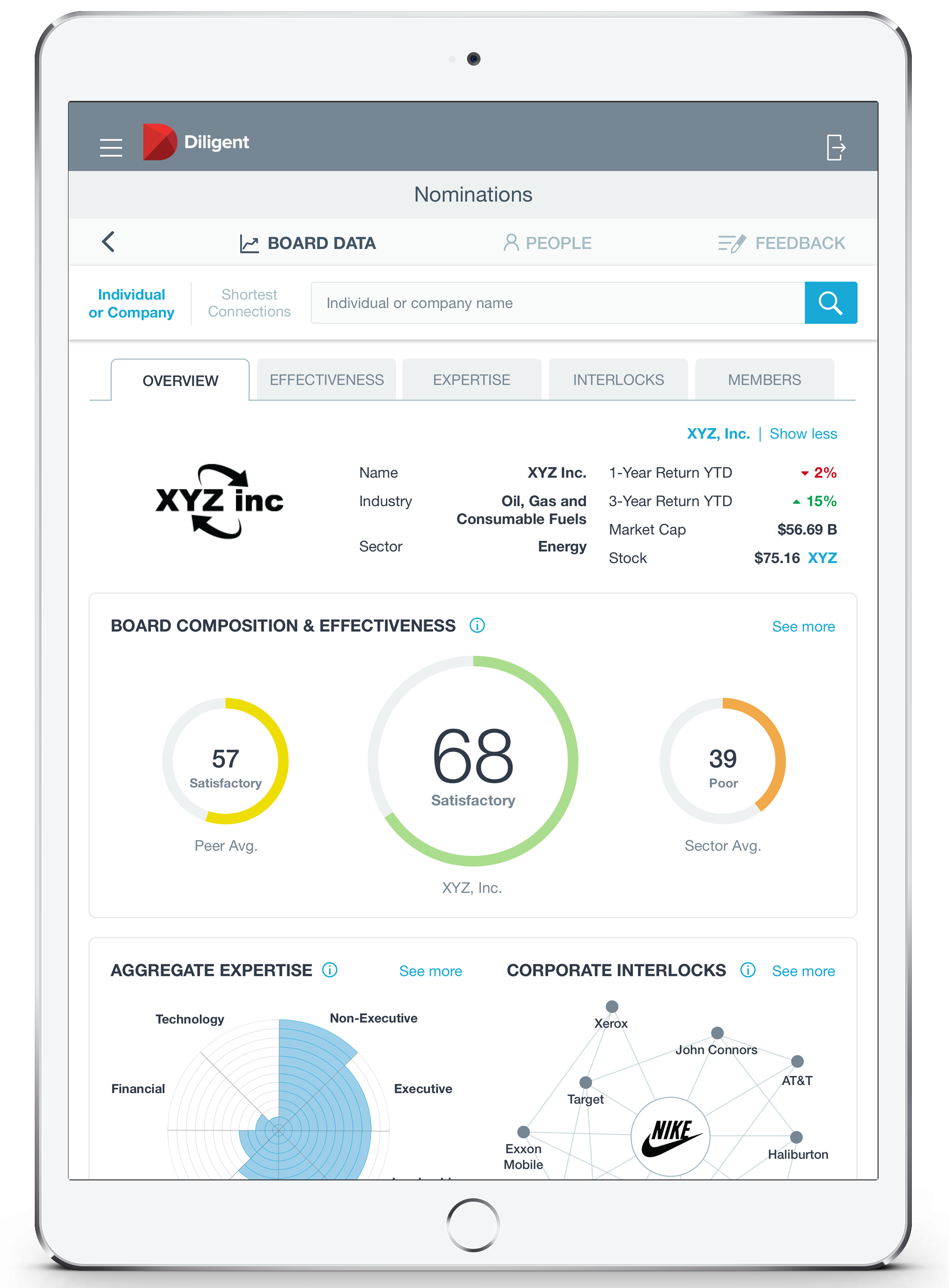

Powerful analytics for sourcing C-suite level executives and spotting inefficiencies and risks in company’s board composition and effectiveness.

Nominations & Governance Committees application

Through this partnership nomination and governance committees, can instantly perform a health check of their board’s composition and effectiveness and compare to regulatory requirements and industry peers.

Boards can access the same data used by leading proxy advisors, activists and institutional investors to screen their board composition, director nominees and governance practices.

Diligent’s Nomination & Governance application provides nom/gov committee instant access to a rich global data set to support building more diverse boards.

The application is powered by a global database of 125,000+ C-level executive profiles and upcoming talent (more than 20,000 female profiles), and easy to use tools for identifying appropriate candidate for succession planning that are hard to reach executives across the globe – all in just a few clicks.

Intuitive and powerful analytics and board intelligence tools, gain instant insights into opportunities where you can improve your board composition, your competitors boards and where you are potentially exposed for activism.

In addition, keep track of key executive movements and corporate changes by receiving daily or weekly updates and alerts.

Interested to know more?

Click here to learn about Diligent’s Board succession planning solution.

Diligent: Modern Governance

Visit diligent.com/board-succession-planning to find out more about how nominations & Governance committees benefit from Diligent’s new solution. to find out more about how nominations & Governance committees benefit from Diligent’s new solution.

Shareholder Engagement and Corporate Governance Solutions

With Over 1 Billion Data Points and Powerful Algorithms, CGLytics is Utilised by Leading Investors and Proxy Advisors.

5,500+

Listed Companies

125,000+

C-Level Profiles

8 MIL+

Company Disclosures

and Filings

800 Mil+

N-PX proxy voting

resolutions

1.3 Mil+

Relationships Connections

Key financial metrics from 2008 onwards for predictive analysis and companies top 25 ownership data

More than ten years of historical compensation data and array of unique performance indicators

Current and historical board composition, skills data and millions of business relations

Curated governance news in real-time