Younger directors on S&P 500 boards show positive effect on companies’ performance

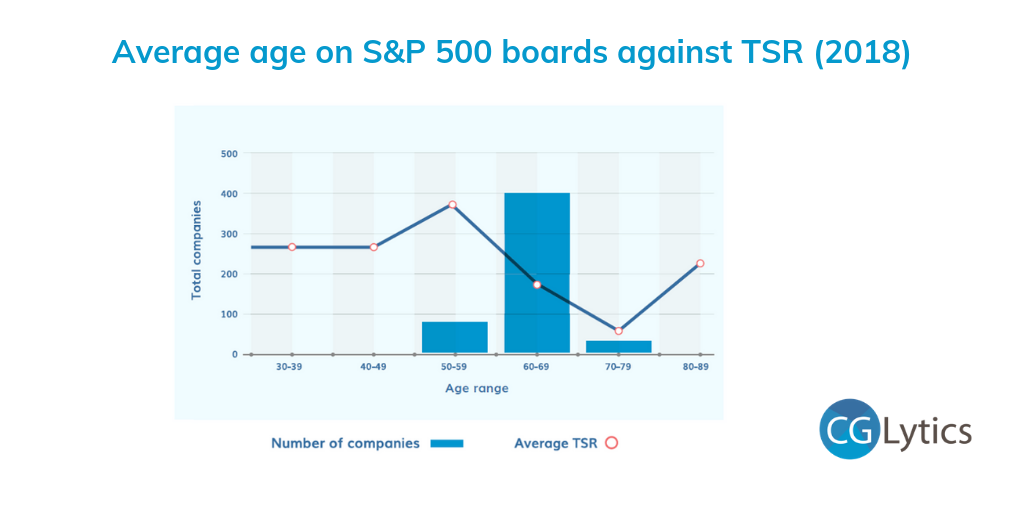

Bringing younger directors into the boardroom does not only add value in terms of unique perspectives and improved innovation, but also impacts company performance. Findings from CGLytics’ S&P 500 Boardroom Diversity Report reveal a clear and positive correlation between the number of younger board members and the Total Shareholder Return (TSR).

Despite our findings that show companies’ TSR was higher when age was lower on S&P 500 boards in 2018, the average age of board members still increased by six months that year.

With lawmakers and investors still calling for companies to appoint younger directors, the oldest demographics are still the most represented.

The following findings by CGLytics highlight how S&P 500 companies are progressing in terms of age diversification and tenure:

Average age on boards is 63.5 with three boards having directors over 90 years of age

Recent pressure on companies to appoint younger directors has not appeared to have an immediate impact with the average age of board members increasing by six months to 63.5 in 2018, and three companies having directors over the age of 90.

The majority of 2018 appointments were between the ages of 60 to 69 years old

While it has been suggested that having a diverse board with a variety of age demographics represented has a positive effect, in 2018 directors between the ages of 60 to 63 were the most appointed. While the proportion of new appointments in the younger age range of 30-49 decreased by 21%.

Average tenure increases to 10.7 but some sectors show promise

Despite calls for board refreshment, the average director tenure climbed higher in most industries, with the exception of Consumer Staples and Utilities. For Consumer Staples, average board tenure dropped from 9.5 years in 2017 to 9.3 years in 2018. The industry with the highest average board tenure was Utilities with an average of 14.9 years.

Getting ready for the coming season’s age debate

Boards need to be fully prepared for conversations around age diversification this upcoming proxy season and companies should be ready to provide evidence of their board refreshment efforts.

In addition to real-time governance risk intelligence and Pay for Performance analytics, CGLytics provides companies with a networking tool for discovering and connecting with top candidates for succession planning.

Access the full report.