In the spotlight: EQT Corporation Proxy Statement

EQT Corporation AGM

As proxy season in the United States is winding down, only a handful of companies are still left to host their Annual General Meeting (AGM). EQT Corporation, the largest natural-gas producer in the US, will host its AGM on July 10 and has subsequently invited its shareholders to attend and vote on four resolutions. Namely:

- The election to the Company’s Board of Directors of the 12 directors nominated by the Board to serve for one-year terms

- The approval of a non-binding resolution regarding the compensation of the Company’s named executive officers for 2018

- The approval of the EQT Corporation 2019 Long-Term Incentive Plan

- The ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2019

Contested Election

With twelve incumbent management nominees, “Rice Group” has also put forward six nominees for election utilizing the universal proxy card, which the board adopted in 2019. Toby Rice, partner of Rice Investment Group, elaborated on individual nominations by saying “We believe a comprehensive solution is required to effect the fundamental course correction needed to deliver full value to shareholders”. In response the leadership team at EQT has urged voters to disregard the plea from the Rice Group by arguing that the nominations would “immediately jeopardize the value of [the] investment by installing their friends”.

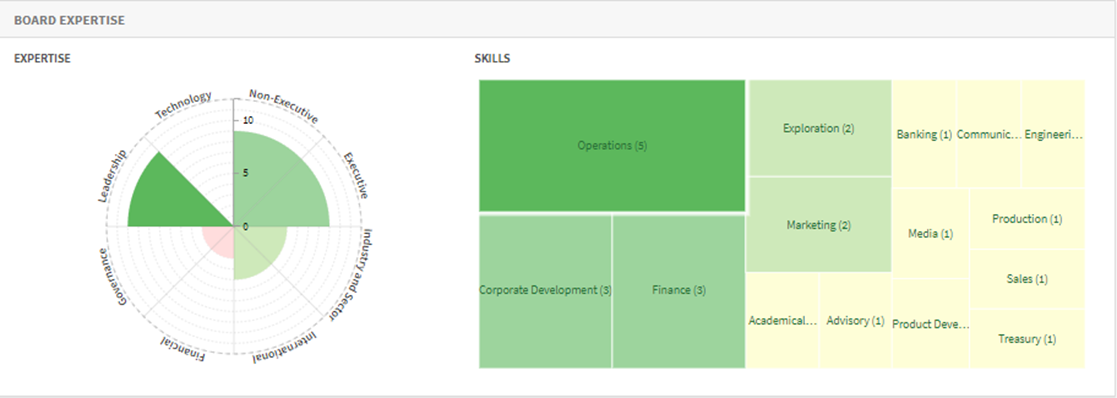

CGLytics’ Board expertise analytics shows that, given the current board’s composition, the board currently lacks expertise in the following sectors: Technology, Financial, Governance, International, and Industry/Sector.

Source: CGLytics Data and Analytics

EQT Corporation proposes the election of the following three individuals: Janet L. Carrig, James T. McManus and Valera A. Mitchell. If elected, the areas of expertise the three nominees would bring to EQT’s Board would be Governance, Executive, Non-Executive, Leadership and International. This also means that post-election of these director nominees, the board would remain unbalanced in regard to Technology and Financial Expertise. However, when reviewing the background of just three of the six nominees from the Rice Group, Lydia I. Beebe, Lee M. Canaan and Kathryn J. Jackson, their aggregate expertise is comprised of Non-Executive, Executive, Leadership, and most notably, Governance, Financial expertise and Technology.

CGLytics does not advocate for or against the election of any of the individuals, however governance matters should entail a certain level of scrutiny. The data analytics available on the CGLytics platform provides for a new and unparalleled insight into governance issues which helps place agency back in the hands of the shareholder and helps companies to better understand their practice against market norms.

Executive Compensation

Earlier in 2018, EQT underwent several key management changes including the appointment of a new CEO and CFO. In March 2018 Steven Schlotterbeck stepped down as CEO for personal reasons and was succeeded by interim CEO David Porges. In November in the same year Robert McNally, previously CFO, was appointed as CEO and Jimmi Sue Smith took over as CFO. Several board members were also appointed to replace departing directors.

