08.13.2020

On June 25, 2020, the US Federal Reserve Bank issued a statement following its annual stress test of banks, saying that it would cap Q3 dividends for banks and prohibit share repurchases until Q4. COVID-19 has created a tumultuous economic environment for many companies. This has prompted many to respond with executive pay cuts and dividend reductions, and suspensions of share buyback programs.

In the wake of this economic situation and announcement by the FED, it is worth looking at how the banking sector responded to the COVID-19 crisis and its corporate governance implications. This article analyzes the S&P 500 Banks Industry Group Index which is broken up into two sub-indexes; S&P 500 Regional Bank Index and S&P 500 Diversified Bank Index.

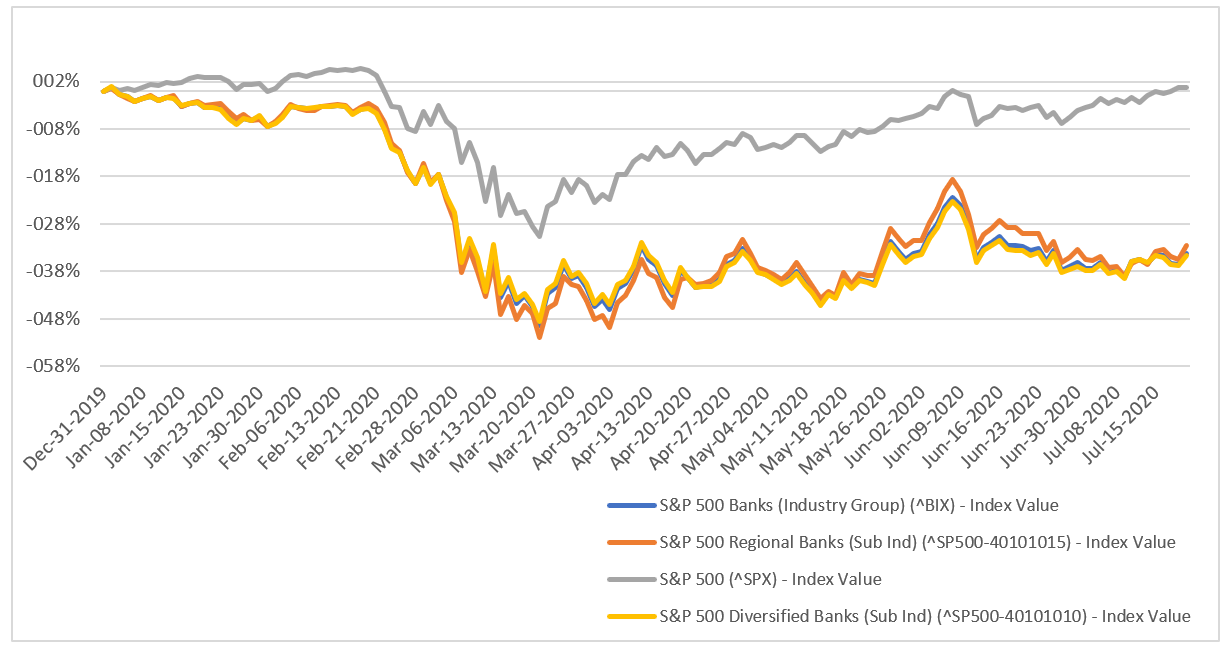

Looking at the banking sector’s performance during the COVID-19 pandemic, when comparing the S&P 500 Bank Industry Group Index to the S&P 500, Year to Date (YTD) change in value as of July 22, 2020; the S&P 500 Banks decreased in value by 34.31% while the S&P 500 increased by 0.82%. When breaking the S&P 500 Bank Industry Group down further into its two sub-indexes, the S&P 500 Regional Bank Index decreased in value by 32.66% while the S&P 500 Diversified Bank Index decreased by 34.74%.

While the S&P 500 has rebounded significantly since its steep decline following the COVID-19 outbreak. The banking industry has yet to see the same recovery.

