Artificial intelligence (AI) is everywhere even as a member of the board of a private equity firm based in Hong Kong. While the exact role of AI in the boardroom is up for debate, the question remains: has the Robo Director come of age?

Enter the Robo Director

On the face of it, the case for an AI-based director is powerful: machines can pull together vast amounts of information and make decisions based on complex algorithms. Moreover, certain technological advancements have given certain algorithms the ability to learn: cognitive technologies – such as machine learning and deep learning – are becoming more reliable and accessible day by day.

However, even the smartest machines are only as clever as the data they have at their disposal. Although this may also be said of humans, in practice people have unique intuition that operates and combines old and new variables at a different level than machines are currently capable of. This capacity enables the human director, or an entire board of directors, to change direction more quickly than a machine can when faced with new, unforeseen situations. Machine learning is based on repeated behaviours to extract data and then create an output based on that data extraction. Regular corrections to the algorithm are made based on human interpretations of the output, increasing the algorithm’s output accuracy over time. Machine-learning however does not currently provide the capacity to solve new problems when externalities comes into play. Often we hear of great business decisions made on the fly based on instinct or business nous, which are uniquely human traits…so far.

AI as the Assistant

AI works best in situations where large volumes of data must be processed and the logic that drives predictions and decisions can be easily expressed. Just as doctors and other medical professionals harness the power of AI to make better diagnoses, AI can support boards to make better decisions. However, the quality of the data plays a critical role in the algorithm’s capacity to identify trends, as it is reliant on “five-star data” for optimal recommendations.

