Providing unprecedented transparency to the U.S. market for constructing and assessing equity based compensation plans.

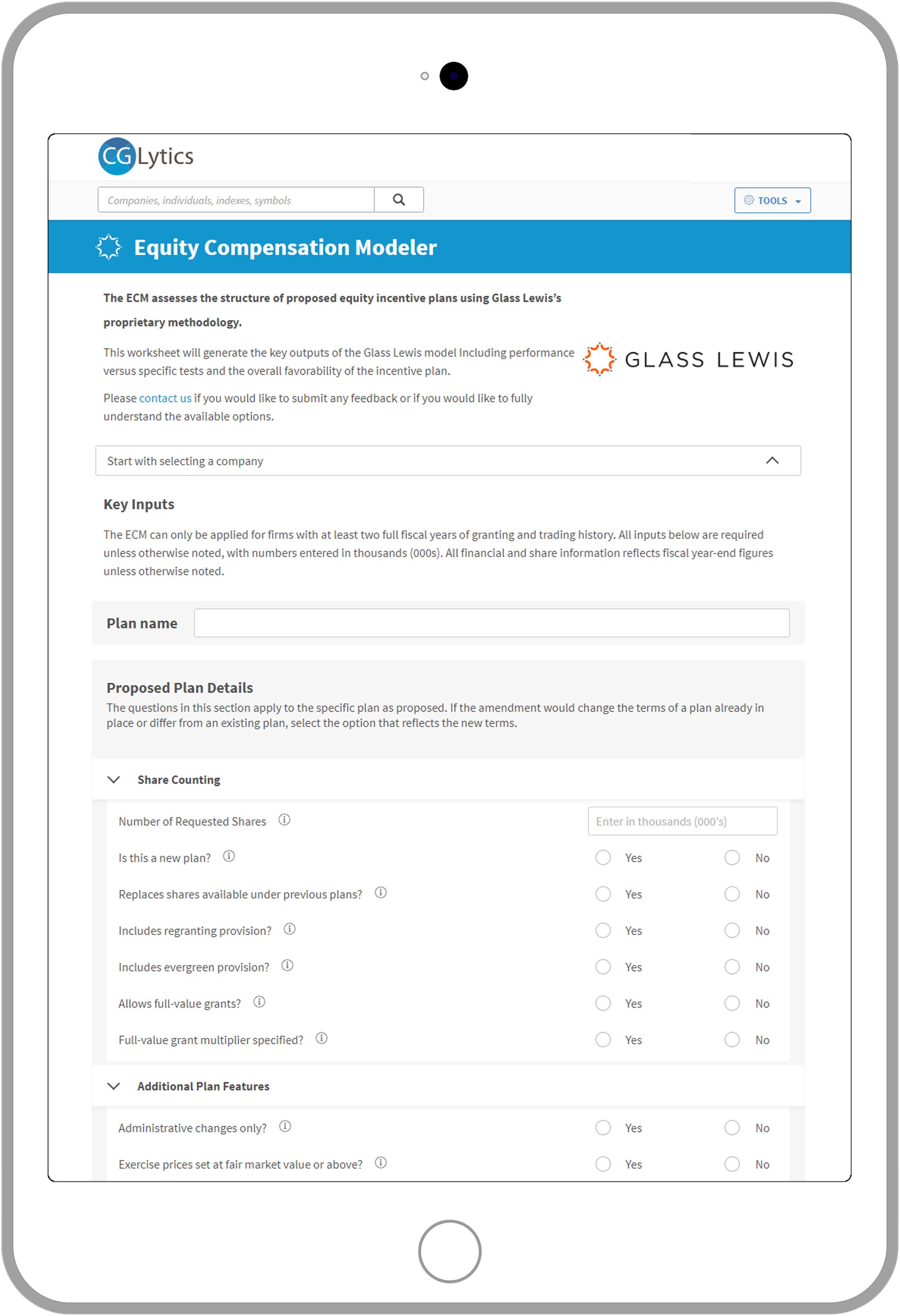

On-demand testing and reviewing equity compensation plans using leading proxy advisor Glass Lewis' key criteria and scoring system

Developed with Glass Lewis

As part of the global partnership between CGLytics and Glass Lewis

A new application in the CGLytics platform for assessing U.S. equity compensation plans

