Action needed despite third of new S&P 500 board appointments being women

Gender diversification on boards was a prominent issue in 2018 and shareholders had never been more explicit in their expectations of companies.

A CGLytics report on diversity in the boardrooms of S&P 500 companies reveals that some progress has been made on an issue that was very prominent in 2018. Companies have improved female board representation – but at a much slower rate than is needed to meet targets set by some proxy advisers and new legislation.

In the past 12 months, the emphasis on gender diversity in the boardroom has never been greater. Demands from not only the media but also shareholders, investors, proxy advisers and governing bodies, as well as campaigns such as the Fearless Girl, have made all companies, regardless of industry, sit up and take notice.

There are, of course, many benefits to improving boardroom gender diversity that go far beyond fresh perspectives and improved profitability. But in order to build an effective board that meets current diversity standards, nomination and governance committees need to find new ways to recruit the right – and best – female candidates to fill their board.

Appointments and departures of S&P 500 company directors between 2017 and 2018 are evidence that companies are actively trying to improve gender diversity on boards. While overall female representation grew by only 1 percentage point, there are some data points that demonstrate how S&P 500 companies are progressing.

1. One third of new board appointments in 2018 were women

One of the most encouraging changes in 2018 was the increase in the percentage of female appointments to boards. Thirty-three percent of new appointments were female, up from 25 percent from the previous year. Of the 60 new appointments under the age of 50, more than half were women, demonstrating that companies are recruiting younger female leaders. In tandem with gender, diversity of age should also not be overlooked as our findings reveal a positive correlation between the number of younger directors on S&P 500 boards and one-year company total shareholder return

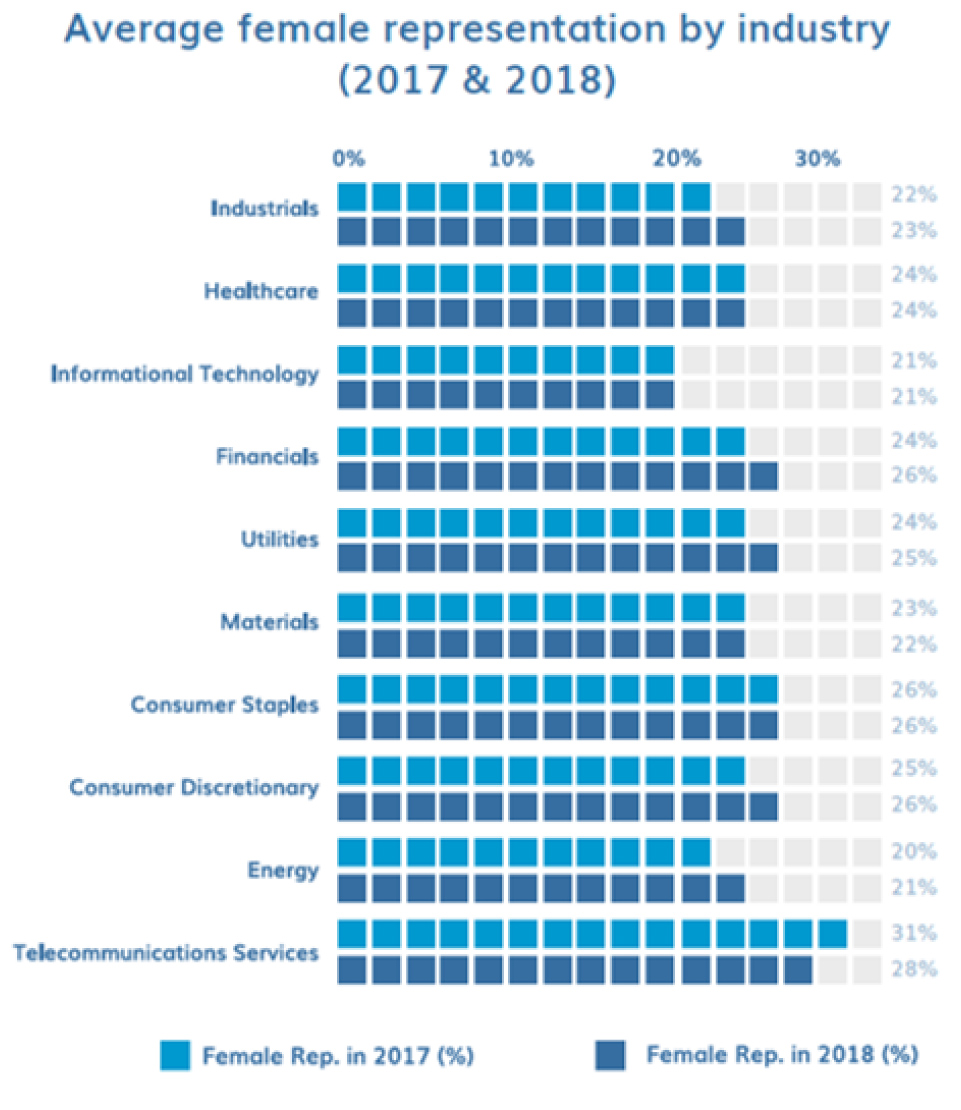

2. Telecommunications services have the highest representation of women on boards

Almost all industries saw an improvement in gender diversity of their boards between 2017 and 2018. The financial sector showed the greatest improvement, with female appointments up by 2 percentage points. While telecommunication services saw a 3 percentage-point fall in female representation in 2018, the industry still shows the largest representation of women on boards, at 28 percent.

