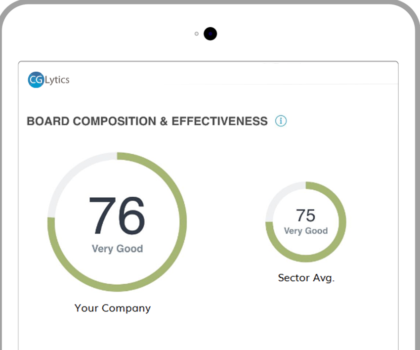

Get your Board Effectiveness Health Score from CGLytics.

Understand your board’s governance effectiveness, risks and red flag exposure and access the same insights as proxy advisors and activist investors. Calculated using 13 effectiveness attributes, and benchmarked against corporate governance codes and standards, gain an overall board effectiveness health score plus a breakdown including director interlocks, overboarding, gender equality, age, board independence and tenure.

If your company is a public company, fill out the form and a CGLytics representative will reach out to you with your free assessment.