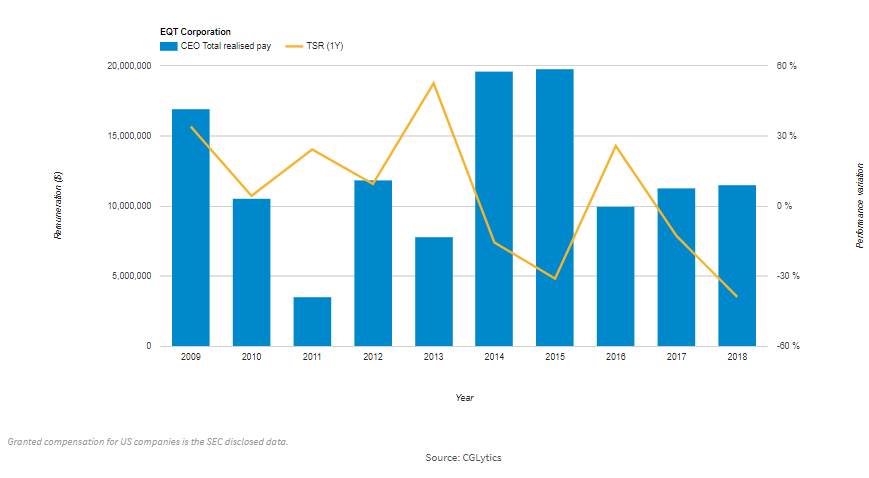

Item 2 on the agenda dictates a vote on the approval of the compensation of the company’s named executive officers. When reviewing the CEO’s compensation proposal with CGLytics’ executive compensation and pay for performance modeler, we find a potential misalignment between CEO remuneration and one-year total shareholder return.

CGLytics’ data and analytics are trusted and used worldwide by Glass Lewis, the leading independent proxy advisor, as a basis for their research on companies.

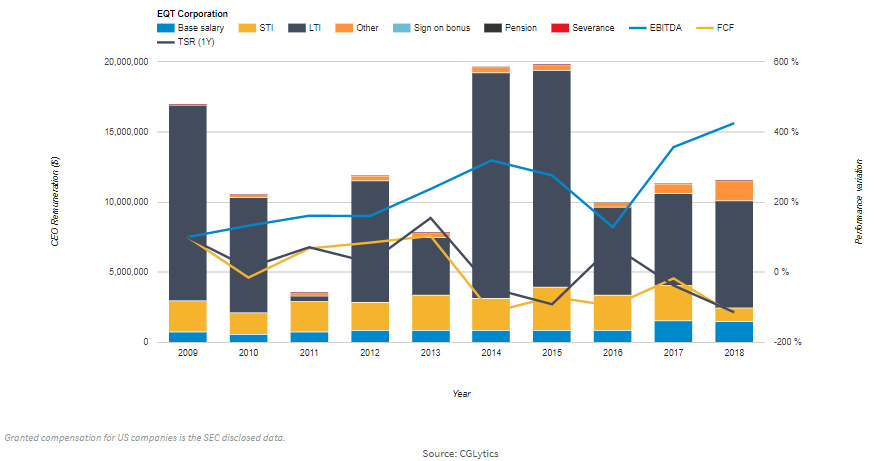

Like most U.S. corporations, EQT Corporations proxy statement describes their compensation packages as “weighted in favor of performance-based, at-risk compensation through annual and long-term performance-based incentive programs”. Delving further into the pay-structure of the CEO, this philosophy seems to hold true as most of the remuneration is derived from Long term and short-term incentives (LTIs and STIs). Stock awards account for the majority of the LTIs for the CEO where the largest contributor in dollar amount is the Incentive PSU program, with TSR being the highest weighted performance criterion. In particular, considering EQT’s emphasis on TSR, it is important to note the long-term diverging trend between the company’s one-year TSR and CEO remuneration. More specifically, executive pay from 2016 and onwards has been on the rise while TSR has been declining and currently sits at its lowest point over the last 10 years.