One of the most encouraging changes we saw in 2018 was the increase in the percentage of new appointments that were women. 33% of new appointments were female, up 25% from the previous year.

3. Representation of female directors is growing, but radical action is required to hit targets

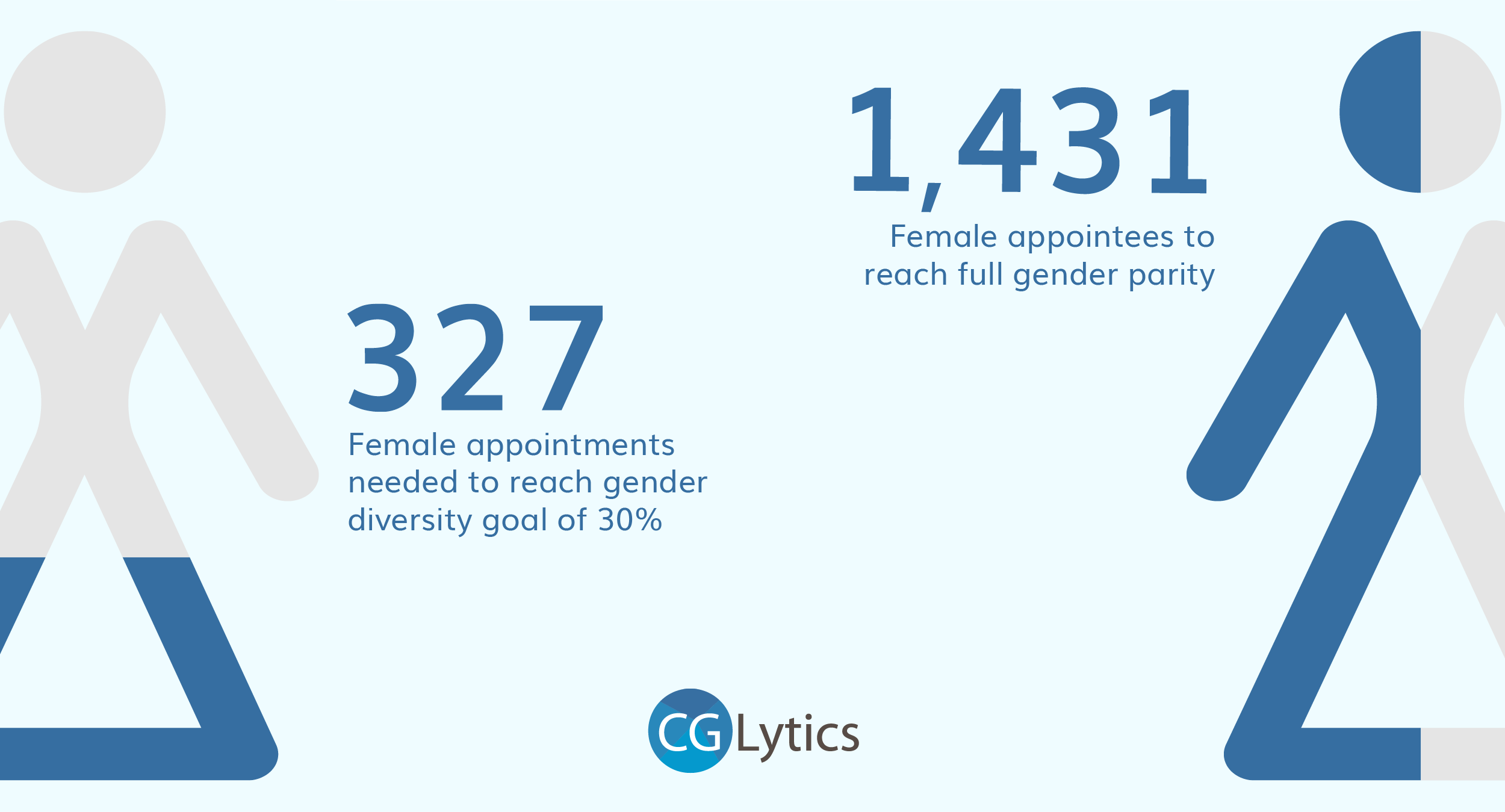

With female board representation reaching 24 percent (up just 1 percentage point from 2017), it’s critical to understand how many more appointments are needed to reach gender diversity goals of 30 percent and 50 percent: currently, 327 female appointments are needed to reach 30 percent and 1,431 to reach full gender parity. But to find suitable candidates to fill S&P 500 boards, companies are going to need to extend their network or look further afield.

