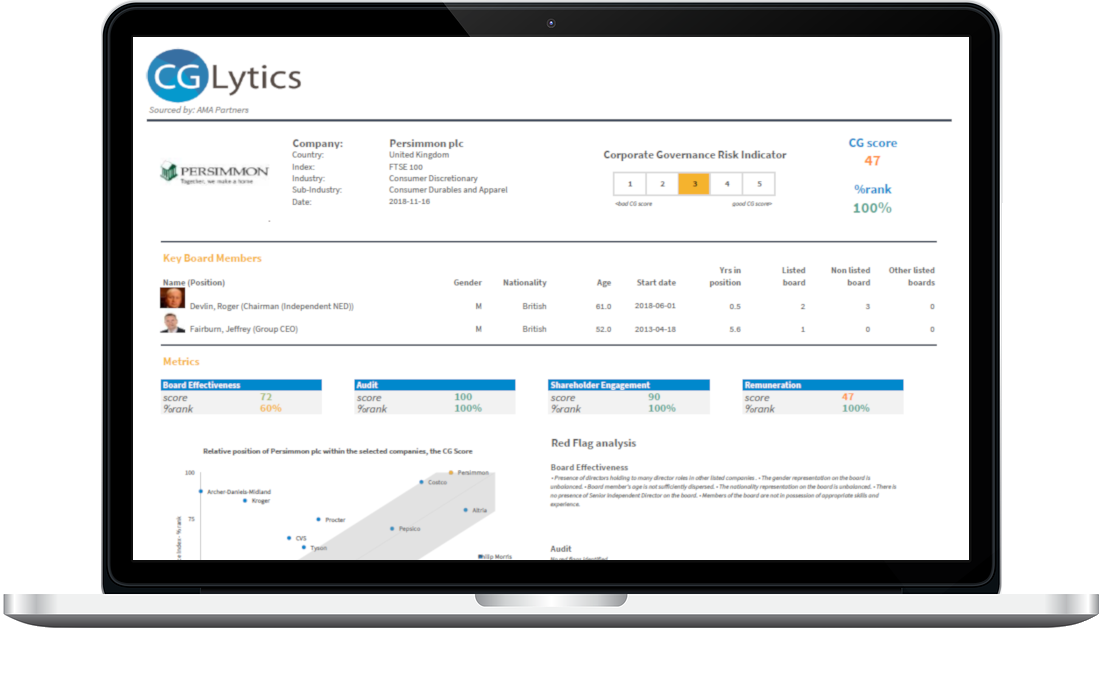

Instantly identify governance red flags for better oversight

Corporate Governance Risk Monitoring

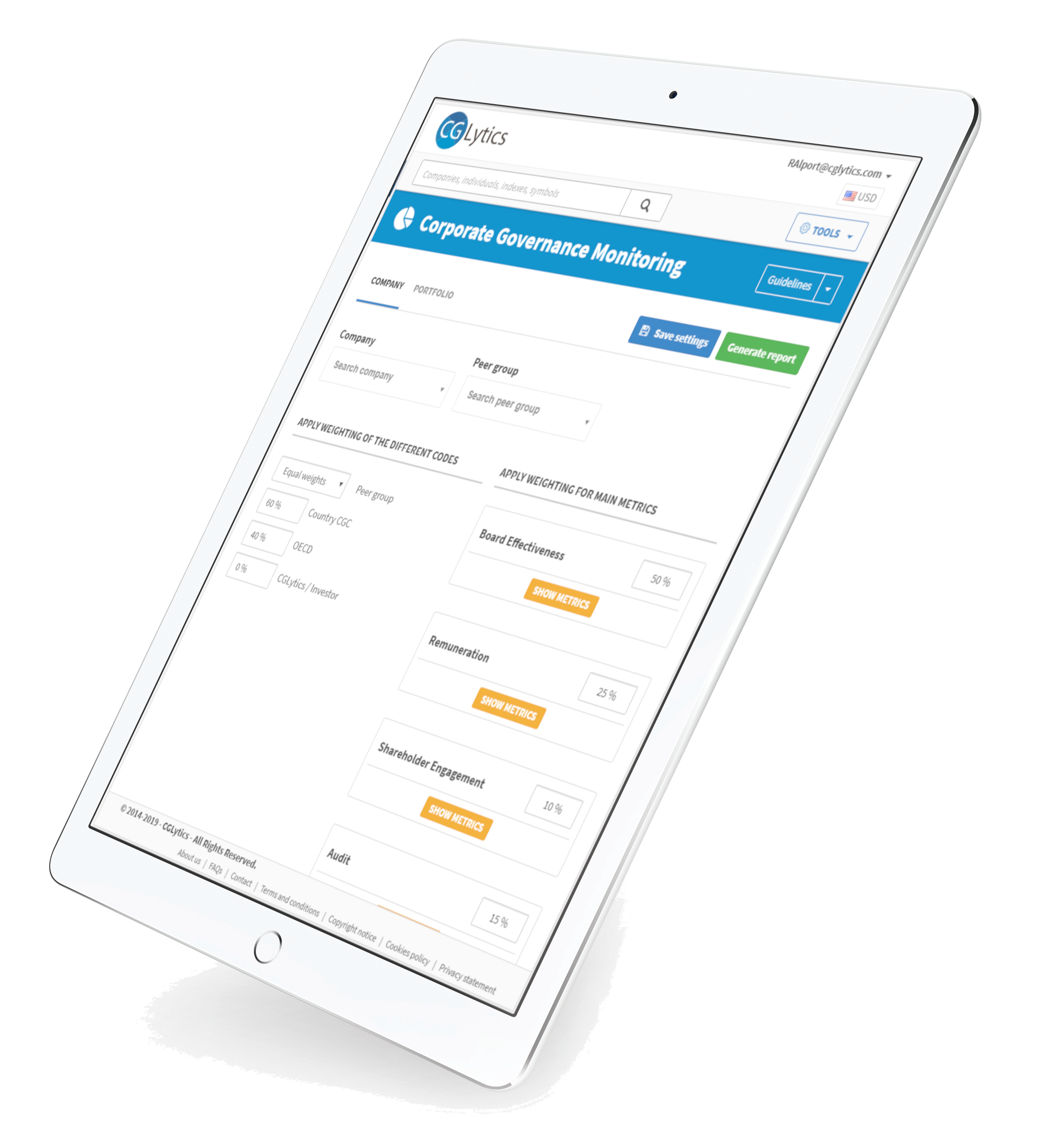

Perform a governance health check and monitor your portfolio

With information covering all aspects of a company’s governance practices, keep your finger on the pulse and instantly spot potential exposure to governance risks.

Compare and benchmark your company against your industry peers or competitors, with information covering board effectiveness, composition, and executive remuneration.

Perform real-time governance health checks against corporate governance codes, norms and guidelines.

Customize and run on demand reports that meet your own unique criteria for screening.

Easily monitor your portfolio and manage any risks by obtaining aggregated portfolio level reports.

CGLytics provides leading companies, investors and advisors with unique insights, real-time data and benchmarking tools in a single convenient software solution.

Shareholder Engagement and Corporate Governance Solutions

With Over 1 Billion Data Points and Powerful Algorithms, CGLytics is Utilised by Leading Investors and Proxy Advisors.

5,500+

Listed Companies

125,000+

C-Level Profiles

8 MIL+

Company Disclosures

and Filings

800 Mil+

N-PX proxy voting

resolutions

1.3 Mil+

Relationships Connections

Key financial metrics from 2008 onwards for predictive analysis and companies top 25 ownership data

More than ten years of historical compensation data and array of unique performance indicators

Current and historical board composition, skills data and millions of business relations

Curated governance news in real-time