Source: CGLytics P4P Modeler

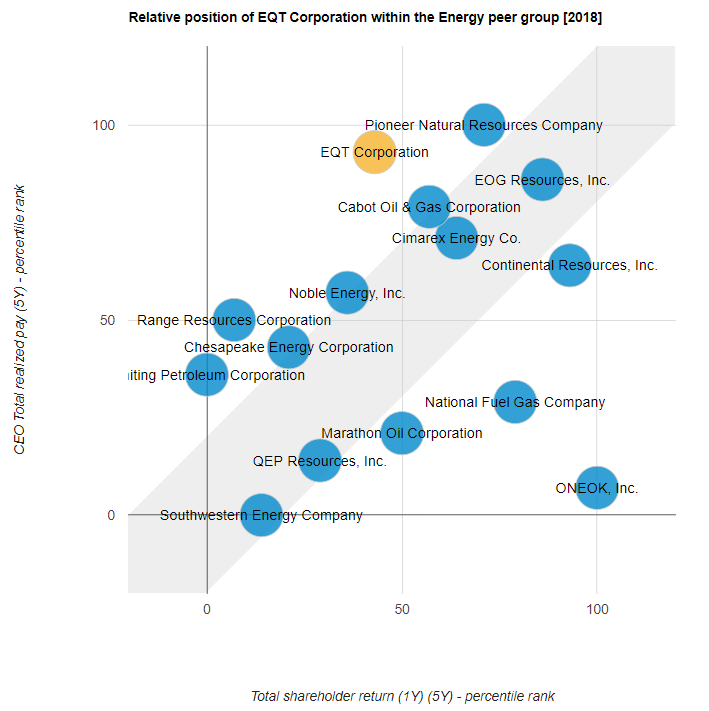

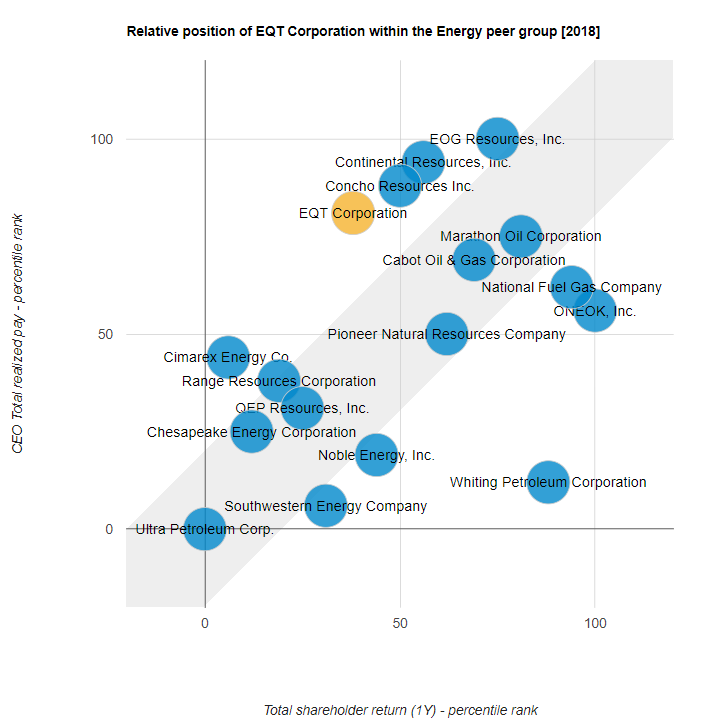

Moreover, when comparing EQT’s CEO pay practise relative to its disclosed peer group, as disclosed in the graphs below, we see a pay for performance misalignment between TSR and compensation over both a one -year and five-year period.

Source: CGLytics P4P Modeler

Item 3 on the agenda entails the approval of the 2019 Long-Term Incentive Plan which enables the company to grant stock awards to its executive officers. The granting of these awards will be based on the achievement of certain performance measures, namely relative TSR (50% weight), operating efficiency (25% weight), and development efficiency (25% weight). Moreover, the ultimate payout under the award plan is subject to a modifier based on achieved ROCE, which could push executives’ payout as high as 1.1 times higher than based on achievement of the three preceding performance criteria alone.

CGLytics offers the broadest, up to date global data set and powerful benchmarking tools to conduct comprehensive analysis for executive compensation decisions and risk oversight. CGLytics is Glass Lewis’ source for global compensation data and analytics. These analytics power Glass Lewis’ voting recommendations in both their proxy papers and their custom policy engine service.

For more information regarding how CGLytics’ deep, global data set and unparalleled analytical screening tools can potentially help you make better decisions, click here.

Sources:

About the Author

Jaco Fourie: U.S. Research Analyst

Jaco holds a Bachelor of Science degree in Accounting and Finance from the University of Reading. He has gained experience as a research analyst from his enrollment at the Henley Business School and the International Capital Market Association Centre.