Effective corporate governance starts with having the right information. In an ever-changing corporate governance landscape of continually increasing, publicly available information, shareholder involvement, activism, ongoing media campaigns and continual changes to governance regulations, having the right information on a timely basis from the start can be the difference between success and ongoing shareholder revolt.

This article first appeard in Ethical Boardroom, the premier subscription based magazine and website that is trusted for its in-depth coverage and analysis of global governance issues. Click here to access the original article.

Boardroom diversity, fair executive compensation, compliance to regulatory requirements, how companies compare against their peers and competitors and how they are perceived by investors and proxy advisors, needs to be thoroughly understood by boards of companies to stay ahead.

With heightened scrutiny of governance practices in the post-financial crisis era, it is now more important than ever for companies’ boards and their executives to be fully prepared, with the same data and information as investors and proxy advisors, before beginning engagement to avoid reputational and governance risk.

CGLytics, the leading provider for global corporate governance data analytics, provides real time data and a suite of powerful benchmarking tools to help companies and their boards with data- driven insights for sustainable practices and effective oversight. These tools support boards in making smarter, more timely and better-informed decisions.

The great debate of executive compensation

Investors over the past 12 months have continued to pay attention to, and even asked more questions about, the pay practices of companies and rewards offered to their CEOs and directors. Add to this the requirements set out in the revised European Shareholder Rights Directive (SRD II) to increase transparency of the company’s pay practices, including CEO to average employee pay ratios, CEO pay relative to company’s performance and extended say on pay rights of shareholders, companies should be sitting up and paying close attention.

During the last proxy season, executive pay was heavily and effectively challenged. Shareholders repeatedly voted down advisory remuneration reports and questioned short-term remuneration plans, urging companies to bring pay into line with performance. Many remuneration-related resolutions were voted down on the grounds of misalignment.

The UK, in particular, was at the forefront of shareholders concerns over excessive pay. To address these concerns, the Financial Reporting Council (FRC) issued a Revised Corporate Governance Code in July 2018, which encouraged directors to exercise independent judgement and discretion when authorising remuneration outcomes, by taking into account company and individual performance along with other circumstances.