Corporate Governance

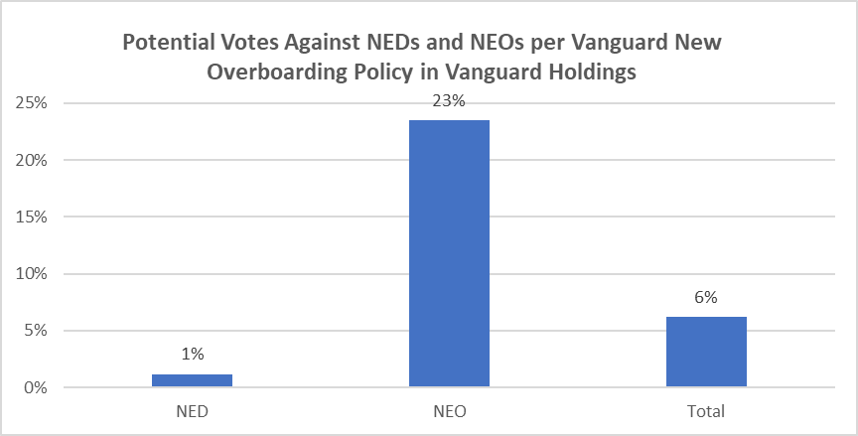

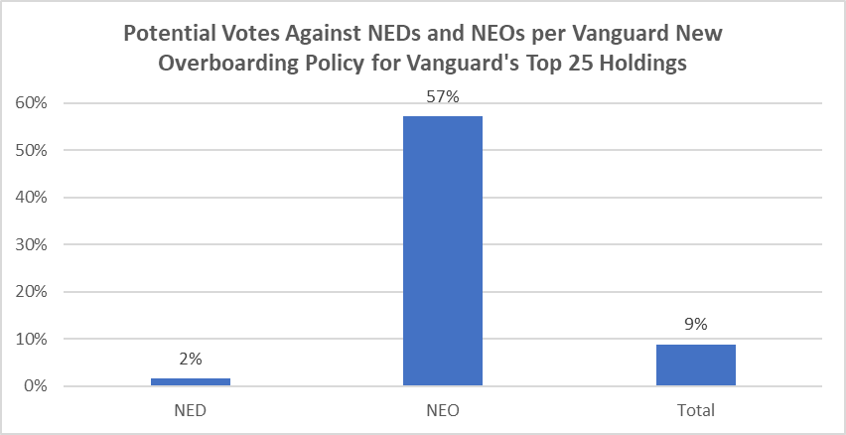

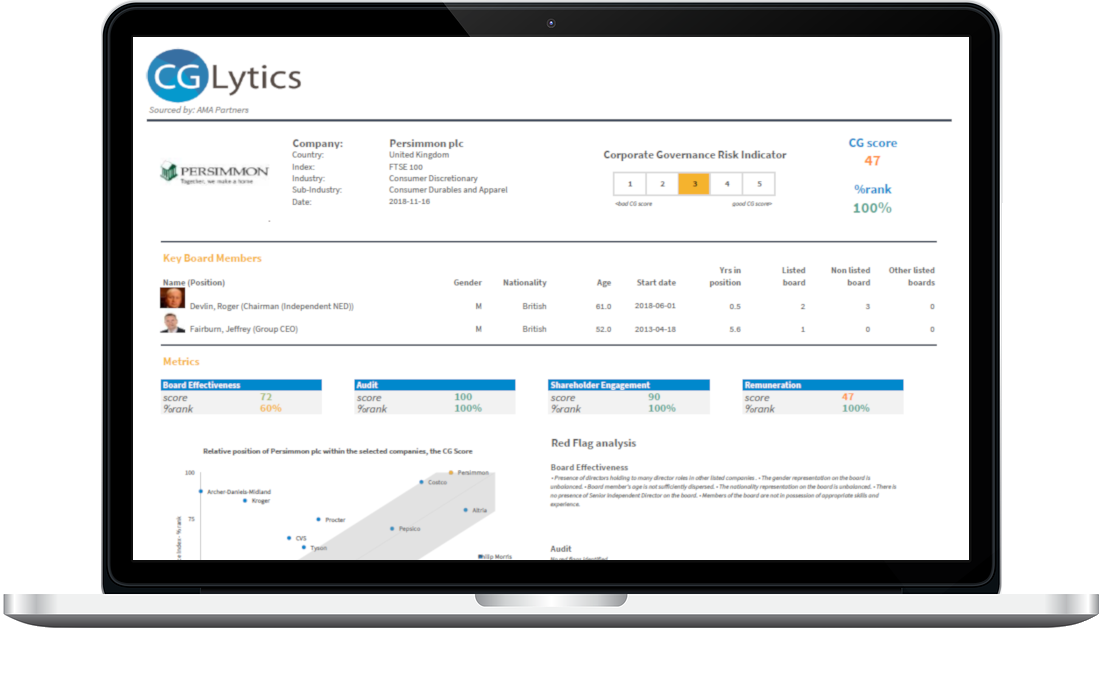

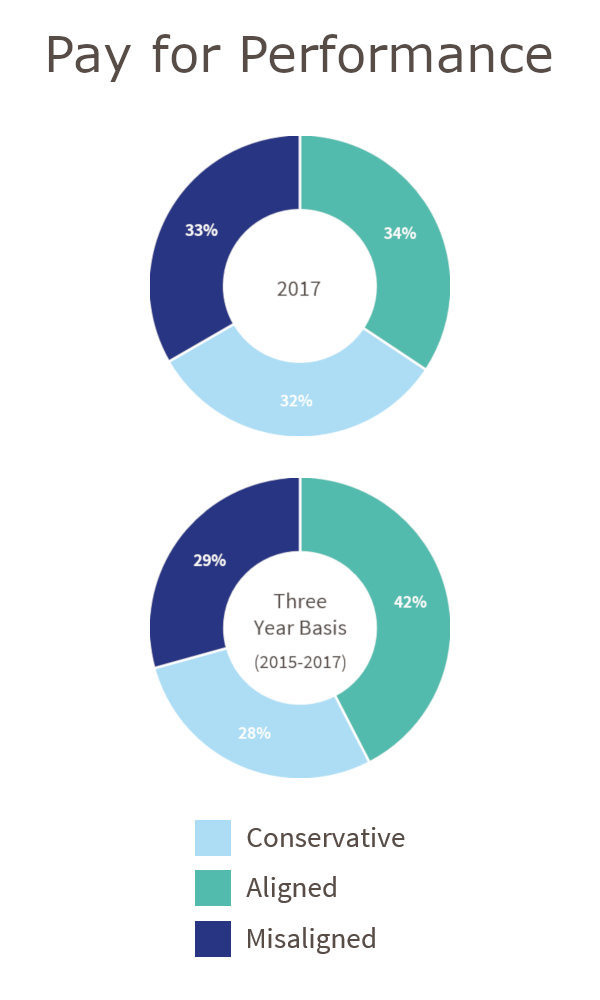

AI can now improve problem-solving by assessing governance risks on a macro-level, and subsequently analyse structural deficiencies in a company’s governance policies and practices when compared to its peers faster than previously possible. Parameters can be set and certain aspects of governance can become data-driven rather than model-driven. This means better decisions and, more importantly, fewer wrong decisions that could lead to reputational and financial risk.

Competitive Landscape

With access to large volumes of data, AI can be harnessed to position a company in its competitive landscape. Models and methods can be developed to pinpoint a company’s competitiveness against competitors and to assess its performance trajectory.

Decision-Support Tools

AI can facilitate better strategic decisions based on real-time data and advanced analytics. Customer marketing journeys can be mapped more accurately, generating more positive outcomes. With better information at their disposal the board can focus on strategy rather than operations.

Unalterable Past, Perfidious Future

In business, many decisions are made using a combination of historical data, modelling and conjecture. But the truth is that the business environment is inherently uncertain: there are no control experiments or reruns. What worked in the past might not necessarily work in future, as evidenced in the classic case of the failure of the firm Long Term Capital Management. However, AI programs and technologies, when supplemented by governance data of the highest quality, can augment a board’s decision-making.

Getting ready for the boardroom of the future

Boards need to be fully prepared with the latest information and insights to make the right decisions, which support their long-term strategy. CGLytics has the deepest global governance data set in the market to date, and if combined with AI, the potential opportunities for boardroom intelligence really are endless.