COVID-19: Changes to Executive and Shareholder Pay in Europe’s Biggest Banks

In March 2020, the European Central Bank (ECB) published a recommendation to banks on dividend distribution, asking financial institutions to refrain from paying dividends or buy back shares during the COVID-19 pandemic. The measure was introduced to help banks cope with losses and support lending in times of the crisis and concerned dividends for financial years 2019 and 2020. The ECB suggested banks to amend dividend proposals for the upcoming Annual General Meetings, at least until October 1, 2020[1]. This article reviews the executive compensation changes and dividend amendments of banks across Europe in response to the COVID-19 crisis.

Numerous banks across Europe decided to follow the recommendation and cancelled, or delayed, dividend payments. Furthermore, senior management and non-executive directors of some institutions also decided to waive parts of their compensation to support the business or donate to the pandemic funds. Some other banks, however, have not announced any changes to executive remuneration at the time of generating this report.

To evaluate the financial industry’s response to the COVID-19 crisis, CGLytics has looked at the executive compensation changes and dividend amendments of 20 listed banks across Europe, with market capitalisation varying from EUR 9B to EUR 148B. The geographical representation of the peer group covers eight countries – Spain, United Kingdom, France, Norway, the Netherlands, Italy, Belgium and Sweden.

Changes in Executive and Non-Executive Compensation

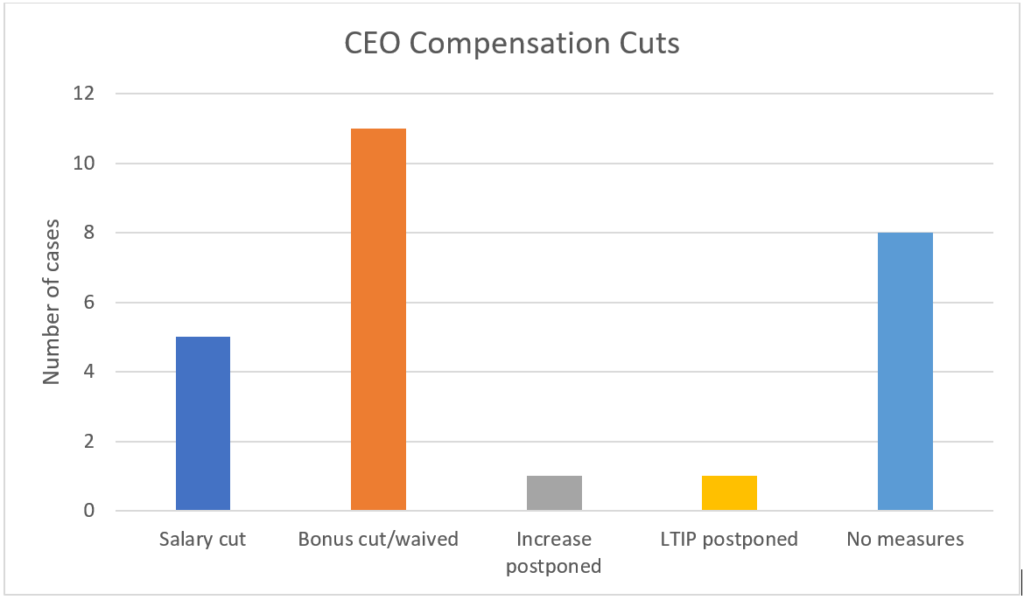

Top executives across the industry chose to contribute part of their fixed or variable compensation in order to help their company or society to combat the crisis. 12 out of the 20 evaluated banks announced various actions taken by the executives, among them reductions in a salary, cuts or waiving of a bonus, or agreement to postpone planned compensation increase.

Source: CGLytics Data and Analytics

For example, the CEO of Banco Santander SA, José Antonio Alvarez, contributed half of his base salary as well as his bonus to the medical equipment fund[2]. Chief executives of three UK banks also announced that both their salary and variable bonuses will be affected by donations or cost cuts. These banks are HSBC Holdings plc, The Royal Bank of Scotland Group plc and Standard Chartered PLC.

