In order to be a leading trusted service provider and advisor, financial and professional service firms require relevant, timely insights on companies’ governance practices.

CGLytics, powering Glass Lewis

Source Glass Lewis’ analysis for client engagement and advisory work

Leveraging sophisticated data analytics and tools provide a competitive advantage and efficiency in client services, advisory and business development work. With the greater adoption of ESG today, new tools and robust data is required for analyzing corporate governance practices and deeper integration in the services provided by financial institutions and professional services firms to asset owners, asset managers and corporates. These tools and data analytics can be deployed for creating defenses against activist campaigns, proactive shareholder engagement strategies, greater adoption of ESG, or spotting new opportunities.

CGLytics’ provides world-leading financial institutions, compensation consultants, proxy advisors and other professional service specialists advanced corporate governance analytics. With intuitive benchmarking tools, to compare and analyse governance practices of companies globally, enhance your offerings and deliver best-in-class solutions to your clients.

SMART DATA ANALYTICS TO HELP CLIENTS ACHIEVE THEIR STRATEGIC GOALS AND CORPORATE GOVERNANCE DECISIONS.

Save time and money with ready to use governance analytics at your fingertips

Building tools inhouse is costly and ensuring quality data is not an easy task. Customize your advice and reporting with access to the broadest and deepest governance data set in the market, available in a single SaaS solution.

Search, compare and analyse governance practices easily

With standardised data covering over 5,500 listed companies globally, search, compare and analyse an array of companies’ governance practices including executive compensation and boardroom effectiveness and diversity. Create preventive measures for governance inefficiencies and effective engagement.

Increase clarity to reduce risks and realise opportunities

Execute excellent advice and expand your offerings with access to real-time governance data and analytics to see potential red flags and realise new opportunities. Provide your clients with new tools and analytics for overseeing ESG risks.

10+ years of C-level board and compensation data

Measure executive pay against an array of unique key performance indicators and your own constructed peer groups, with compensation benchmarking tools used by leading investors and advisors including Glass Lewis.

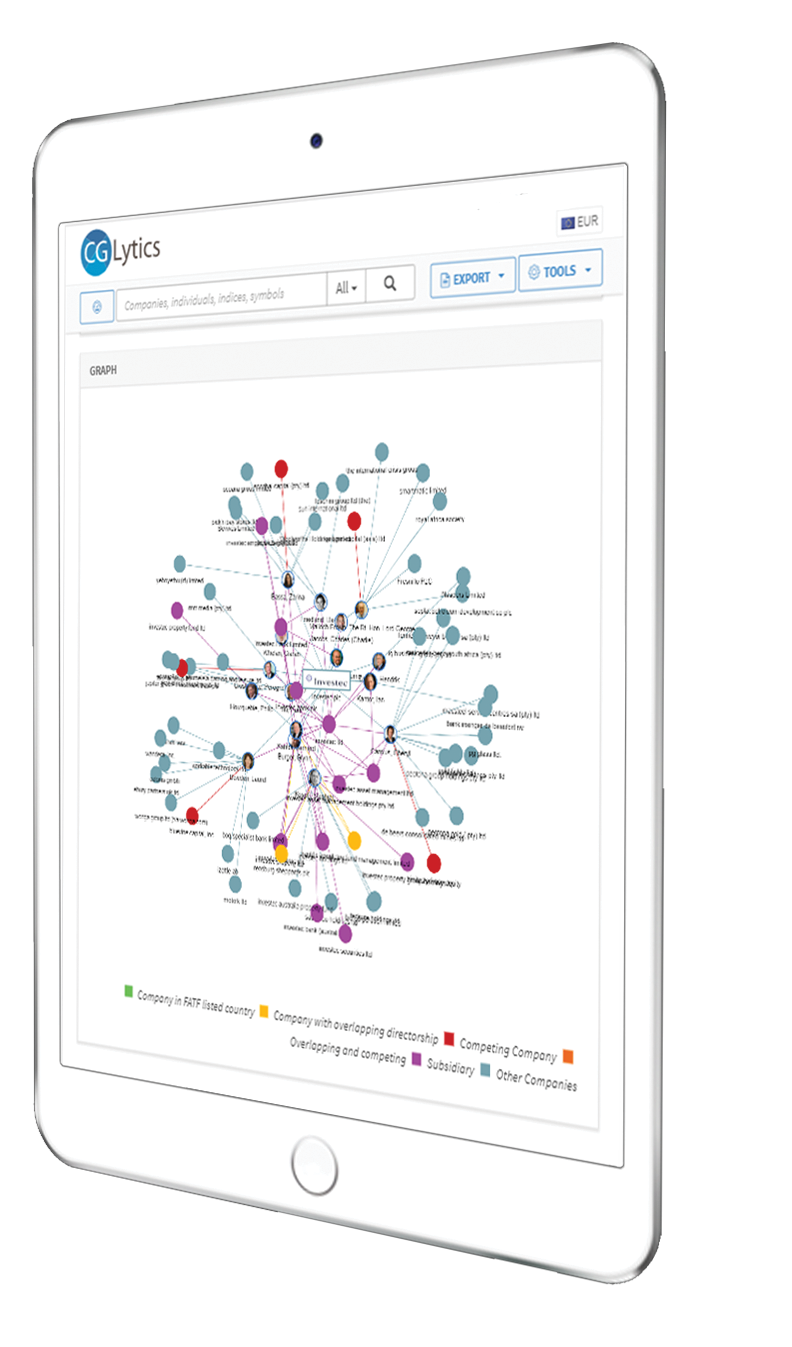

Drive business development with powerful relationships mapping tools

To take advantage of business opportunities you need access to the right networks. Access over 125,000+ C-level executive profiles with relationships mapping capabilities and find the simplest paths to connect.

Shareholder Engagement and Corporate Governance Solutions

With Over 1 Billion Data Points and Powerful Algorithms, CGLytics is Utilised by Leading Investors and Proxy Advisors.

5,500+

Listed Companies

125,000+

C-Level Profiles

8 MIL+

Company Disclosures

and Filings

800 Mil+

N-PX proxy voting

resolutions

1.3 Mil+

Relationships Connections

Key financial metrics from 2008 onwards for predictive analysis and companies top 25 ownership data

More than ten years of historical compensation data and array of unique performance indicators

Current and historical board composition, skills data and millions of business relations

Curated governance news in real-time