Predict the outcome of shareholder resolutions.

With the latest in machine learning technology, anticipate results of shareholder proxy voting

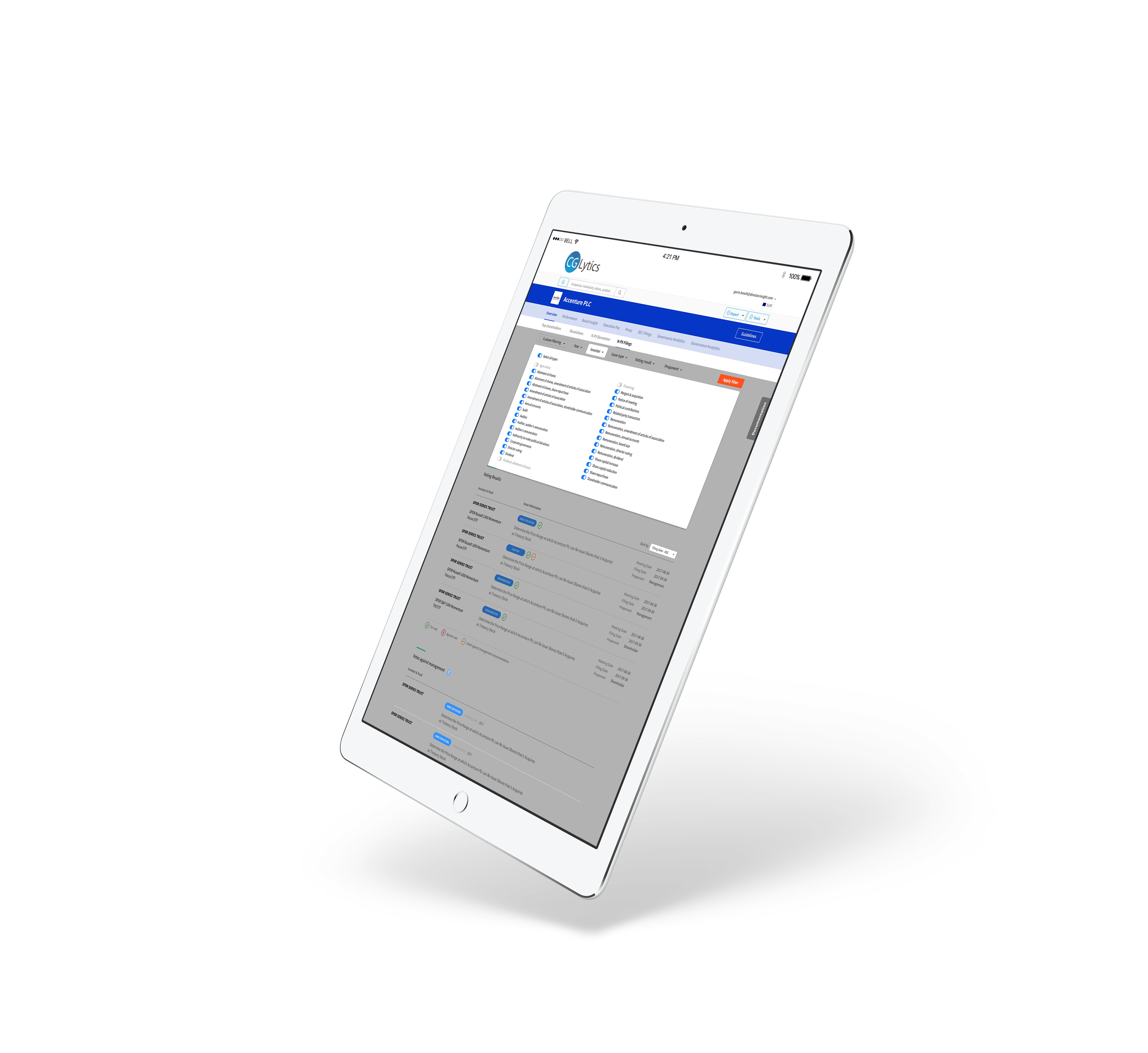

Voting Data and Analytics

Search the extensive database of N-PX filings* with voting proposals and resolutions from 2004 onwards from 4,000+ investors with 800 million+ data points.

Receive up-to-date alerts of shareholder voting outcomes and stay on top of voting trends.

Instantly analyze companies’ voting resolutions with information of their top 25 shareholders and voting guidelines.

*Voting records, completed by U.S. mutual funds and other registered investment management companies.

With Over 1 Billion Data Points and Powerful Algorithms, CGLytics is Utilised by Leading Investors and Proxy Advisors.

5,500+

Listed Companies

125,000+

C-Level Profiles

8 MIL+

Company Disclosures

and Filings

800 Mil+

N-PX proxy voting

resolutions

1.3 Mil+

Relationships Connections

Key financial metrics from 2008 onwards for predictive analysis and companies top 25 ownership data

More than ten years of historical compensation data and array of unique performance indicators

Current and historical board composition, skills data and millions of business relations

Curated governance news in real-time

CGLytics provides powerful data and board intelligence to

stay up to date and identify opportunities, and preempt

reputational risks

Shareholder Engagement and Corporate Governance Solutions