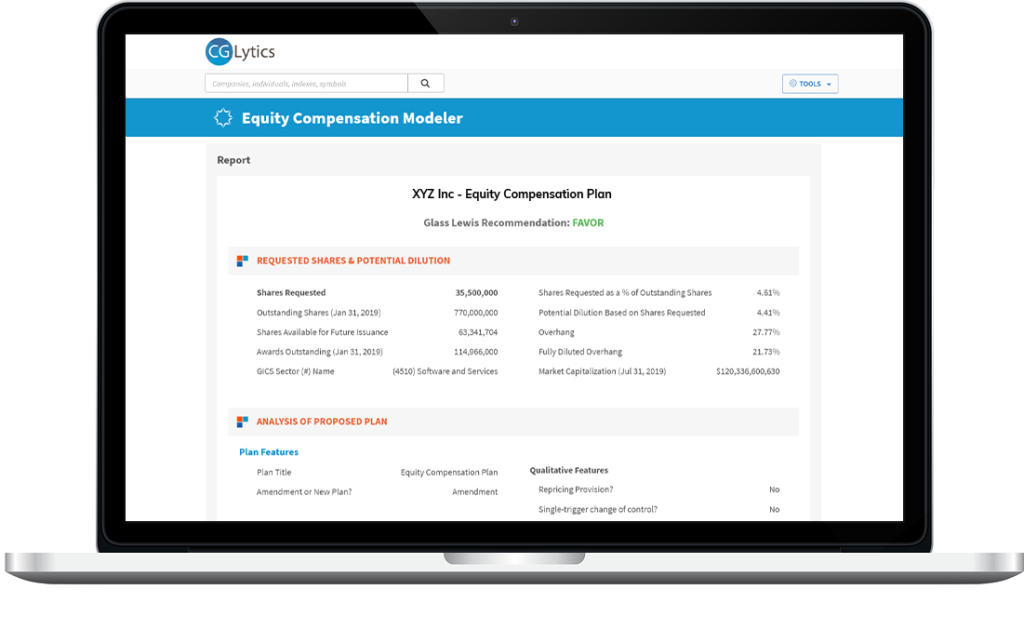

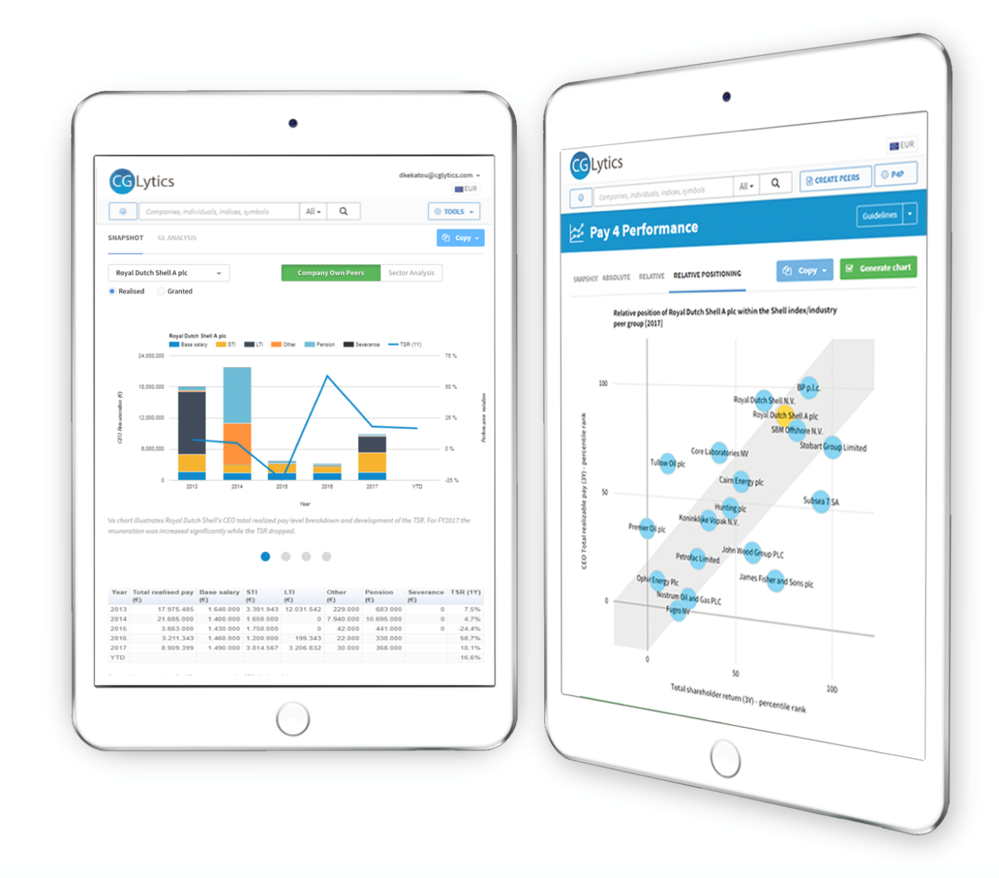

To increase transparency and truly understand how stakeholders, including proxy advisors, are viewing executive compensation and predicting how they are going to vote, companies and their boards need access to, not only information, but also data and tools that allow them to instantly compare their company to their industry peers’.

