This article by CGLytics CEO, Aniel Mahabier, first appeared in Dutch in Mgmt. Scope on 11th March 2020: https://managementscope.nl/opinie/bestuurdersbeloningen-bedrijfsprestaties

Executive compensation gains attention in the run-up to annual shareholder meetings. The key question is whether compensation plans are socially responsible and align with company performance relative to its peers. In 2019, companies already got a taste of the increasing interest in CEO pay from shareholders. “That attention is only increasing,” says Aniel Mahabier, founder and CEO of CGLytics, the leading global provider of governance data and executive compensation tools. “Executives and directors who are not sufficiently prepared are facing reputational risks.”

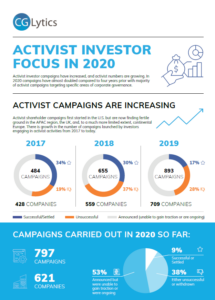

As shareholders and other stakeholders prepare themselves for annual shareholder meetings, it’s the moment to speak out on these important issues. Shareholders will again make themselves heard this year. For several years now, engagement between shareholders and companies has been growing. Parties are more likely to vote and use their voting rights to steer business policy: the number of votes against remuneration policies are increasing proportionally at the meetings of the 5,900 listed companies we track. An increasing number of shareholders want compensation to reflect the company’s long-term performance and value creation (in other words, pay for performance and earnings per share).

Pay for performance

It is obvious that the compensation of executives should reflect the company’s performance, however data shows a different picture.

In a large number of the publicly listed companies, there is pay for performance misalignment. The CEO’s compensation is – consciously or unconsciously – not in line with the value create by the company over multiple years.

More than half of companies in the US S&P 500 Index lack a correlation between CEO compensation in 2019 and the development of the company’s earnings per share over the past three years.

In some instances, the CEO compensation is lower than expected based on CEO value creation. With a much larger proportion of companies, the value created by the CEO is much lower than you would expect based on the level of their compensation received. In many situations, at the general meeting of shareholders, companies proposed increasing executive pay, although the company’s performance declined.

Mismatch

This misalignment between CEO compensation and company performance is increasingly gaining the attention of shareholders, employees, governments and other stakeholders. The top 35 executives of companies in the S&P 500 collectively earn almost more than $3 billion, which contributes to the discussion. In Europe we see a similar picture. For a third of the listed companies in the Benelux, the CEO’s compensation does not align with the realized value creation. A similar picture is seen at a third of companies in Britain’s FTSE 350 Index.

Drivers of change

The focus on responsible compensation is in line with the focus in society on sustainable business growth.

Large investors – pension funds and insurers – are drivers of the change in compensation. Passive investors, such as asset managers Vanguard and BlackRock, are also increasingly using their control to influence compensation proposals. We see that they are trying to encourage a more socially responsible compensation policy in different ways. For example, by engaging on compensation policies and proposals with shareholders and other stakeholders before the general meeting of shareholders and underpinning this with data. We see signs that this is reducing the number of dissent votes against the proposed policy.

Shareholders do not hesitate to enforce change where necessary. For example, by voting against incentive proposals including equity plan proposals at the meeting. A large investor has stipulated that if more than 25% of shareholders speak out against a compensation proposal, they will in turn vote against the reappointment of the chairman of the compensation committee. The same strategy is used if the compensation proposals provoke a substantial number of counter-voters in two consecutive years.

Reward regulators

All efforts to promote sustainable value creation are having an effect: short-term pay is making way for a long-term performance-based compensation structure. Several listed companies have either decreased, shifted or changed the variable compensation component of their executives’ pay plan into fixed compensation. The latter includes, more often, a combination of cash and shares of the company. Using shares as an incentive, there is a direct alignment between the pay of the CEO and the performance of the company.

The same development is also seen when looking at the compensation of directors (non-executive directors). Where it is common practice in the United States to reward directors with, among other things, shares of the company, this was not common, or even prohibited, in Europe for a long time. That has changed. For example, the new corporate governance code in Belgium offers the possibility to reward non-executives partly in shares. This creates a shared interest with shareholders.

Sustainable criteria

An important development is seen in the use of non-financial metrics for executive and CEO compensation.

Shareholders expect companies to include non-financial guidelines such as ESG criteria in their compensation system in addition to financial guidelines – such as earnings per share and Total Shareholder Return (TSR). These criteria show how the company takes into account various ESG sustainability criteria: Environmental, Social (social policy) and Governance (good governance).

In many countries in Europe, listed companies are obliged to include such non-financial disclosure in their annual reports. It therefore seems logical to also link the compensation of the executives to the goals set by the company in the field of corporate social responsibility. The recent governance crisis at a major Swiss bank illustrates how the lack of good governance can affect the oversight and value creation of a company in the long term.

Although attention to the inclusion of non-financial metrics is increasing, the application is still limited in practice. Only 27% of FTSE 350 and ISEQ 20 companies have included some form of measurable ESG criteria in incentive plans. And even in these companies, the proportional share of compensation determined by ESG performance is small. This deserves attention: if the sustainable objectives are not included in executive compensation, there is a risk that the compensation policy will lose connection to the business strategy.

Risk factors

A responsible compensation plan based on financial and non-financial metrics is more important than ever. An increasing number of directors, regulators, compensation committees and investors are therefore scrutinizing CEO compensation and use CGLytics data and pay for performance benchmarking tools to review compensation proposals and policies. Directors are using this information to prepare their engagement with active shareholders, proxy advisors like Glass Lewis and other stakeholders. Investors are looking for red flags, undiscovered risk factors that threaten the quality of governance in the company. Having access to similar information and tools ahead of the proxy season, is allowing compensation committees to respond in a timely manner to pitfalls in the existing compensation plan and proposal to avoid potential reputational and activism risk.

Would you like to gain instant insights into more than 5,900 globally listed companies’ board composition, diversity, expertise and skills?

Or access the same CEO pay for performance insights used by Glass Lewis in their proxy papers?

Click here to request a demo to learn more about CGLytics’ boardroom intelligence capabilities and executive remuneration analytics, currently utilized by world-leading institutional investors, activist investors and advisors.