Gender diversity in Spanish boardrooms

In Spain, the Comision Nacional de Mercado de Valores (CNMV), has put a series of changes to the corporate governance code of public companies under consultation. This is widely regarded as one of the most relevant proposed amendments relating to gender diversity in boardrooms.

The new proposal is moving from a “mere” recommendation to a “direct” recommendation of a minimum of a 40% presence of females in boardrooms, significantly up from the current 30%. Besides, the CNMV also acknowledges that the current recommendation hasn’t been given enough attention by Spanish corporates. To address the issue, the new proposal recommends to include executive selection policies and processes in order to promote diversity of knowledge, experience and gender.

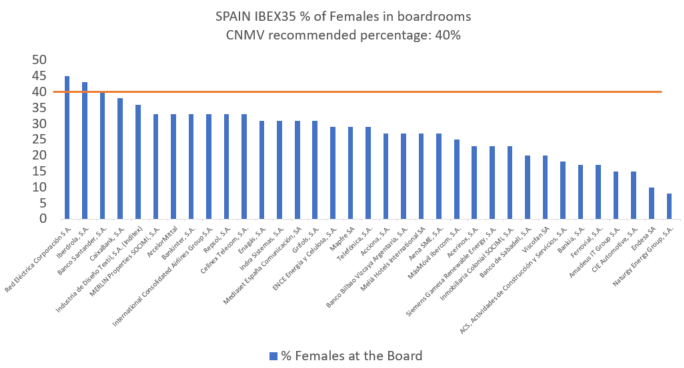

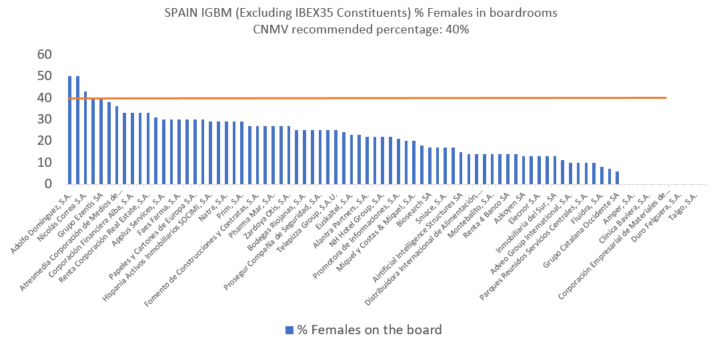

Considering these substantial and at the same time exciting changes, I decided to take a look at the current state of gender diversity in Spanish boardrooms, selecting both the IBEX35 and the remainder constituents of the IGBM. The result of the analysis is as follows:

Within the IBEX35, only 3 constituents already meet the new recommendation of the CNMV. Much worse is that only 43% meet the current threshold that has been introduced in 2015, and 20% have less than 20% of females on their board.

Within the rest of constituents of the IGBM (82 corporates), the situation is mixed:

- • 2 corporates have already achieved real gender parity

- • 3 corporates meet or exceed the new threshold of 40%

- • 18 corporates are already above or meet the current recommendation

- • 59 corporates are below or significantly below the current recommended 30%. Within this group, there are 11 companies which have no females at all in their boardrooms. Following Larry Fink’s latest letter, it is likely that these companies will be facing tougher environments and questioning from investors and stakeholders in the future, as well as higher financing costs.

Source: CGLytics Data and Analytics

Considering that the current recommendation was set by the CNMV in 2015, it is clear to see that companies will have a challenging future ahead if they want to meet the new recommendation for gender diversity, either via succession planning or boardroom expansions.

In view of the above, how can CGLytics support public corporates’ growing demand for board diversity and effective succession planning, at the required pace?

Whilst at the same time guarantee they achieve a well-balanced board, paramount to maintaining good corporate governance for long-term success?

CGLytics’ Nominations & Governance solution is the answer. Basically, Nominations is a strategic tool through which nomination committees and HR teams are empowered to maintain a pulse on how the board composition of their organisations measures up against peers, investors’ requirements and market standards.

Using Nominations & Governance, nomination committees and HR teams can benchmark the skillset of their boards versus peers and competitors, prepare for investors’ pressure related to board composition, identify the right skills needed now and in the future to best serve the board’s ability to make the right decisions and build a talent pipeline, getting instant access to 125.000+ (including over 20.000 females) global executive profiles of key decision-makers from listed companies, including comprehensive biographies containing employment, compensation, education and extracurricular activities, to search, find, engage and network with the best-quality prospects for boardroom recruitment and succession planning.

Please get in touch should you want to know more.

Would you like to gain instant insights into more than 5,500 globally listed companies’ board composition, diversity, expertise and skills?

Or access the same CEO pay for performance insights used by Glass Lewis in their proxy papers?

Request a demo to learn more about CGLytics’ boardroom intelligence capabilities and executive remuneration analytics, currently utilized by world-leading institutional investors, activist investors and advisors.

Request a Demo

About the Author

Francisco Lopez, Regional Sales Director

Francisco Lopez is a senior sales professional with two decades of successful experience in delivering growth to organizations and building long-lasting, profitable and sustainable relationships with clients and stakeholders worldwide. Francisco has developed his career in the market intelligence, information services and technologies industries, having fulfilled senior business development positions at blue-chip organizations such as Nielsen and GfK. Prior to joining CGLytics, Francisco was the global head of the Industrials sector at a global supplier of SaaS solutions for third-party risk & performance management. Francisco holds a Master’s degree in Business Administration from the Complutense University of Madrid.

Latest Industry News, Views & Information

Shareholder Engagement and Corporate Governance Solutions

About the author