CGLytics’ extensive database hosts more than 10 years of global compensation data and is driving good corporate governance practices by increasing CEO pay transparency and helping companies to be more prepared than ever before.

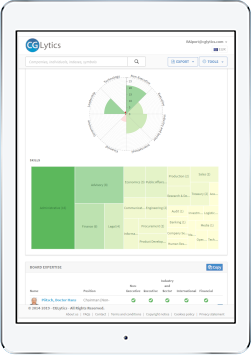

Using the same solution as leading proxy advisors and institutional investors, companies can replicate the peer groups of proxy advisors and investors with CGLytics’ customisable peer group modeler and easily perform a pay-for-performance alignment review. This empowers boards to know exactly what investors are looking at and scrutinising prior to engagement, be proactive with their reporting and make sure there are no hidden surprises come AGM time.

Diversity in the boardroom: where are all the women?

With companies, their boards, investors and governmental stakeholders all agreeing that goals that promote long-term value creation are imperative to corporate governance health, the issue of diversity comes into play. Why? Because having a diverse board is linked to long-term value creation.

A diverse board of directors with different ages, genders, nationalities, cultures, skills, experiences, tenure and backgrounds certainly creates new and interesting dialogue around best practices for long-term value creation and brings fresh ideas to the table.

With the speed of change happening today, driven by technology innovations, a variety of ideas, perspectives and knowledge is mandatory to keep up and make the best decisions by taking into account worldly happenings. And government and regulatory bodies are taking note. In particular, during the past year, the US has seen strict regulation changes in some states to even out the gender imbalance in corporate boardrooms.

California was the first state to legally require female representation on boards with the California Senate Bill 826 being passed. The law requires the appointment of at least one female to a company’s board of directors by 2019 and between one and three by 2021, depending on the size of the company. A fine of $100,000 can be expected for not complying. This was shortly followed by New Jersey , which mimicked California’s approach of at least one female director by 2019.

Earlier this year, using CGLytics’ software solution that provides extensive boardroom composition data and analytics, a review was carried out to evaluate the progress made in the US market and likelihood of achieving greater diversity in the coming years. By taking a deep dive into the board composition of S&P 500 companies, it was revealed that even though there is a push from investors for more diverse boards in order to maximise returns, change is not happening as fast as desired.

In CGLytic’s S&P 500 Diversity report it shows that from 2017 to 2018 total female representation on boards grew marginally, reaching 24 per cent, up just one per cent from 2017. In response to engagement with the investor community, as well as the new regulatory requirements, the number of women on boards rose from two in 2017 to three in 2018, showing only a slight increase in efforts being made. However, despite the slow growth in overall female representation, six of the seven companies that lacked at least one female director in 2017 corrected this in 2018.

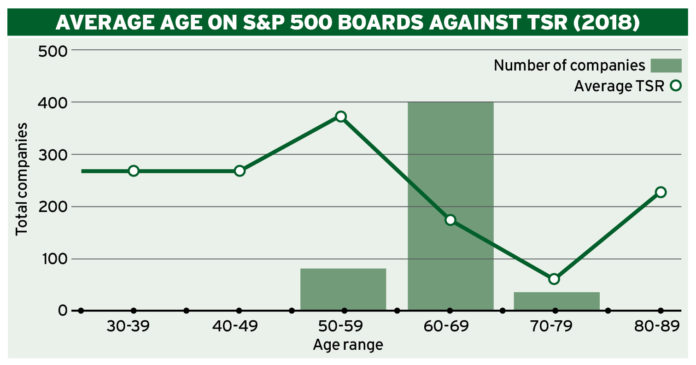

The report also revealed that bringing younger directors into the boardroom does not only add value in terms of unique perspectives and improved innovation, but also impacts company performance. The findings show that there is a clear and positive correlation between the number of younger board members and the total shareholder return (TSR).

As many investors continue to encourage and push for boardroom diversity for long-term value creation, it is now crucial for companies to, firstly, see how their boardroom composition, including skills, expertise, age and gender diversity is seen by the outside world. And, secondly, see how their company stacks up against their peers and competitors (see graph below).