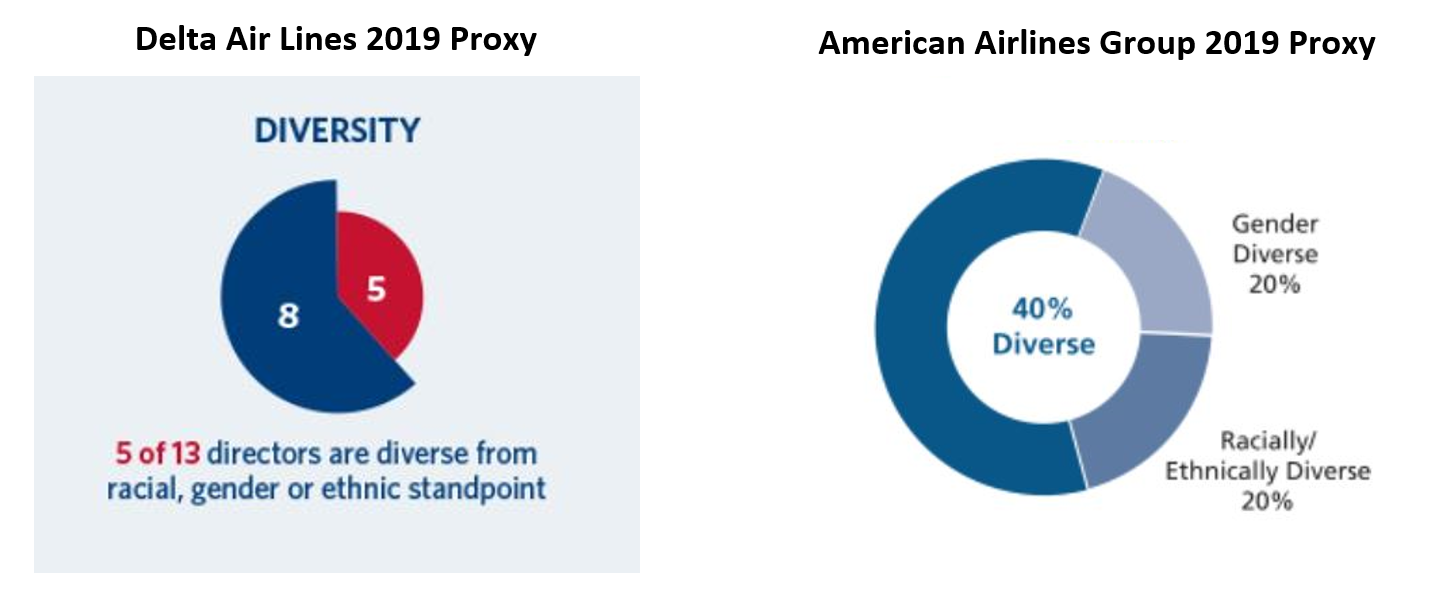

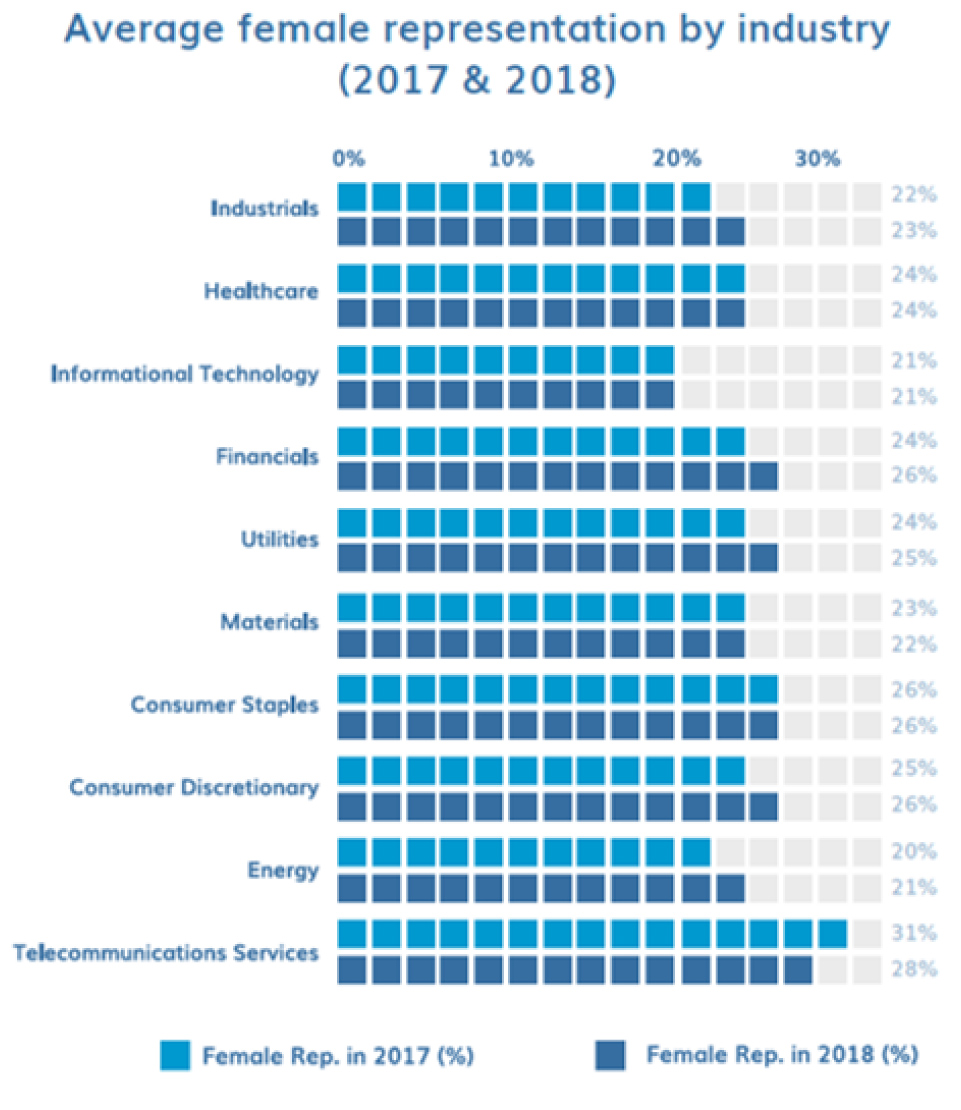

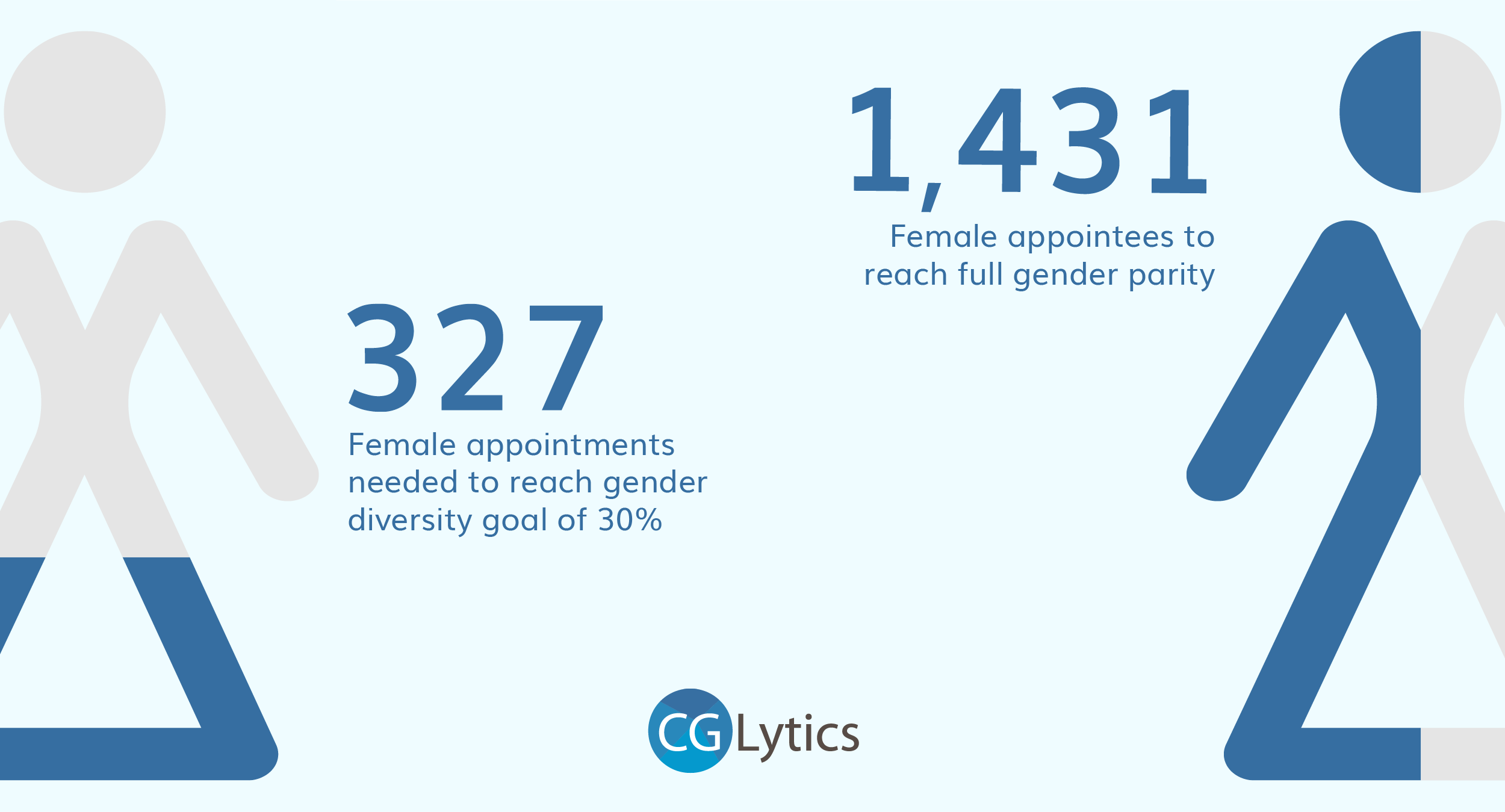

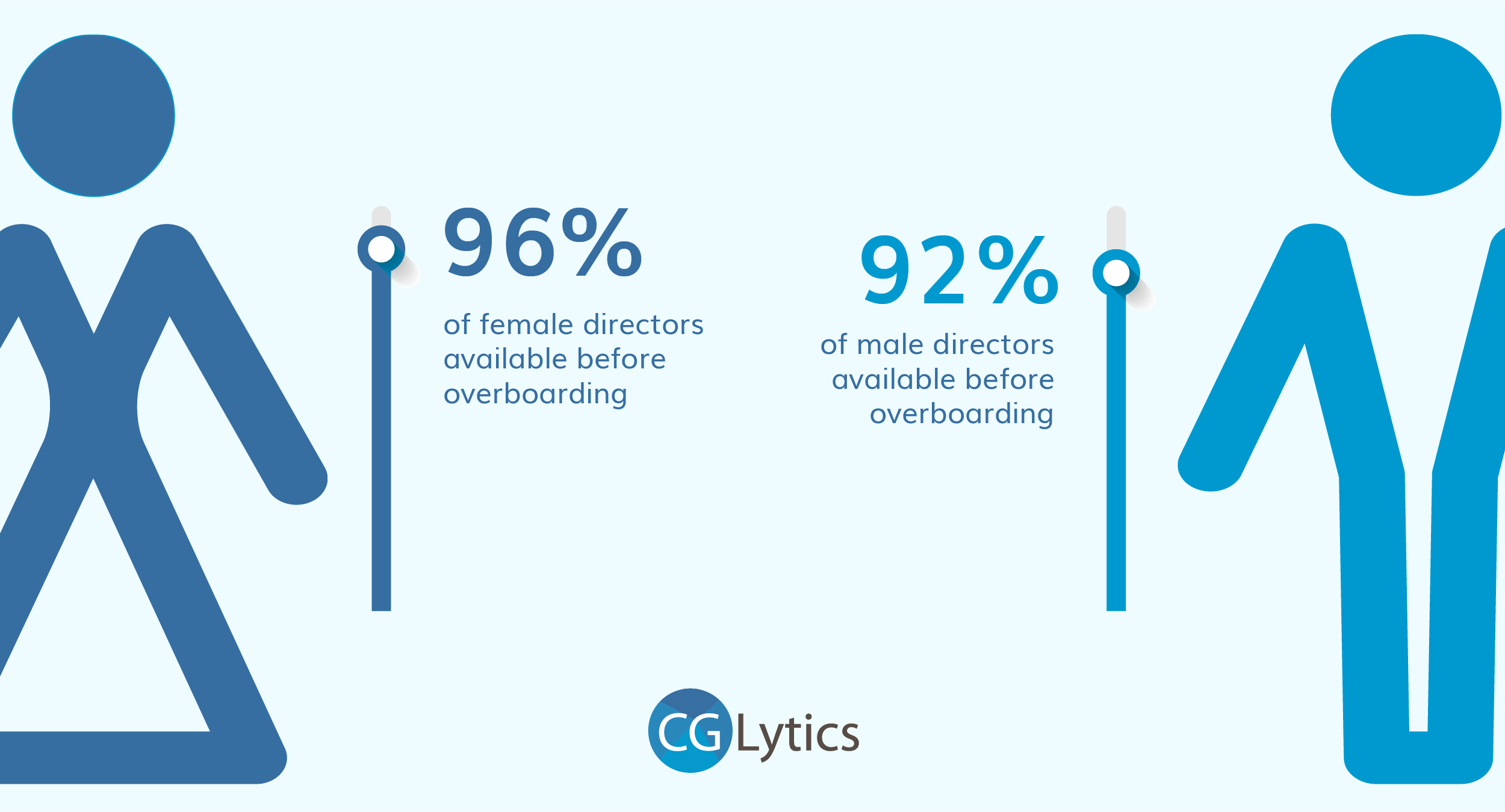

CNBC mentions about the motivation to change the makeup of boards, and that the representation of women on boards on the FTSE, is abysmal (still remaining below 30%). Will boards be motivated to improve diversity, due to the pandemic and the Black Lives Matter campaign?

The activist landscape is changing. We used to have the traditional activists playing a big role. Now you have passive institutional investment managers changing their style and becoming more active.