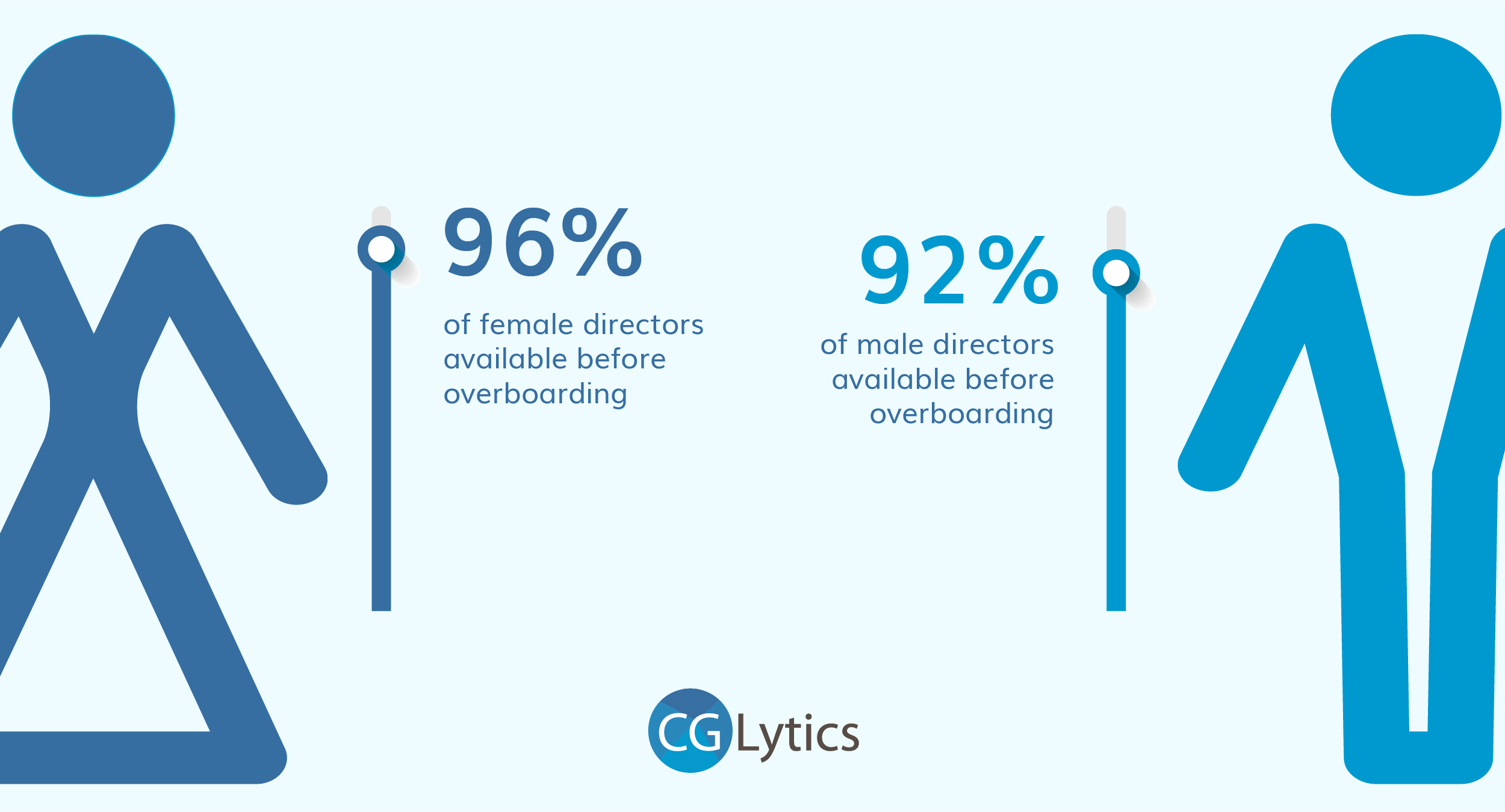

If a wider net is cast – for instance, looking at female directors on S&P MidCap 400 and S&P SmallCap boards, as well as C-level executives – then in the US alone 2,577 candidates are available. Beyond the US market, the CGLytics database shows more than 20,000 professional and experienced female candidates.

3. 27 female appointments needed to reach gender diversity goals of 30% and 1,431 female appointees to reach full gender parity

With female representation reaching 24%, we investigated how many more appointments are needed in order to hit 30% and 50% targets. We discovered that if the net is cast wider than the current 1,329 women sitting on S&P 500 boards, then an additional 1,227 female candidates are available (drawing from S&P Midcap 400 and S&P SmallCap 600 boards).

Getting ready for the coming season’s gender debate

Boards need to be fully prepared for conversations around gender diversification this upcoming proxy season and companies should be ready to provide evidence of their efforts to improve female representations.

In addition to real-time governance risk intelligence and Pay for Performance analytics, CGLytics provides companies with a networking tool for discovering and connecting with top candidates for succession planning.