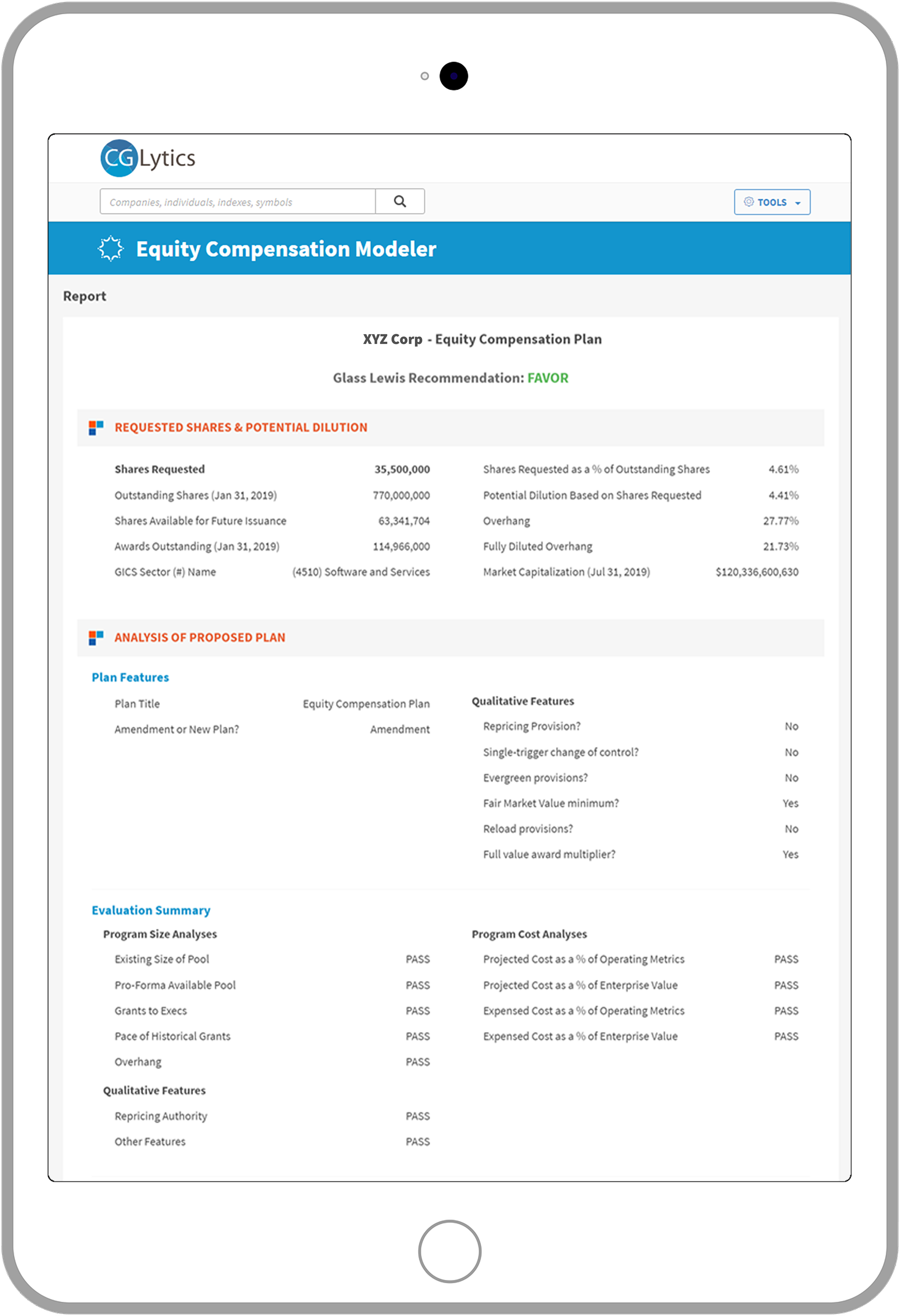

[Amsterdam, London, San Francisco – September 19, 2019] – CGLytics, a leading global provider of governance data and analytics, and Glass Lewis, the world’s leading independent provider of governance and engagement support services, today announced the launch of Glass Lewis’ Equity Compensation Model (ECM) – a powerful new application for assessing U.S. equity-based compensation plans, available exclusively via CGLytics.

This new application provides invaluable intelligence with year-round, on-demand access to Glass Lewis’ methodology which is used to evaluate the overall favorability of current and future equity plans, including tests against 11 key criteria. Companies and investors can now instantly test, review and adjust the same individual inputs as Glass Lewis’ analysts to ensure the best compensation, engagement and voting outcomes for their respective sides.

The ECM provides companies with immediate and proactive insight into the concerns regarding current and future equity plans, which Glass Lewis highlights to more than 1,300 investors representing more than $35 trillion in assets under management. In addition, with coverage of more than 4,300 publicly traded U.S. companies, investors can assess investment risks across their portfolio with regard to current equity plans or those being proposed.

Aaron Bertinetti, SVP of Research & Engagement at Glass Lewis explains: “Our analysts research and openly engage with thousands of companies and their investors every year, building invaluable insight and governance expertise as a result. We strongly believe that good governance is good for everybody, which means we must empower the capital markets by democratizing access to our deep governance expertise in a transparent, intuitive and unconflicted manner. The ECM gives companies and investors the same governance tools we use internally and have developed over many years. It will bring greater transparency, improved governance and market confidence by fostering alignment of corporate and investor interests in compensation plans.”

The ECM is available as a stand-alone service and is only available via CGLytics and its market-leading software. Corporate issuers can test and refine their equity plans, understand the level of concern from shareholders and ultimately be successful in seeking the shareholder support required to legally grant equity compensation. On the other hand, investors can test the equity plans for companies in their portfolio, perform comprehensive benchmarking of plan costs and evaluate the risk of any potential dilution to enhance their engagement and voting decisions.

“Getting equity compensation right is a pivotal part of modernizing corporate governance. Issuers and institutional investors must be satisfied that proposed plans meet the long-term needs for the business and its shareholders. ECM will completely change the way both sides approach these challenges, setting a new benchmark for transparency in the decision-making process and driving good governance practices.” said Aniel Mahabier, CEO of CGLytics.

The offering, initially launched for the U.S. market, covers 4,300+ publicly traded U.S. firms including the Russell 3000, S&P 1500, S&P MidCap 400 and SmallCap 600.

About CGLytics

CGLytics is transforming the way corporate governance decisions are made. Combining the broadest corporate governance dataset, with the most comprehensive analytics tools, CGLytics empowers corporations, investors and professional services to instantly perform a governance health check and make better informed decisions. From unique Pay for Performance analytics and peer comparison tools, to board effectiveness insights, companies and investors have access to the most comprehensive source of governance information at their fingertips – powering the insights required for good modern governance.

About Glass Lewis

Glass Lewis, the leading independent provider of global governance and engagement support services, helps institutional investors understand and connect with companies they invest in. Glass Lewis is a trusted ally of more than 1,300 investors globally who use its high-quality, unbiased Proxy Paper research and industry-leading Viewpoint proxy vote management solution to drive value across all their governance activities.