Out of the reviewed sample, only Barclays plc chose to delay releasing of a portion of the long-term incentives awarded in 2017 and due to vest in June 2020. In addition, both the CEO and CFO of the bank have requested any increase to their fixed pay to be postponed until at least 2021. The bank’s Chief Executive, James Staley, has also volunteered to contribute one-third of his salary for the next six months to charitable causes[3].

Eight out of 20 banks have not reported any changes to the executive remuneration caused by the pandemic, including all Swedish banks represented. However, it is worth noting that senior management of Swedbank AB has been affected by pay cuts due to a money laundering scandal[4].

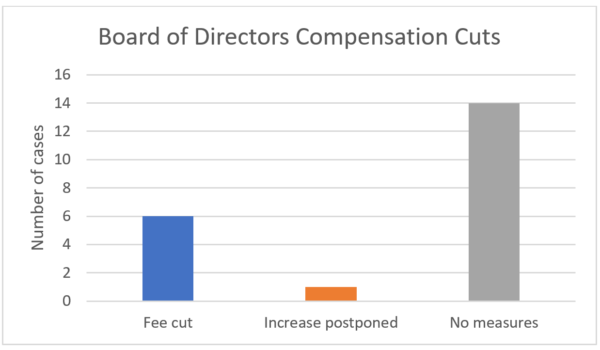

The situation with compensation adjustments for non-executive directors differs significantly for the chosen peer group. Only six out of 20 banks announced that the Chair or members of the Board of Directors agreed to forego wholly or partially the annual fees.

Source: CGLytics Data and Analytics

Chairs of Banco Santander, Barclays PLC, Banco Bilbao Vizcaya Argentaria and The Royal Bank of Scotland Group took cuts in their fees to support charities. Mark Tucker, Chairman of HSBC Holdings plc, donated his entire fee for 2020 (roughly GBP 1.5m)[5].

Non-executive directors of Banco Santander volunteered to contribute 20% of their fees to charity while Directors of Svenska Handelsbanken AB proposed to recall an increase of the Board fees. However, no other banks from the sample announced any changes to the fees paid to non-executive directors due to the pandemic crisis.

Changes in Dividend Payments

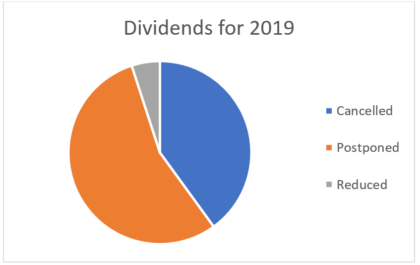

All 20 banks announced changes to the dividend payments in response to the ECB recommendations or the losses due to the crisis. Banks chose to cancel or postpone the dividend payments for 2019 financial year until more certain circumstances.

Source: CGLytics Data and Analytics

Following the ECB suggestion, the banks did not cancel interim dividends that have already been paid out but amended payments of the final dividends for 2019. Most of the banks chose to postpone the decision regarding the dividends for 2019 until later this year, hoping for clearer overview of the results and forecasts, while allocating the 2019 profits to the reserve accounts. CaixaBank SA decided instead to reduce 2019 dividends and change the 2020 dividend to a cash pay-out not higher than 30% of reported consolidated earnings[6].

Regarding the interim dividends for financial year 2020, some of the banks have already announced that they do not plan to undertake any dividend payments until uncertainties caused by COVID-19 disappear.

Financial regulators and banks across Europe are taking measures in times of the COVID-19 pandemic to support the economy. The recommendation of the European Central Bank to refrain from paying 2019 dividends until more certain times led to many financial institutions cancelling or postponing the dividend payments and using all funds available to combat the crisis or as a reserve backup.

Moreover, top managers and members of the Board of Directors are voluntarily donating part of their fees for 2020 financial year to charities and to support the business. Even though all evaluated banks have chosen to amend dividend payments, only some have been spotted on account of voluntary contributions from the top management. The results and impact of current decisions made by the banks will be visible by the end of the current crisis, when companies will evaluate the state of their business to estimate what kind of return they will offer to their shareholders.

Would you like to see how your executive compensation is viewed by leading independent proxy advisor Glass Lewis?

Click here to learn more about the Glass Lewis CEO compensation analysis and peer group modeling for Say on Pay engagement, available exclusively via CGLytics.