A Single Source for Governance Intelligence

Smart data analytics for better informed decisions and engagement

Corporate Issuers

With increased shareholder activism and heightened awareness of corporate governance practices, companies and their boards face greater scrutiny than ever before. Boards need access to accurate, comprehensive data to ensure they meet shareholder requirements and preserve good governance oversight.

Investors

With the increasing importance of Environment Social and Governance (ESG) issues, in-depth analysis of governance risks and opportunities is essential for investors to stay ahead and remain confident in the management and stewardship of their investments.

Financial and Professional Services

In order to be a leading trusted service provider and advisor, financial and professional service firms require relevant, timely insights on companies’ governance practices.

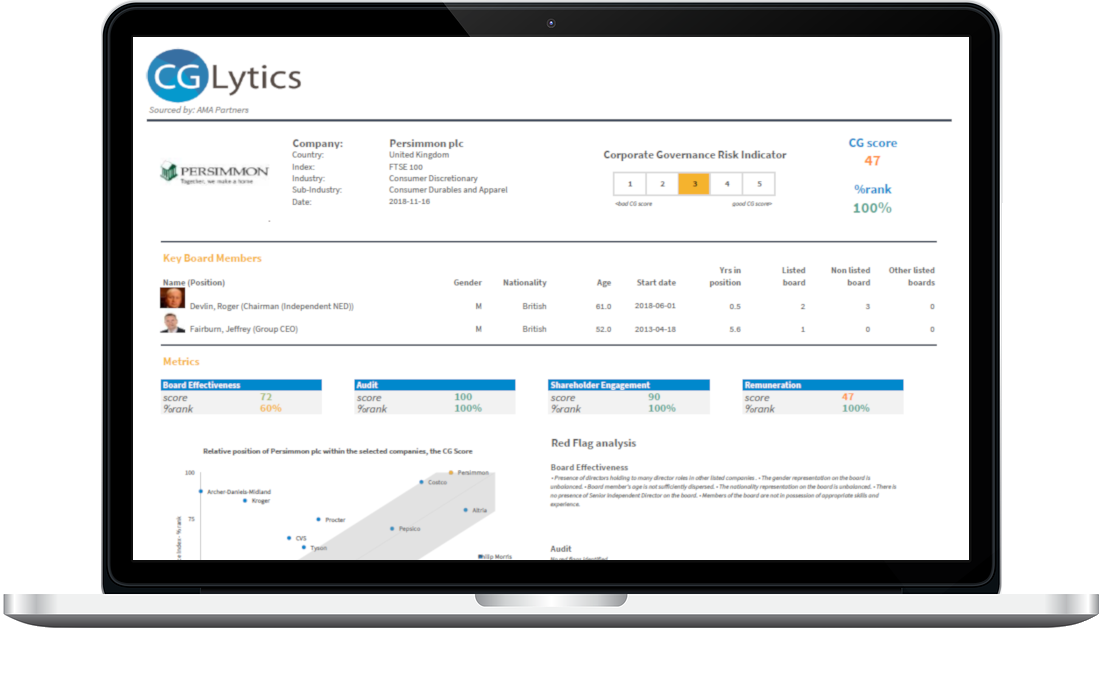

Shareholder Engagement and Corporate Governance Solutions

With Over 1 Billion Data Points and Powerful Algorithms, CGLytics is Utilised by Leading Investors and Proxy Advisors.

5,500+

Listed Companies

125,000+

C-Level Profiles

8 MIL+

Company Disclosures

and Filings

800 Mil+

N-PX Proxy Voting

Resolutions

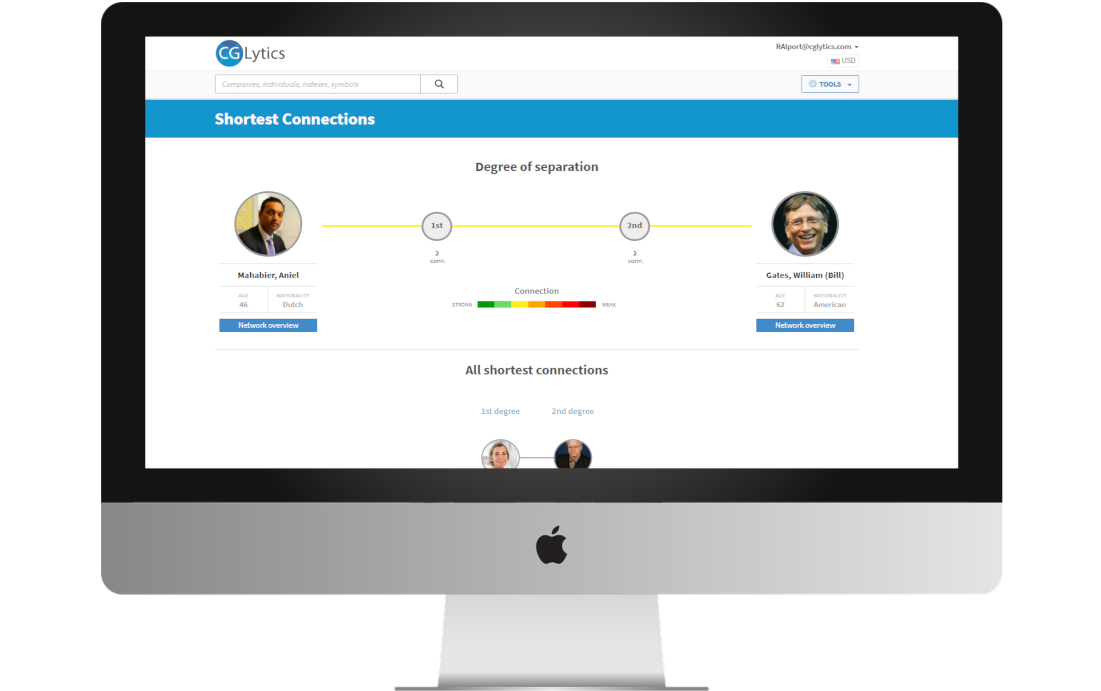

1.3 Mil+

Relationships Connections

Key financial metrics from 2008 onwards for predictive analysis and companies top 25 ownership data

More than ten years of historical compensation data and array of unique performance indicators

Current and historical board composition, skills data and millions of business relations

Curated governance news in real-time