Seventy-five percent of first-time say-on-pay (SoP) votes failed in 2019, and a large number of these negative votes focused on incentives.

There is an increasing need for companies to fully rethink their incentive plans, as the CGlytics whitepaper “How to take the testing of equity-based compensation plans into your own hands” points out.

“It is imperative that companies design their equity pay plans to ensure they receive shareholder approval first time, every time. In order to meet investor expectations, companies need to understand how they, and the proxy advisors they rely on, evaluate equity plans and make voting decisions.”

Marc Ullman, a partner with Meridian Compensation Partners explains what to do and what not to do in rethinking incentive plans.

First of all, companies need to fully rethink their compensation plans, and not to just tweak them. Making just a few cosmetic changes will not suffice to ensure that incentives are effective. At least every two years, a real restructuring is needed.

Often shareholder pushback will incite a rethink, but even with shareholder support, benchmarking for effectiveness is critical as priorities change and the business climate evolves. The plan must reflect the new realities the business faces.

Or the incentive plan may simply become too complicated to be useful, as continually including more metrics and other add-ons makes application confusing. This often happens as businesses try to simply tweak the plan instead of really rethinking it.

Here are the do’s and don’ts to achieve as near optimal alignment between pay and performance as possible:

– If you need a full-scale rethink, don’t settle for a mere tweak. Make sure that what you do matters, don’t nibble around the edges. Make sure the metrics truly benchmark performance.

– But don’t overdo it. Pick out the key metrics and focus on that; don’t try to transform the whole structure unless you really feel that you have to.

– As the rethinking process is underway, take note of the solid rationale that stems from the business model. This will be something to communicate at the end of the process, and one that can be used for grounding the basis of your thinking.

– Make sure you include all the right people: Finance, HR, Corporate leadership, corporate leadership and the business unit. Everyone should buy in to the metrics and the targets that are being set.

– Make sure your plan pays something in year one. After a big rollout you need to make sure that design provides results. Otherwise it could hurt your credibility.

– Take advantage of feedback from shareholder outreach. More and more companies are actively talking to shareholders, and their points of view should at least be considered as the design is taking shape. Consider investor relations and investor perspective and proxy advisors like ISS and Glass Lewis.

– Communicate internally and externally. You have multiple audiences internally.

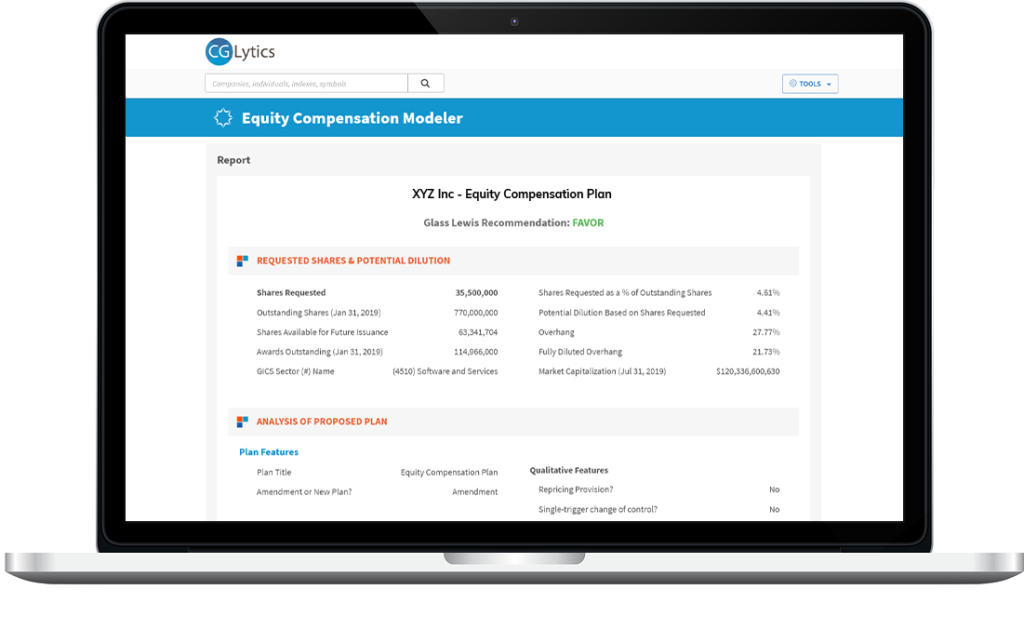

Predict Shareholder Approval with Glass Lewis’ Equity Compensation Model

The Glass Lewis Equity Compensation Model (ECM) allows you to instantly test and review your incentives plan using the same key criteria and scoring system as leading proxy advisor Glass Lewis. The ECM supports testing of 4,300+ publicly-traded U.S. firms including the Russell 3000 and exclusively available via CGLytics.

With the ECM you can confidently engage, knowing the strengths and weaknesses of your current and future equity plans. Ensure you get the votes to legally grant equity compensation to your executives, board members and staff.

Click here to learn more about the ECM application or request a no-obligation demonstration.