Making their voices heard: Shareholders increase opposition to executive pay

During 2019 we saw an increase in the volume of shareholders making their feelings known about what they perceived as misaligned executive pay policies. This was brought on by lacklustre performance by their portfolios.

With a string of high-profile stories, executive compensation was rarely out of the news, and an increasing number of organisations became the focus of media outcry, damaging brands and forcing companies onto the defensive.

As the press and investor relations teams scrambled to justify the remuneration of their CEOs and other executives, CGLytics has taken a look into its historical data set to see whether this is part of an increasing trend of shareholder activism.

From the CGLytics coverage, which includes more than 5,500 companies across the globe, we have analysed the proxy votes submitted so far in 2019. During this time more than 3 trillion votes were cast against remuneration policies submitted. We have compared this number to the three years prior.

An accelerating trend

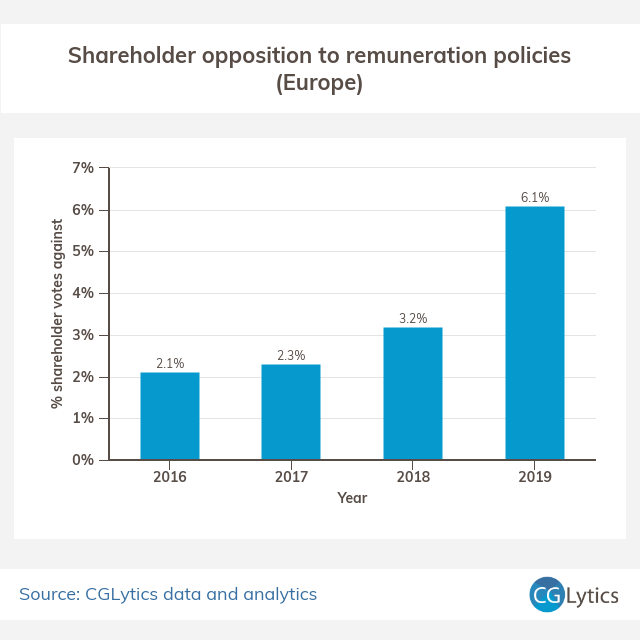

Looking back, we can see that shareholder opposition to director remuneration policies across Europe has increased. And increased significantly.

From 2016 to 2017 there was only a proportional 9% increase from 2.1% to 2.3% opposition, however in 2018 we see an indication that shareholders were getting frustrated.

From 2017 to 2018 there was a 40% increase in opposition to remuneration policies. While this is still a relatively overall small percentage of 3.2% opposition of the total votes, for some issuers this was a red flag and ensured that they proactively engaged with their shareholders to ensure clarity on awards and demonstrate that they were taking shareholder views into account.

However, many organisations failed to heed the warnings and 2019 saw the proportion of votes against director remuneration policies increase by 90%, up to 6.1% of total votes cast.

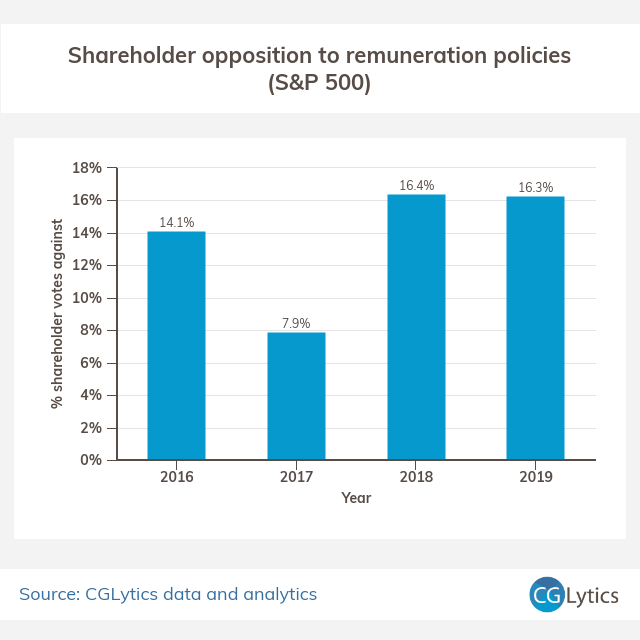

Meanwhile in the S&P500

Many US based companies have been under pressure from shareholders to curb perceived excessive pay, and this can be seen by the annual comparison below where in 2019, shareholders cast 16.3% of their votes against the recommended remuneration policies.

This consistently high level of shareholder opposition to executive remuneration reflects the idea that executives are receiving outweighted rewards compared to the overall growth and performance metrics that they are delivering.

What does 2020 have in store?

As you may have seen in our “Top 50 Highest Paid CEOs” article earlier in the summer, executive pay has the potential to increase significantly compared to relatively flat performance indicators (such as TSR), so it’s not unexpected that the shareholder opposition will continue to accelerate into the 2020 proxy season.

Proactive engagement is the key

CGLytics is the global compensation partner for Glass Lewis, the leading independent proxy advisor, who work with over 1,300 institutional investors around the globe. In our recent “behind the scenes with Glass Lewis” webinar, Andrew Gebelin, VP of Research, Engagement and Stewardship highlighted the benefits of organisations proactively engaging with both proxy advisors and investors to reduce the risk of mis-interpretation of remuneration policy elements and maximise the information available prior to AGM votes.

Access Glass Lewis’ Say on Pay analysis – Available through CGLytics

Glass Lewis uses CGLytics as it’s global compensation data provider. For the 2020 proxy season our data will provide the basis of Glass Lewis’ Say on Pay recommendations.