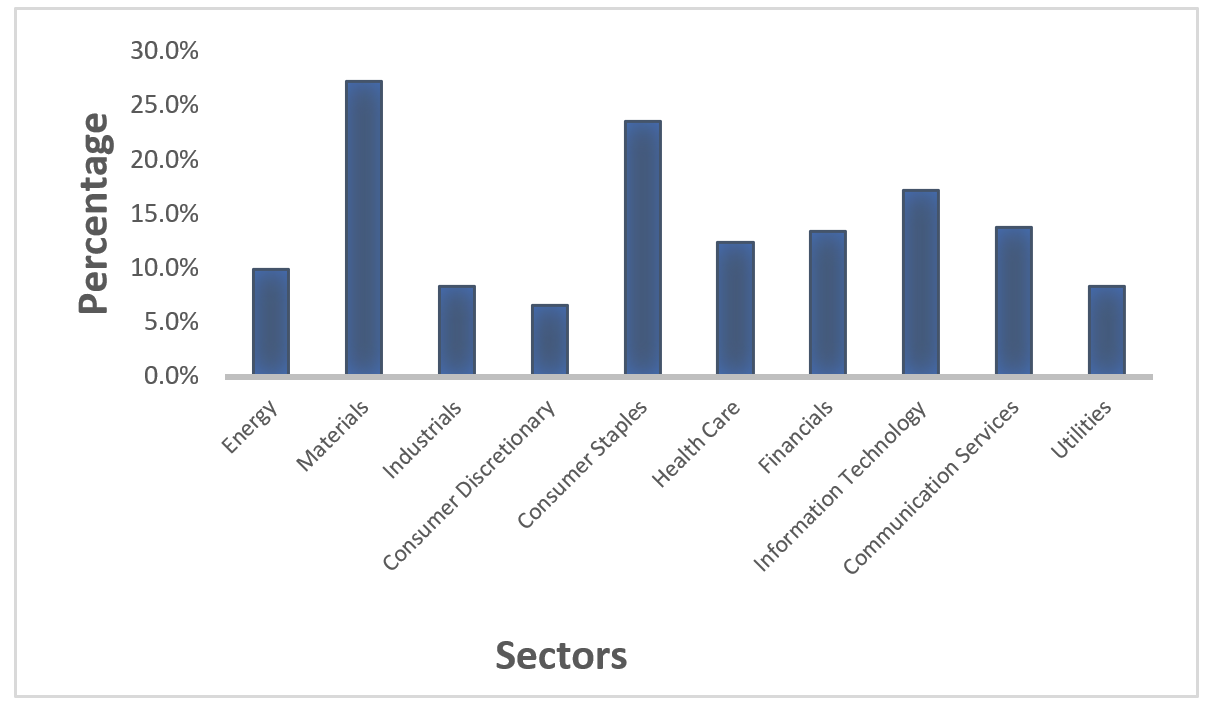

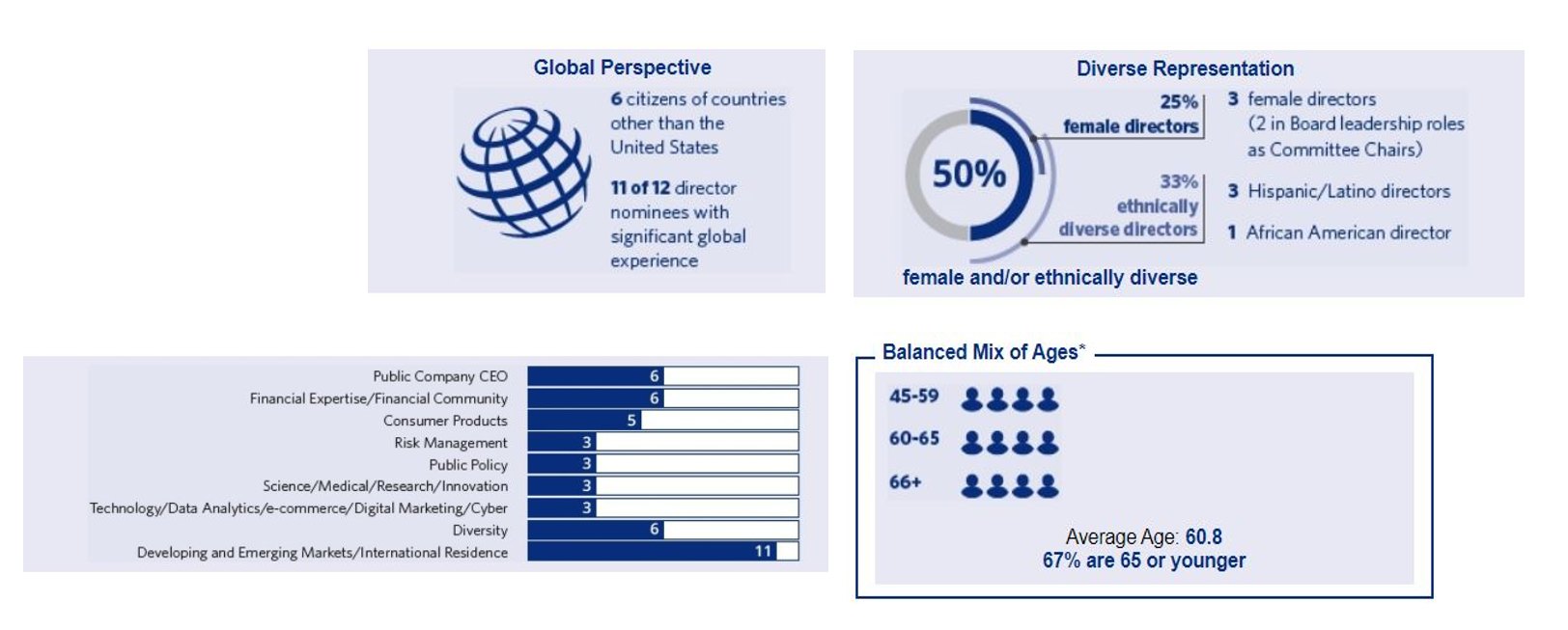

If you look at the BlackRocks and the Vanguards of the world, they are focusing on boards being composed with the right mix. Diversity plays a big role. Not only from a gender perspective, or a race perspective, but making sure you have the right skill set in place, the right tenure, and the right age diversity. It’s a number of things that make a board very effective, and I expect diversity to continue to be a focus going forward. – Aniel Mahabier, CEO of CGLytics

Companies need to be prepared for activist investors and engage with shareholders on a more timely basis. Proactive