In the recent report published by PwC, using CGLytics data and analytics, the critical trends from the 2019 proxy season for Belgium and Luxembourg listed companies surrounding executive compensation were revealed.

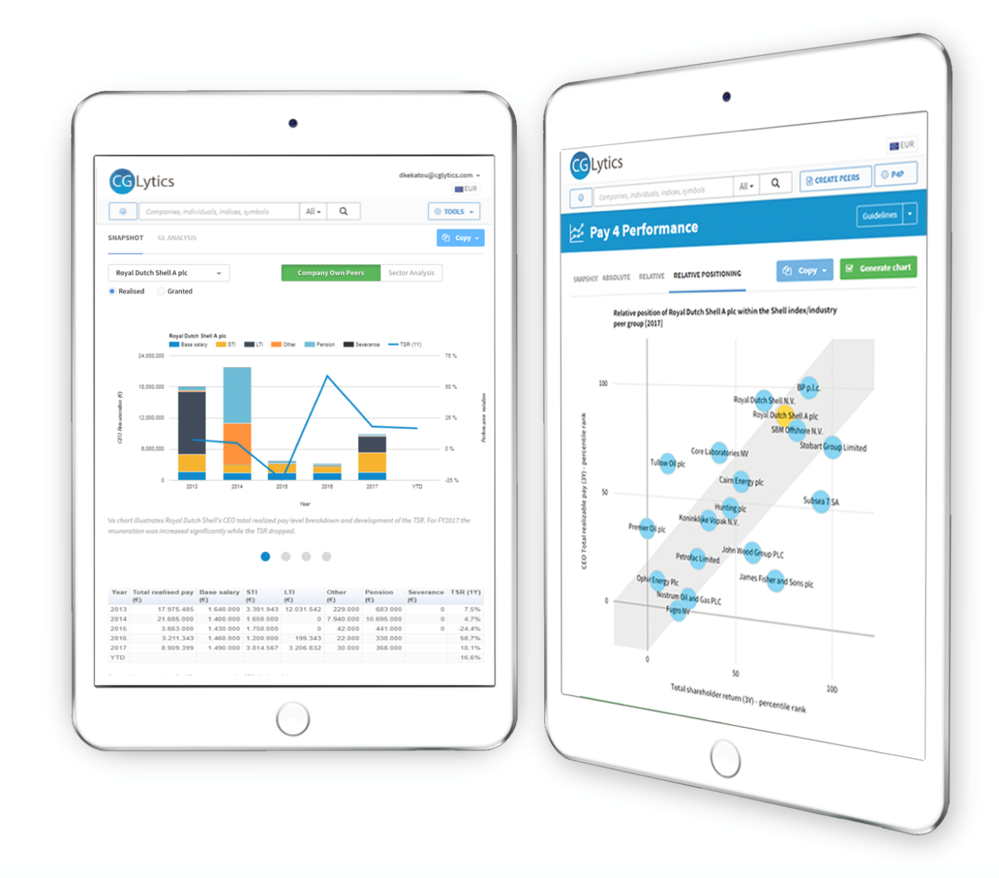

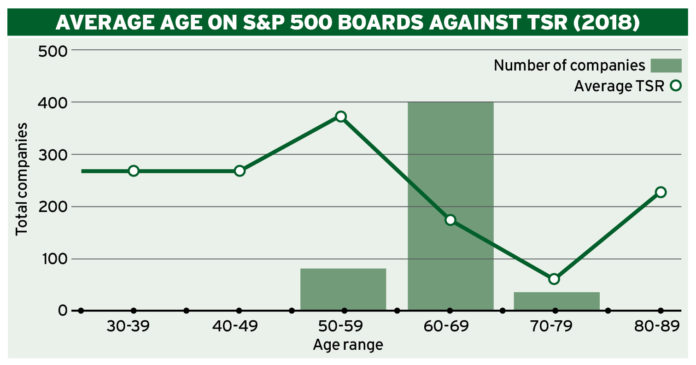

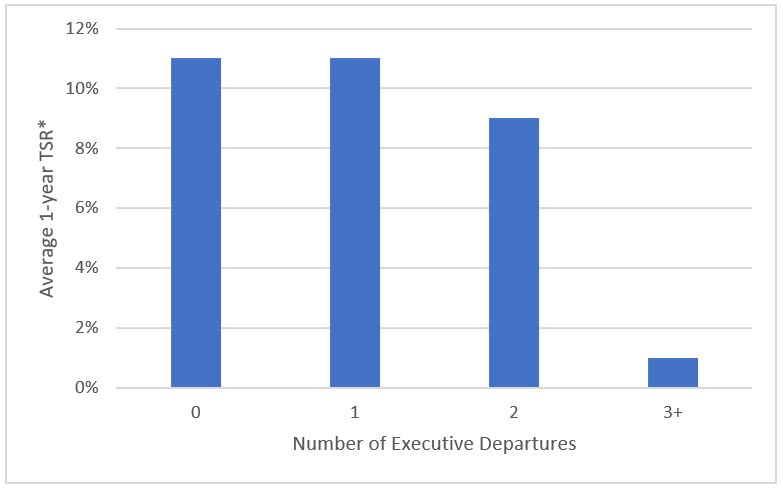

Analysis of votes on remuneration items shows an increasing focus on making sure companies have sustainable value creation and a growing expectation of increased disclosure of financial and non-financial information. Shareholders have become more active over the past few years and the average CEO total realised compensation seems to show a decreasing trend and is adapting slowly to the evolution of the total shareholder return.

Belgian companies see more revolt on remuneration items

Belgium listed companies were seen to be more active compared to shareholders of Luxembourg listed companies. The data of the Selected Index of 49 companies indicates that Belgian listed companies were more affected by shareholder revolt on remuneration items than Luxembourg companies.

Shareholder Rights Directive

Luxembourg successfully implementing SRD II, however Belgium failed to transpose the revised Shareholders Rights Directive to national law by the 10 June 2019 cutoff. Draft law implementing SRD II is being discussed in the Belgian Chamber of Representatives

The new Belgian Corporate Governance Code