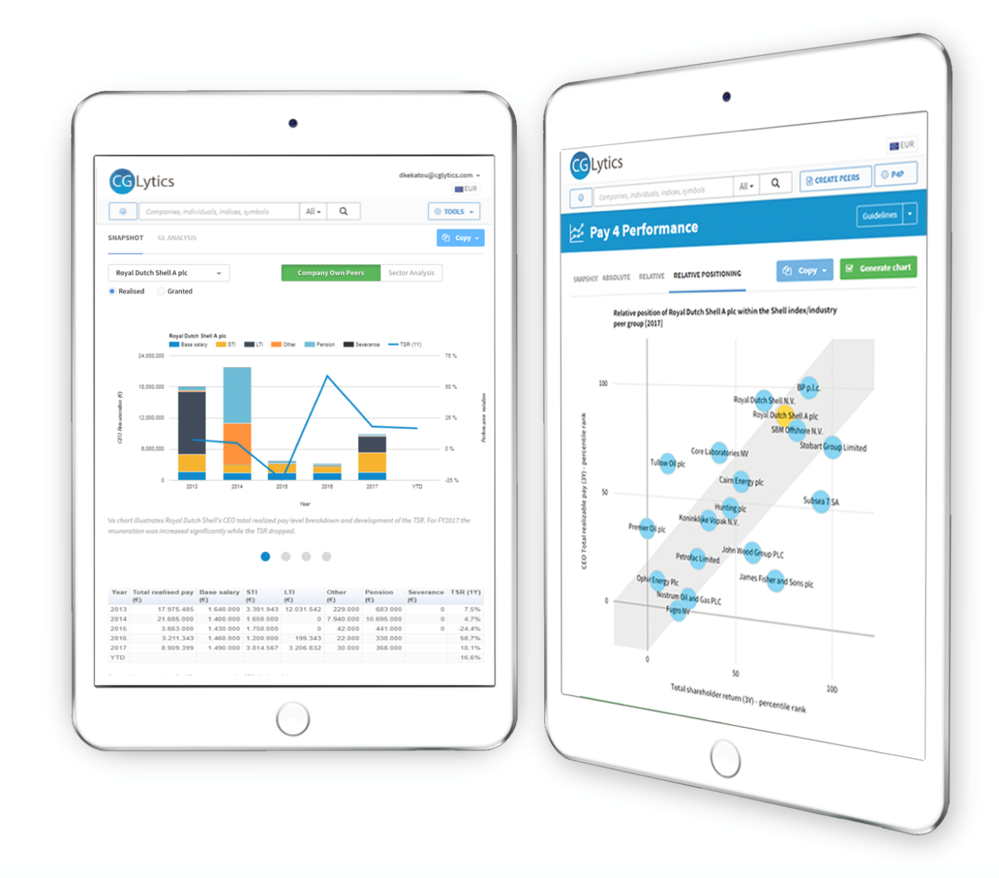

Executive compensation data available in the CGLytics application

CGLytics carried out a proxy review with data from its extensive, global governance database of FTSE 100 companies and their pay practices. The study revealed that in 2018, 33 companies in the index sought a binding shareholder approval for their remuneration policies. Generally, investors questioned the earning potentials in short-term incentive plans, for example Rentokil Initial plc’s decision to increase the annual bonus from 100 per cent to 150 per cent cost the board a dissent of around 25 per cent on their remuneration policy. In addition, shareholder revolts were seen regarding remuneration reports where there was not enough clarity about contractual entitlements, as seen in the case of Royal Mail’s retiring CEO Moya Greene and new CEO Rico Back.

In other markets, shareholders became increasingly involved in company strategy, as seen in the Dutch AEX study carried out by CGLytics. Of the past years’ proposals to amend executive and supervisory directors’ remuneration, the majority encountered criticism and some were withdrawn prior to the AGM, or resulted in a large number of votes against.

“WITH HEIGHTENED SCRUTINY OF GOVERNANCE PRACTICES IN THE POST-FINANCIAL CRISIS ERA, IT IS NOW MORE IMPORTANT THAN EVER FOR COMPANIES’ BOARDS AND THEIR EXECUTIVES TO BE FULLY PREPARED”- Aniel Mahabier, CEO of CGLytics

To increase transparency and truly understand how stakeholders, including proxy advisors, are viewing executive compensation and predicting how they are going to vote, companies and their boards need access to, not only information, but also data and tools that allow them to instantly compare their company to their industry peers’.

CGLytics’ extensive database hosts more than 10 years of global compensation data and is driving good corporate governance practices by increasing CEO pay transparency and helping companies to be more prepared than ever before.

Using the same solution as leading proxy advisors and institutional investors, companies can replicate the peer groups of proxy advisors and investors with CGLytics’ customisable peer group modeler and easily perform a pay-for-performance alignment review. This empowers boards to know exactly what investors are looking at and scrutinising prior to engagement, be proactive with their reporting and make sure there are no hidden surprises come AGM time.

Diversity in the boardroom: where are all the women?

With companies, their boards, investors and governmental stakeholders all agreeing that goals that promote long-term value creation are imperative to corporate governance health, the issue of diversity comes into play. Why? Because having a diverse board is linked to long-term value creation.

A diverse board of directors with different ages, genders, nationalities, cultures, skills, experiences, tenure and backgrounds certainly creates new and interesting dialogue around best practices for long-term value creation and brings fresh ideas to the table.

With the speed of change happening today, driven by technology innovations, a variety of ideas, perspectives and knowledge is mandatory to keep up and make the best decisions by taking into account worldly happenings. And government and regulatory bodies are taking note. In particular, during the past year, the US has seen strict regulation changes in some states to even out the gender imbalance in corporate boardrooms.

California was the first state to legally require female representation on boards with the California Senate Bill 826 being passed. The law requires the appointment of at least one female to a company’s board of directors by 2019 and between one and three by 2021, depending on the size of the company. A fine of $100,000 can be expected for not complying. This was shortly followed by New Jersey , which mimicked California’s approach of at least one female director by 2019.

Earlier this year, using CGLytics’ software solution that provides extensive boardroom composition data and analytics, a review was carried out to evaluate the progress made in the US market and likelihood of achieving greater diversity in the coming years. By taking a deep dive into the board composition of S&P 500 companies, it was revealed that even though there is a push from investors for more diverse boards in order to maximise returns, change is not happening as fast as desired.

In CGLytic’s S&P 500 Diversity report it shows that from 2017 to 2018 total female representation on boards grew marginally, reaching 24 per cent, up just one per cent from 2017. In response to engagement with the investor community, as well as the new regulatory requirements, the number of women on boards rose from two in 2017 to three in 2018, showing only a slight increase in efforts being made. However, despite the slow growth in overall female representation, six of the seven companies that lacked at least one female director in 2017 corrected this in 2018.

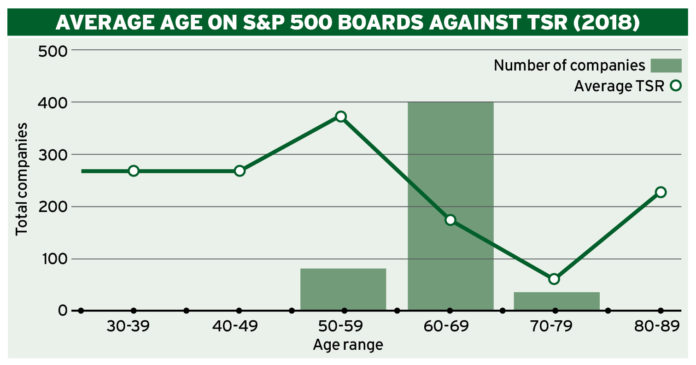

The report also revealed that bringing younger directors into the boardroom does not only add value in terms of unique perspectives and improved innovation, but also impacts company performance. The findings show that there is a clear and positive correlation between the number of younger board members and the total shareholder return (TSR).

