CGLytics Response to COVID-19

As a steward of modern governance, the CGLytics team is taking comprehensive measures to ensure our employees, products, and services continue to operate at the highest levels of performance and support as the COVID-19 epidemic continues to evolve. Governance is critical in times of uncertainty, and we want to make sure our customers and partners know that they can confidently rely on CGLytics during this time.

To provide greater visibility and assurance, we are highlighting a few ways CGLytics is upholding its devotion to supporting our customers, partners and employees.

Secure Infrastructure & Communications

Leaders and governance professionals worldwide rely on the CGLytics platform for their governance oversight, decision-making and driving modern governance best practices in their organization. We are committed to maintaining all product service levels for availability, access, and security, globally, despite any virus-related challenges that we face.

This includes continual improvement and releases of new product capabilities to support our customers’ modern governance needs.

Protecting Our Workforce

The health and safety of our employees are of the utmost importance to CGLytics. As the situation evolves, the CGLytics leadership team is ensuring that every employee has the tools and technology to work remotely to maintain business continuity. As a company that works to improve the remote work of business and organizational leaders, CGLytics use best-in class tools for collaboration, audio and video communication, messaging, and secure identity, along with other business-critical technologies.

Furthermore, CGLytics has restricted all non-essential travel, including all conferences, until risks have subsided. Executive leadership has emphasized the importance of following CDC and WHO recommendations to ensure safety. CGLytics have also adjusted its internal work structure to limit potential risks in the workplace.

Support Resources

We know that governance software and the resources available to customers are mission critical. Therefore, we want to assure customers that our Customer Success and Support Teams will continue to operate as normal and are available to assist customers with any and all account management requests.

We highly value your partnership with CGLytics. We are always here to support business continuity and wellbeing, and especially during uncertainty.

Aniel Mahabier

CEO

CGLytics

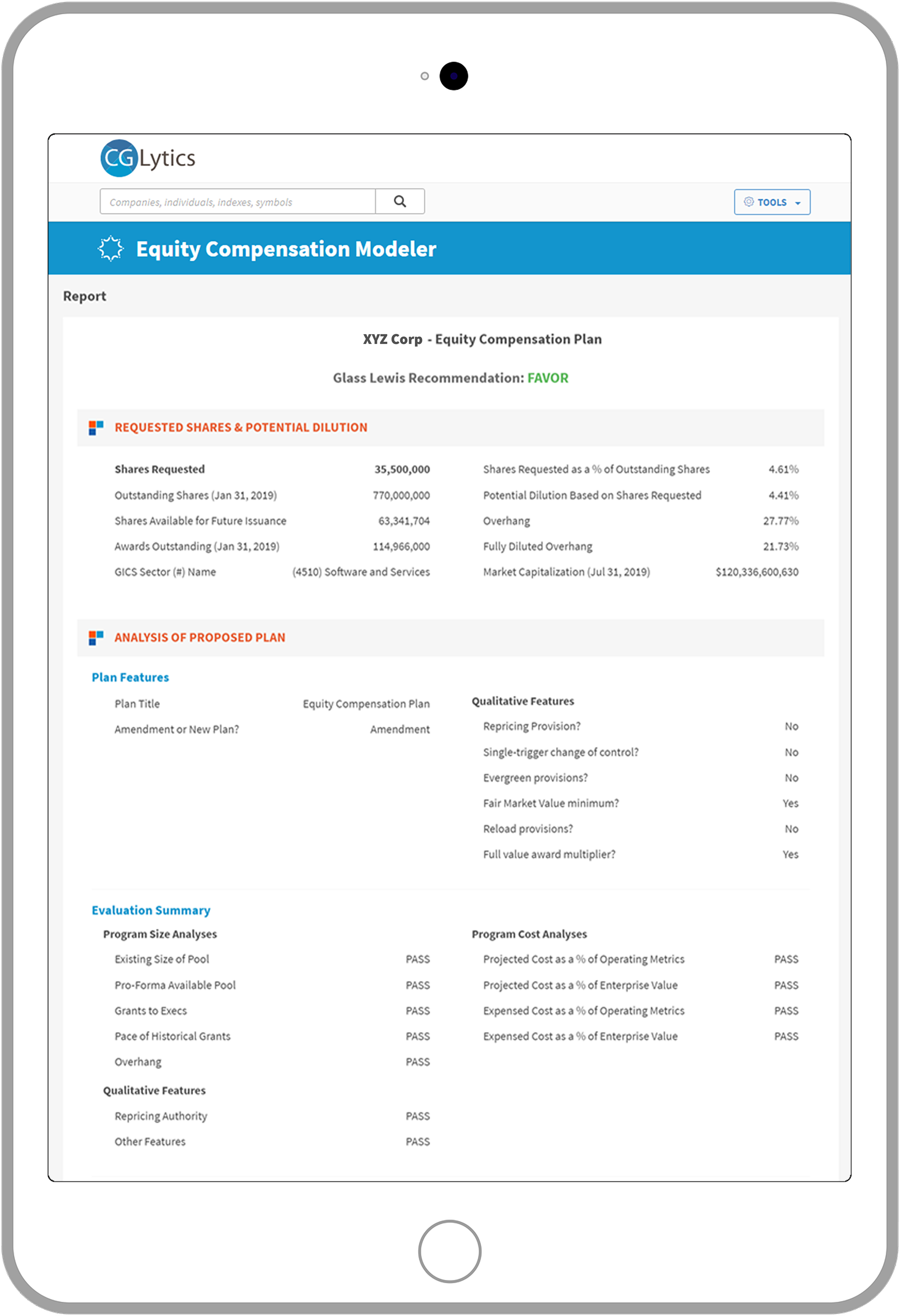

Shareholder Engagement and Corporate Governance Solutions

With Over 1 Billion Data Points and Powerful Algorithms, CGLytics is Utilised by Leading Investors and Proxy Advisors.

5,500+

Listed Companies

125,000+

C-Level Profiles

8 MIL+

Company Disclosures

and Filings

800 Mil+

N-PX proxy voting

resolutions

1.3 Mil+

Relationships Connections

Key financial metrics from 2008 onwards for predictive analysis and companies top 25 ownership data

More than ten years of historical compensation data and array of unique performance indicators

Current and historical board composition, skills data and millions of business relations

Curated governance news in real-time