The report sheds light on the new Belgian 2020 Corporate Governance Code (‘CGC’) compared to the 2009 CGC, which includes positive steps such as:

- • A cap being placed on short-term variable remuneration awarded to executive management; and

- • The principle that non-executive board members should receive part of their remuneration in the form of shares in the company.

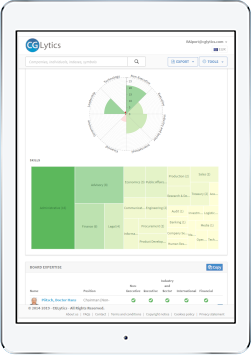

- • Particular attention to be paid to diversity, talent development and succession planning

Compensation design: Ratio of fixed versus variable remuneration

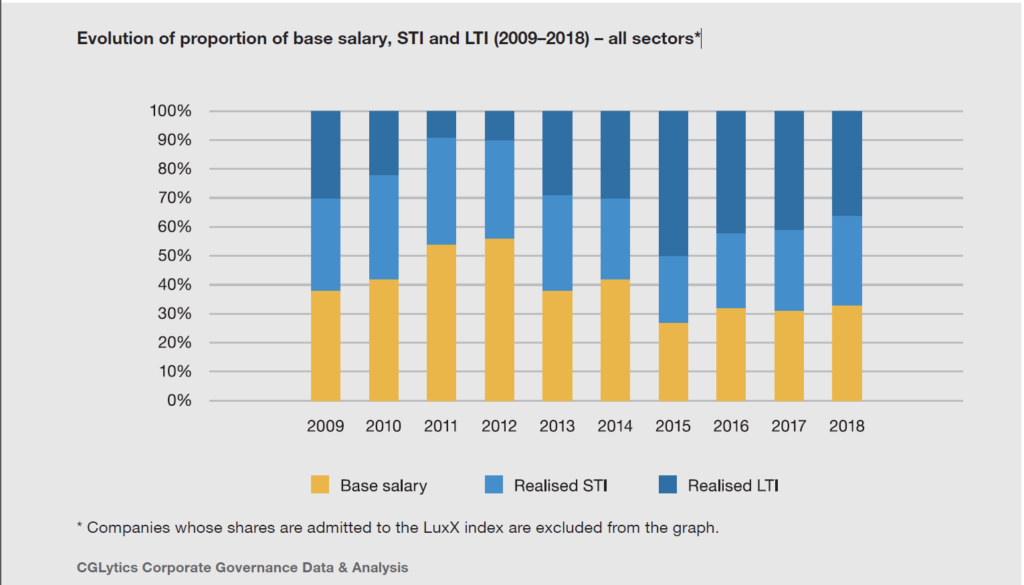

The report reveals that there is an increasing focus on long-term sustainable value creation.

The proportion of short-term incentives (STI) decreased from 2013 and continued to stagnate over the past few years. Next year’s analysis will tell whether the recent regulatory developments (the introduction of a cap on STI in the 2020 Belgian Corporate Governance Code) will impact the proportion of pay components.

To learn more about:

- • The implementation of the revised Shareholder Rights Directive (SRD II) into Belgian and Luxembourg law,

- • Evolution of votes on remuneration items,

- • Shareholder revolt seen in 2019,

- • Detailed insights into the CEO compensation mix (Base Salary, STIs, LTIs), and

- • CEO Pay for Performance alignment of the Selected Index

Download the report here