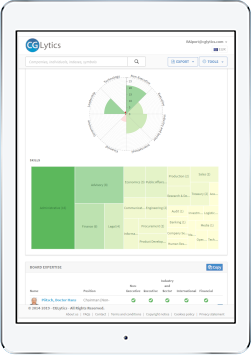

As many investors continue to encourage and push for boardroom diversity for long-term value creation, it is now crucial for companies to, firstly, see how their boardroom composition, including skills, expertise, age and gender diversity is seen by the outside world. And, secondly, see how their company stacks up against their peers and competitors (see graph below).

Source: CGLytics Data and Analytics

Companies using the CGLytics software-as-a-service platform now have access to boardroom intelligence and can see exactly what their investors and proxy advisors see. Using this intelligence, which includes a skills and expertise matrix of more than 5,500 listed companies across the globe, boards are better preparing for AGMs, implementing effective succession plans and, at the same time, reducing their risk to reputational damage and activist investors.

In addition, having access to 125,000-plus global executive biographies in the CGLytics solution, including more than 20,000 female profiles (both existing as well as upcoming directors), with detailed information of skills, experience, compensation, interlocks and connections, nomination committees can lever new ways of scanning the market for talent, understanding corporate networks and work smarter with their search and HR firms when it comes to succession planning and recruitment. It really is helping companies to look beyond the standard practices and information available by leveraging technology to drive and implement good corporate governance practices and sustain a competitive advantage.

Why data, tools and smart technology are mandatory in the challenging times ahead

As we continue to see regulatory requirements to increase transparency of governance practices, such as CEO pay (through implementation of SRD II) and improve diversity (through legislation not only in the US but worldwide), a trend is emerging of investors becoming increasingly knowledgeable and sophisticated.

Not only are leading proxy advisors and institutional investors choosing to use data and analytics delivered to them from CGLytics, but some are building their own systems to stay informed and take advantage of investment opportunities. Companies need to have access to the same information as proxy advisors and investors, with the same sophisticated tools, in order to assess risks, better prepare for shareholder engagement and avoid potential activism. With knowledge being power, and transparency becoming a mandatory requirement, in the near future companies will have no choice but to use systems, such as those offered –by CGLytics, to keep up with investors and improve their reporting practices.

Board insights available in the CGLytics application

The need to keep up with intel on governance risk exposure was evident during the 2018 proxy season. The season saw record levels of shareholder activism, with some high-level campaigns – notably those of Elliott Management and Icahn Partners – hitting the headlines. Changes to board composition and M&A were the primary aims of these campaigns. A recent study performed by Lazard, shows that activists won 161 board seats in 2018, up 56 per cent from 2017 and continue to name accomplished candidates, with 27 per cent of activist appointees having public company CEO/CFO experience. The message is clear: boards must regularly review their governance vulnerabilities to minimise their exposure to activists, and to review vulnerabilities they must have access to the analytics and tools in platforms such as CGLytics’.

And themes that were established in the 2018 season are likely to continue. Shareholder activism will increase with institutional investors playing a more active role and driving change. It also seems likely that US activists will launch campaigns focussed on European companies. Forcing European companies to have access to global data for instant comparison of not just their country peers, but their industry peers and competitors globally.

To prepare effectively for shareholder engagement and anticipate response, companies and their boards must also be looking at past voting habits and patterns, and resolutions from other AGMs during the season. By looking at the trends of past shareholder voting and keeping abreast of happenings during the current proxy season, boards can spot patterns and predict the outcomes of shareholder voting resolutions.

CGLytics’ platform hosts an extensive database of N-PX filings with voting proposals and resolutions from 2004 onwards, covering 4,000-plus investors with more than eight million data points. With this information on hand, plus the benefit of receiving up-to-date alerts of shareholder voting outcomes, boards remain on top of voting trends and can easily identify investors for a proactive engagement.

The next era in corporate governance intelligence

The pressure on companies and their boards to increase transparency of executive compensation and pay practices, improve age and gender diversity, and constantly assess their board quality and effectiveness will not go away.

As investors and their proxy advisors gain greater insights and intelligence by use of data and smart solutions, companies will need to do the same. Boards need to ensure they are on top of their exposure to governance risks in order to avoid activism at all costs and any possibility of reputational risk – and they need to do this efficiently.

Would you like to learn more about how, you too, can have instant insights into more than 5,500 globally listed companies’ board composition, diversity, expertise and skills? As well as access the same executive compensation data used by Glass Lewis in their Proxy Papers? Click here to learn more.