During the 2018 proxy season, shareholders engaged actively in governance matters. The CGLytics FTSE 100 Proxy Review revealed shareholders to be particularly interested in director election, board effectiveness, CEO pay and Environmental Social Governance (ESG) practice. So what’s in store for 2019?

By looking at the UK, which currently has the spotlight on corporate governance practices, we can be sure that company boards will be compelled to implement good governance practices. They should prepare for early engagement with investors, who have expanded their ESG capabilities with access to best-in-class analytics to aid engagement and voting.

CEO Pay, Board Refreshment and Gender Diversity will continue to dominate

We envisage the following themes will dominate 2019 across Europe:

Proactive shareholder engagement

To obtain early shareholder buy-in during the proxy season. Investors will favour an ongoing positive dialogue in preference to a reaction to a negative vote.

Transparency will endure as a central theme

Boards should be prepared to engage openly on their board composition, say-on-pay proposals and governance decisions.

Board refreshment, gender diversity and board composition

These will be key governance matters as investors seek to favour board strategy and composition that ties to long-term company performance.

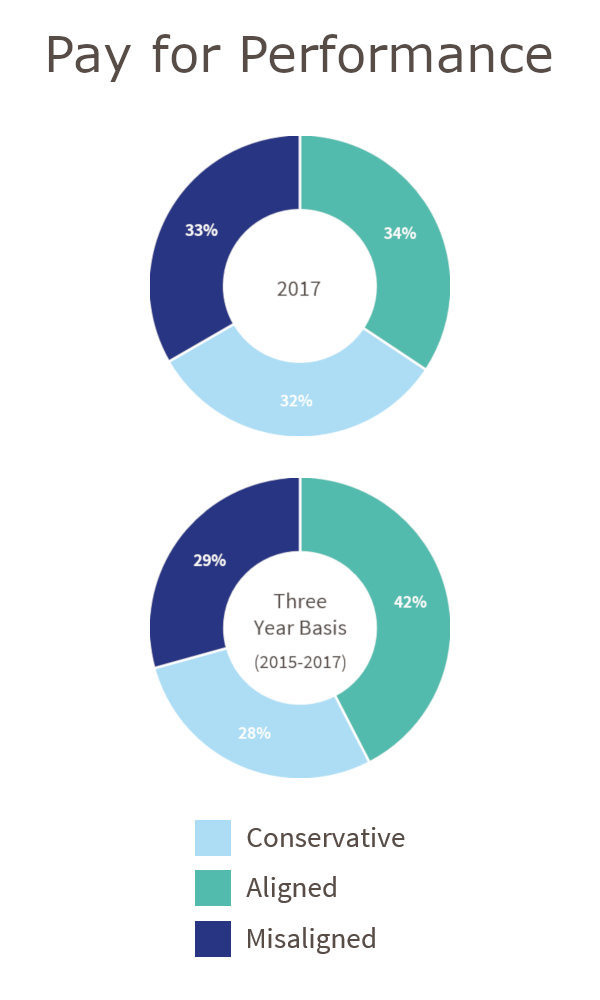

CEO Pay

Pay will be scrutinised – compensation policies and practices must be fully transparent and reflect, and support, business strategy and promote long-term success.

CEO succession planning

Chairs and nomination and governance committees will be required to plan for CEO succession to mitigate business continuity risk.

Environmental, Social and Governance (ESG)

ESG will continue to gain momentum as investors continue to become more information savvy and continue to evaluate companies’ progress on their environmental, social and governance practices.

Boards must be equally, if not better, informed as shareholders in order to engage adequately and constructively

Getting ready for the coming season

Boards need to be fully prepared for the upcoming proxy season. They must be equally, if not better, informed as shareholders in order to engage adequately and constructively, to be certain to avoid any reputational risks. Having access to the same intelligence as proxy advisors and investors is fundamental to proxy season preparedness and good governance decision-making.

CGLytics provides real-time governance risk analytics and solutions that provide actionable insight for companies, shareholders and proxy advisors. We empower boards of companies and investors with data analytics that enable good governance.

In preparation for the 2019 proxy season, CGLytics released its third annual FTSE 100 Proxy Season report. This series of articles summarise some of the key findings. Access the full insights and statistics by downloading the report.