Source: CGLytics Data and Analytics

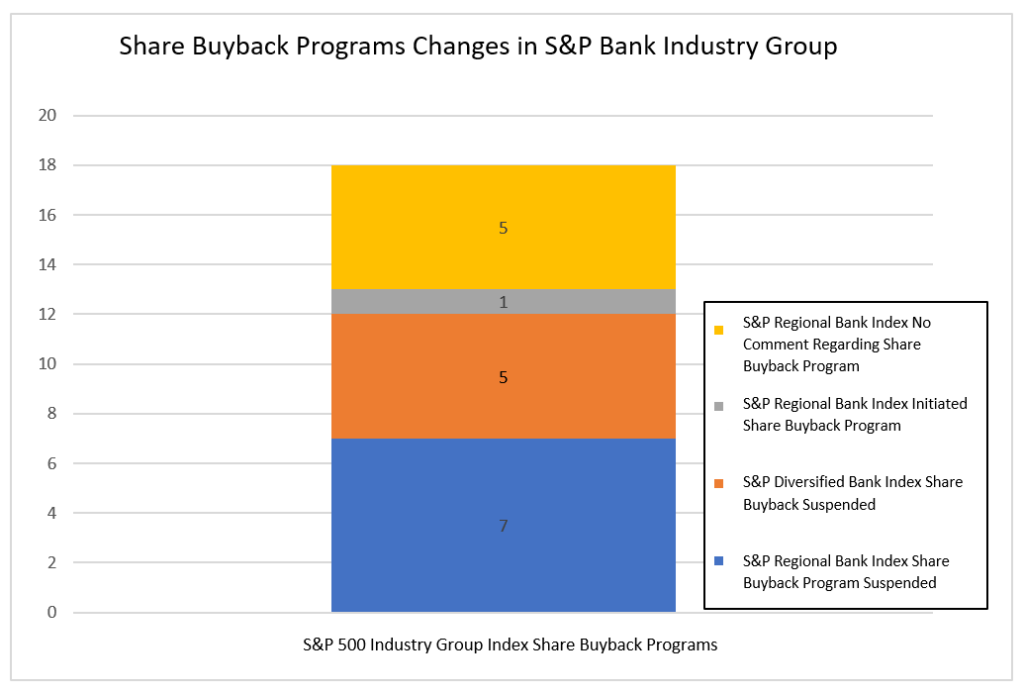

Prior to the FED’s announcement, not one of the banks in the S&P 500 Diversified Banks Index announced a suspension, reduction, or change in their dividend. Also, during this time, none of these banks recorded any changes to executive compensation due to COVID-19. All five of these banks (JPMorgan Chase, U.S. Bancorp, Citi Group, Wells Fargo, and Bank of America) announced on March 15, a suspension of share repurchases.

Examining the S&P 500 Regional Banks Index prior to the FED’s announcement in June 2020, seven banks (Region Financial Corp, Citizens Financial Group, Fifth Third Bancorp, KeyCorp, PNC Financial Services Group,. Trust Financial Corp, Comerica) all announced plans to temporarily suspend their share repurchase plans in the middle of March 2020. Hunting Bancshares however announced that it planned to continue its share buyback program during this same period. First Republic Bank, M&T Bank Corporation, People’s United Financial, Zion Bancshares, and SVB Financial Group all did not comment regarding share buyback programs during this time period. Concerning dividends, no bank in the Regional Bank Index suspended or changed their dividend during this period.

Source: CGLytics Data and Analytics

However, when analyzing Russel 3000 companies during the time period from March 15th through to April 17th, at least 105 companies reduced or adjusted executive and director compensation in response to the COVID-19 according to research by CGLytics’s. In addition, over the same period at least 47 companies reduced or suspended their dividend and at least three companies suspended share buyback programs.

When analyzing Diversified Banks in the S&P 500 and their response to the FED’s announcement at the end of June to cut dividends, only Wells Fargo announced a reduction in its dividend, with all five companies (JPMorgan Chase, Citigroup, Bank of America, US Bancorp, and Bank of America) announcing that they would maintain their current dividend.

Regional Banks provided a similar response as Diversified Banks following the FED’s June 25 stress test. Out of the 13 banks labeled as Regional banks, six provided responses to the FED’s stress test (Truist Financial Corp., Region Financial Corp., Huntington Bancshares Incorporated, Fifth Third Bancorp., KeyCorp, Citizens Financial Group). All six stated that the company would maintain its dividend. The other seven companies (Zion Bancshares, SVB Financial Group, PNC Financial Services Group, M&T Bank Corporation, People’s United Financial, Comerica, First Republic Bank) did not provide a statement regarding the results of the FED’s stress test.

Ultimately, COVID-19 has exposed the vulnerability of the banking industry to external shocks and their readiness for market developments. The pandemic has generated significant uncertainty and high volatility in global capital markets and the banking industry is of no exception. While the full impact is yet to be determined, it’s predicted that the adverse effects are expected to linger from the virus’ knock-on effects and are likely to affect liquidity, profitability and valuation of these issuers eventually affecting returns to investors.

To understand how companies are adapting their executive pay practices and adhering to regulations during the pandemic, institutional investors and proxy advisors use CGLytics data and analytics software tools.

CGLytics offers the broadest and deepest global compensation data set in the market for reviewing corporate executive compensation plans, assessing Say on Pay vote proposals and performing benchmarking analysis.