Shareholders, including large institutional investors, are continuing the growing momentum to link executive pay to company performance.

The UK Investment Association, which represents more than £7 trillion ($9 trillion) in assets, responded to investor dissent of FTSE350 companies not acting on executive pay concerns by issuing a new version of executive pay guidelines for disclosures in 2019. With a statement claiming, “companies need to demonstrate the link between pay and company performance. If they don’t, they should brace themselves for more shareholder revolts”. It is clear from this statement that executive pay and pay regimes are still hot topics.

In the US, the Council of Institutional Investors (CII) have also commented in the past on the “excessive complexity in U.S. executive pay plans, and questions on the effectiveness of approaches to pay-for performance.”

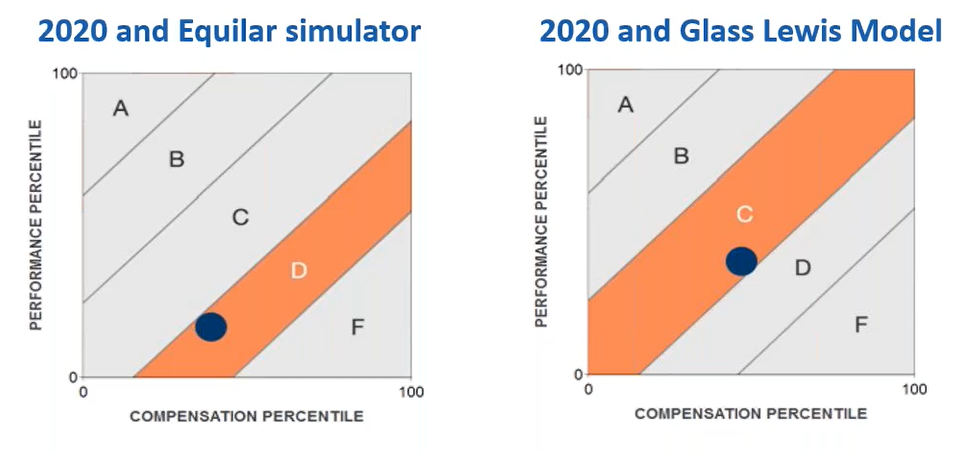

There are indeed vast disparities between compensation at select companies within the S&P500 index and their Total Shareholder Return (TSR). CGLytics, as part of its S&P 500 CEO/Executive Compensation review, has developed an extremely granular view of CEO pay in comparison with performance for the index, helping to focus the debate on the issue. The review examines different aspects of CEO pay among the constituents of the S&P 500index, including fixed v. variable compensation mix, overview of Pay vs. TSR, and a pay for performance review on a one- and three-year basis.

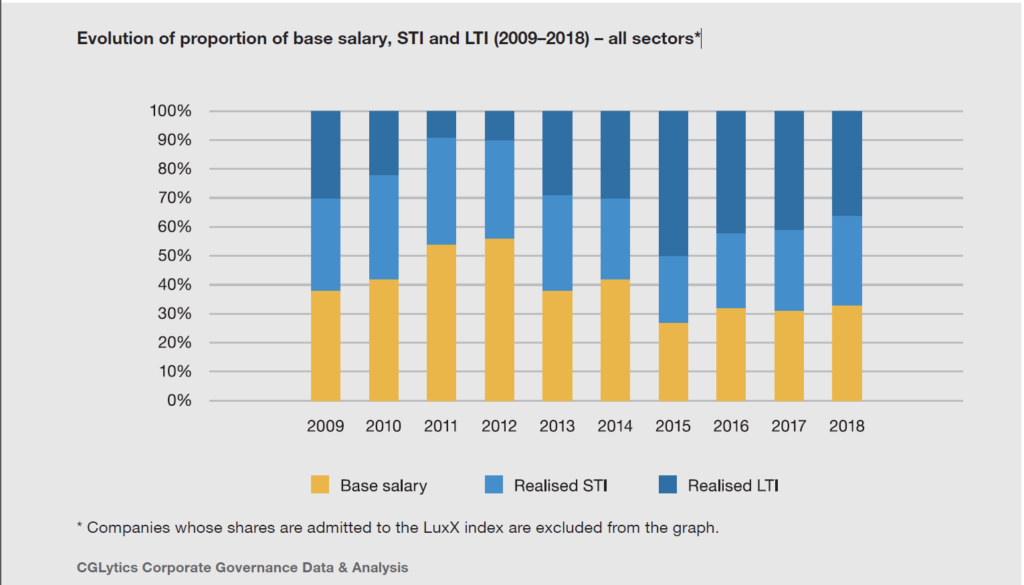

Realized Pay Correlates with Growth

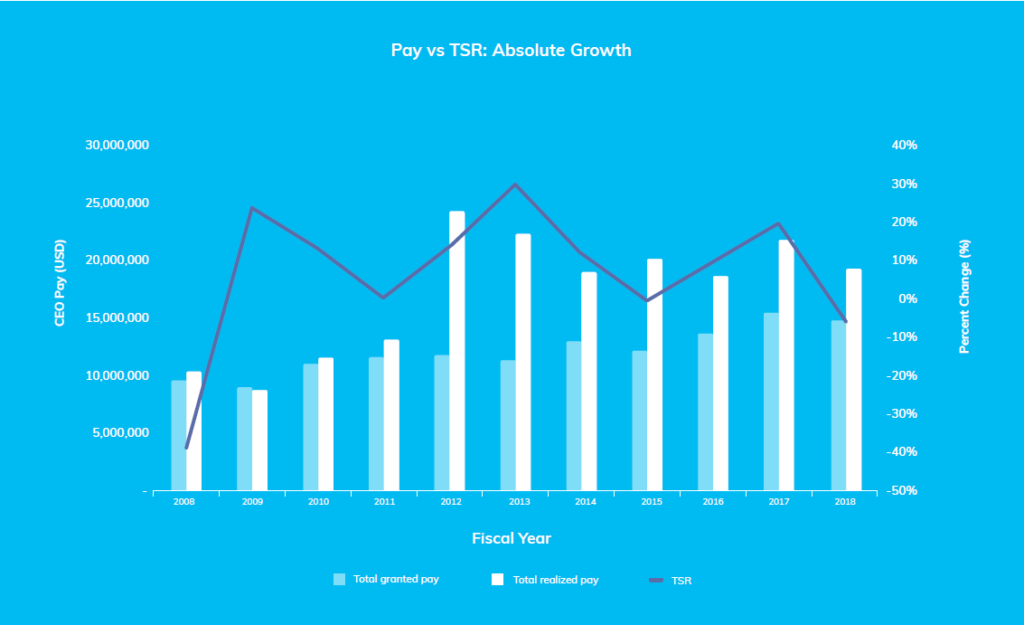

CEOs received an average of $14,748,284 in Total Granted Compensation (TGC) and $19,276,476 in Total Realized Compensation (TRC) in 2018, the report shows. Yet the average TSR for S&P 500 companies in 2018 was -6 percent. While this is an improvement from 2008, in which average TSR was -39 percent (average granted pay was $9,563,165 and average realized pay was $10,318,656), it is not a result that is likely to satisfy shareholders.

Indeed, the report indicates a trend that supports the need for performance-related incentives: Granted pay steadily increases from year to year while realized pay tends to coincide with absolute growth.