Get access to the same scoring and methodology used by Glass Lewis

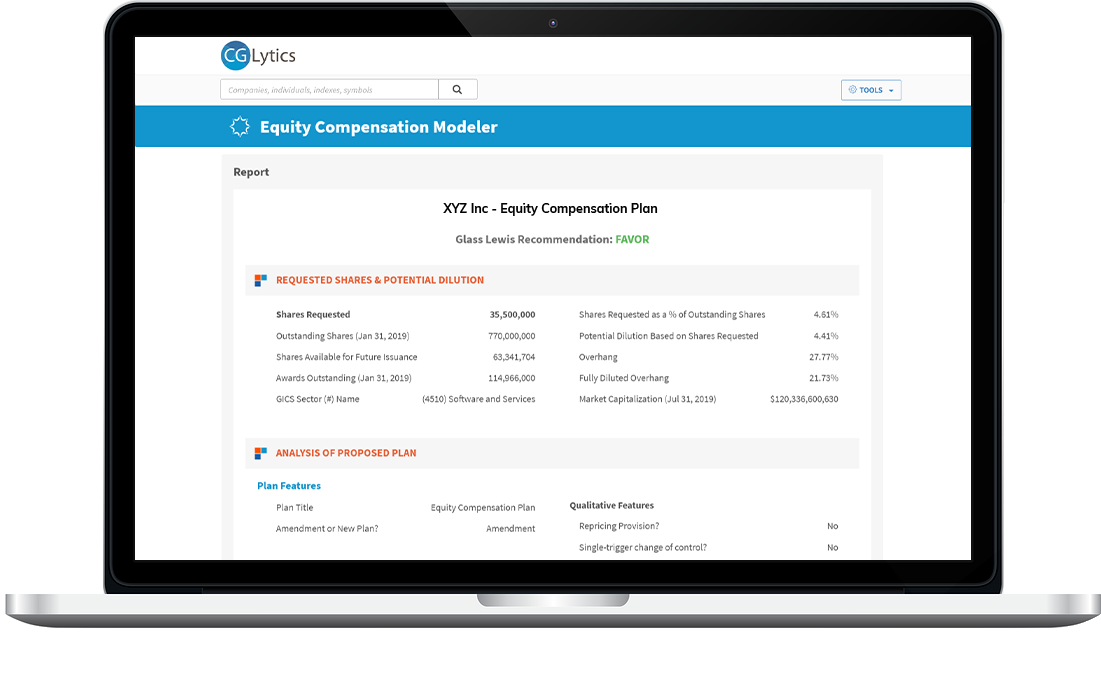

Companies and investors use the Equity Compensation Model to see how current and future share based compensation plans score against the 11 key criteria used by Glass Lewis and understand how they are perceived by proxy advisors

Have the best chance of receiving ‘for’ vote on equity proposals

Secure the votes necessary for your company’s equity plan proposal to legally grant equity compensation to your directors and employees for talent retention with competitive compensation and benefits.

Understand the impact of equity requests on your portfolio

Know you are making the best possible decisions for long-term shareholder returns in your investment portfolio by performing benchmarking of stock based compensation plan costs and evaluating risks of share dilution.

ECM delivers invaluable intelligence and much-needed transparency to the market

On-demand equity compensation plan testing

Glass Lewis’ Equity Compensation Model levels the playing field for both companies and investors for understanding the risks associated with stock based compensation plan proposal. Use the equity compensation tool by adjusting individual inputs of key financial tests to know the strengths and weaknesses of stock based compensation plans year-round.

Gain Insights into the concerns of proxy advisors and more than 1,300 investors trusted by Glass Lewis

Corporate issuers test and refine equity based compensation plans to reduce scrutiny and increase the likelihood of positive shareholder votes on proposals, while investors have visibility of equity plan that pose risks and push for changes in their investment portfolios.

Proactively test the share based plans of 4,300+ U.S. publicly traded companies

With data covering the testing of U.S. listed firms including Russell 3000, S&P 1500, S&P MidCap 400 and SmallCap 600, enhance engagements by identifying the key concerns and likely advice from proxy advisor Glass Lewis.

Driving modern governance practices to leading U.S. companies and investors

Bringing unique transparency to the market

Never before has a model such as Glass Lewis’ ECM been available for purchase in the market. Providing their proprietary methodology on stock based compensation assessment, companies and investors are empowered with unique insights into Glass Lewis’ key voting criteria.

Demonstrate effective stewardship and ensure success

Reduce any risk of share dilution or shareholders voting against your company’s stock based compensation grant. Lead your company forward, demonstrate modern governance practices and ensure long-term financial success.

Save valuable time and money with the right tools at your fingertips

Being equipped with the right tools for the job, take matters into your own hands and save on the costly fees from ISS, proxy solicitors and compensation consultants for evaluating stock based compensation plans.

"The ECM gives companies and investors the same governance tools we use internally and have developed over many years. It brings greater transparency, improved governance and market confidence by fostering alignment of corporate and investor interests in compensation plans."

- Aaron Bertinetti, SVP of Research & Engagement at Glass Lewis

Next steps:

Interested to learn more about how you can help your remuneration committee with tools to test and review your company’s equity compensation plan on-demand with Glass Lewis’ ECM?

Then join the webinar with Julian Hamud, Director of Executive Compensation Research from Glass Lewis and CGLytics for a 25 minute overview of the ECM.