With the increasing importance of Environment Social and Governance (ESG) issues, in-depth analysis of governance risks and opportunities is essential for investors to stay ahead and remain confident in the management and stewardship of their investments.

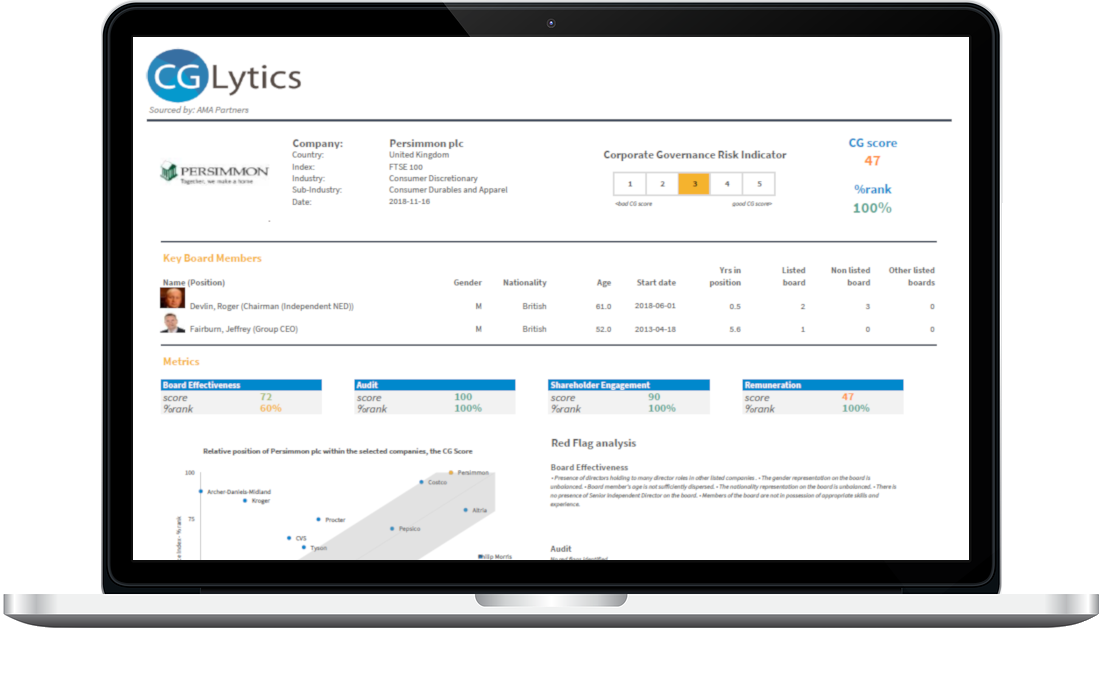

CGLytics combines the broadest global datasets in the market, with the highest quality analytics, for investors to instantly analyse their portfolio for potential governance red flags. With the most flexible screening tools for assessing pay for performance of executives, director performance and board composition, monitoring of companies’ governance practices has never been easier.

WITH THE DEEPEST DATASET IN THE MARKET TODAY, INSTANTLY IDENTIFY RED FLAGS IN YOUR INVESTMENT PORTFOLIOS FOR BETTER DECISION-MAKING

CGLytics, Global Glass Lewis Data Provider

Improve monitoring of exposure to governance risks

Easily identify governance red flags and effectively investigate higher-risk portfolio companies. With extensive real-time data and intuitive screening tools, all the intelligence you need to monitor your global portfolio for governance risk and opportunities is available in one single, convenient solution.

Unique Pay for Performance analytics

With over ten years of historical compensation data, and flexible benchmarking tools, review executive pay against an array of unique key performance indicators and your own constructed peer groups. Access the same executive compensation data analytics used by Glass Lewis for assessing say on pay proposals.

Powerful board intelligence

Extensive standardised data support due diligence of governance risks including boardroom composition and diversity, overboarding indicators and skills shortage insights.

Run on-demand reports

With all governance information in one platform, run on-demand screening reports for quick comparison and continual consistency.

Used by proxy advisors and investors across the globe

CGLytics is a trusted provider of global data to leading proxy advisors, such as Glass Lewis, institutional investors, and compensation consultants for in-depth comparison of companies’ governance practices.

Data delivery

Instant delivery of structured corporate governance and company-level real-time data sets, capable of being easily integrated into your own internal platform.

Save time and cost

Consolidate data providers to achieve time and cost efficiencies. Access relevant governance intelligence in one system for company research and engagement.

Shareholder Engagement and Corporate Governance Solutions

With Over 1 Billion Data Points and Powerful Algorithms, CGLytics is Utilised by Leading Investors and Proxy Advisors.

5,500+

Listed Companies

125,000+

C-Level Profiles

8 MIL+

Company Disclosures

and Filings

800 Mil+

N-PX proxy voting

resolutions

1.3 Mil+

Relationships Connections

Key financial metrics from 2008 onwards for predictive analysis and companies top 25 ownership data

More than ten years of historical compensation data and array of unique performance indicators

Current and historical board composition, skills data and millions of business relations

Curated governance news in real-time