engagement between investors and companies will prevent activist campaigns going forward. Companies need the right information and tools to ensure their corporate governance risks are reduced and any deficiencies are quickly resolved.

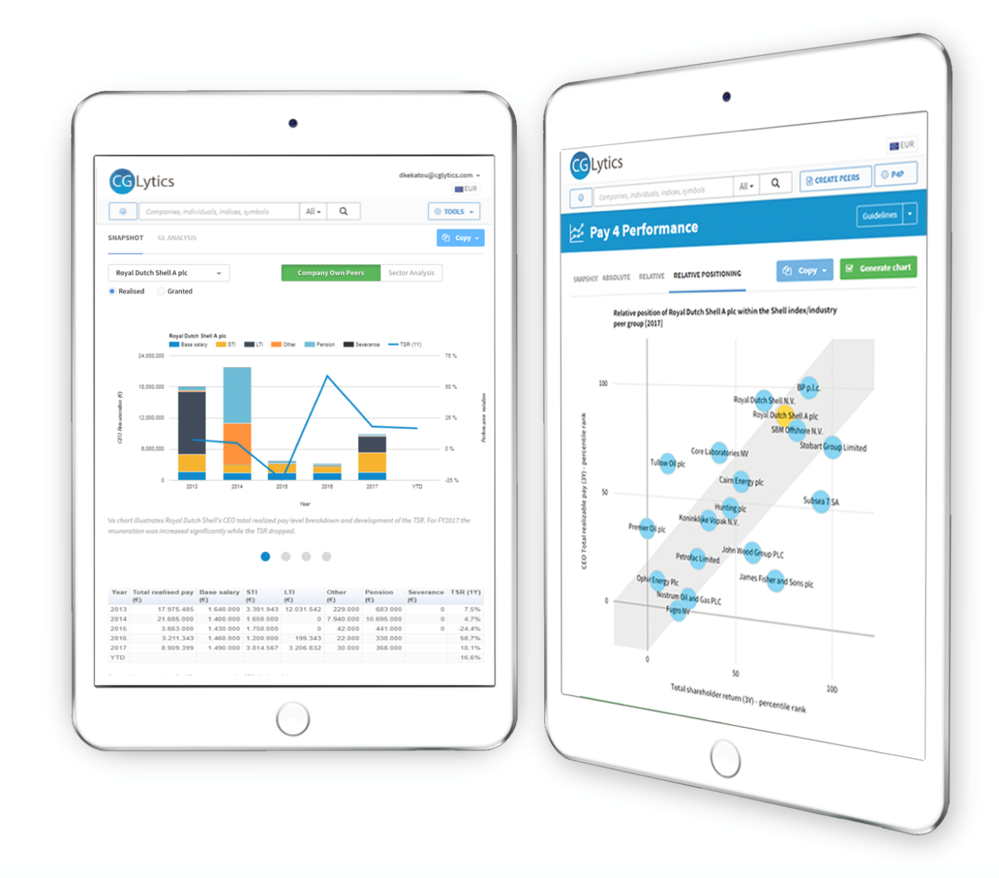

Contact CGLytics and learn about the governance tools available and currently used by institutional investors, activist investors and leading proxy advisor Glass Lewis for recommendations in their proxy papers.

CGLytics provides access to 5,900 globally listed company profiles and their governance practices, including their CEO Pay for Performance, board composition, diversity, expertise, and skills.