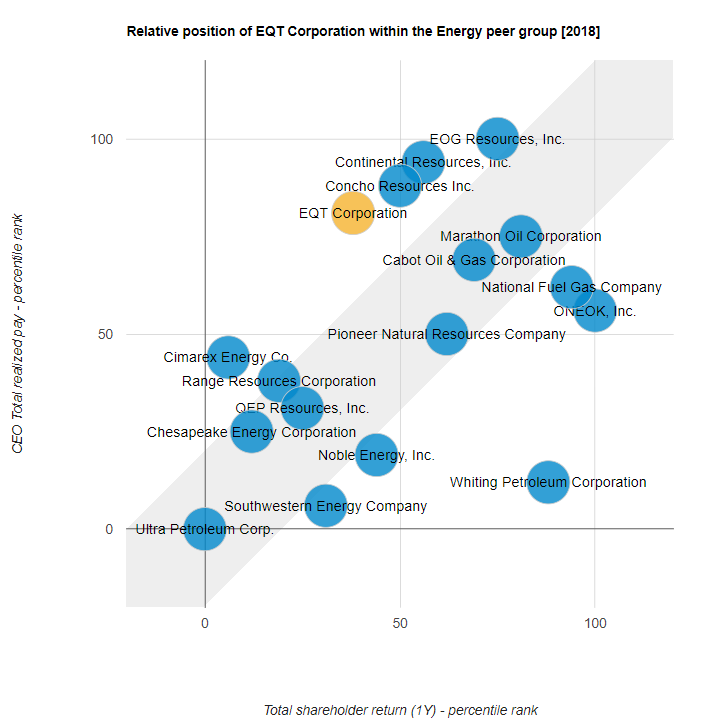

CEO Pay continued to dominate the AGM season in 2019. As we take a break over the summer, it’s worth reviewing the top 50 highest paid CEOs and seeing how this has changed from 2018.

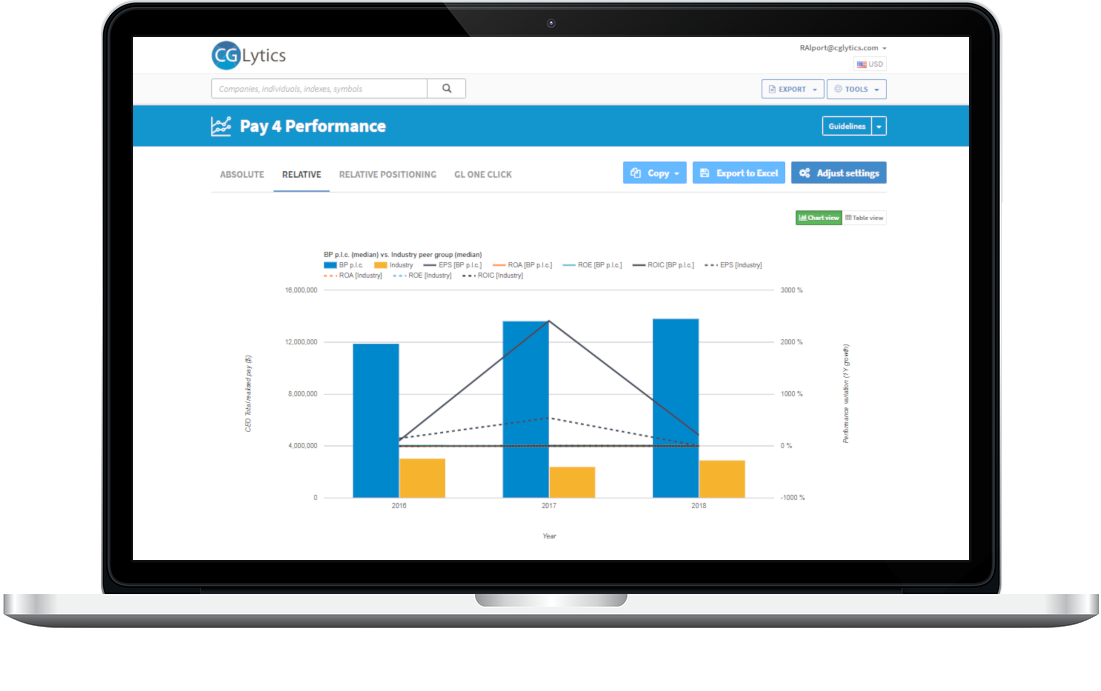

We also take a look at how the performance of these companies has increased to understand how executives are rewarded for performance.

Key CEO pay take aways from the first half of 2019 :

- The top 50 total granted compensation has increased by over 300% from 2018 to 2019 ($4.49bn compared to $1.12bn).

- Although over 50% of the $4.4bn is attributable to one individual’s granted compensation (Elon Musk, Tesla: $2.28bn).

- Even discounting this outlier, total granted executive compensation increased by 97%.

- Meanwhile the average growth in market capitalisation was around 3% from 2018.

- And 1 year Total Shareholder Return (TSR) actually shrank by 1%.

Given these significant increases in total granted compensation compared to the value being delivered to shareholders, it’s easy to see why CEO pay and compensation continues to dominate AGM discussions.

Trending Top 50 CEOs

|

Ranking |

CEO |

Company |

Total Granted |

Total Realised Pay |

TSR in % |

TSR 1YR growth in |

|

1 |

Musk, Elon |

Tesla, Inc. |

$2,284,044,884 |

$56,380 (513%) |

57% |

515% |

|

2 |

Smith, Patrick |

Axon Enterprise, Inc. |

$246,026,710 |

$25,488,720 |

565% |

592% |

|

3 |

Zaslav, David |

Discovery Communications, Inc. |

$129,499,005 |

$33,498,259 |

511% |

543% |

|

4 |

Glancey, Stephen |

C&C Group plc |

$119,819,023 |

$1,643,004 |

50% |

62% |

|

5 |

Hodler, Bernhard |

Julius Baer Group Ltd. |

$78,813,367 |

$2,979,804 |

640% |

639% |

|

6 |

Levine, Jay |

OneMain Holdings, Inc. |

$71,532,583 |

$71,532,583 |

67% |

62% |

|

7 |

Schwarzman, Stephen |

The Blackstone Group L.P. |

$69,147,028 |

$69,147,028 |

50% |

51% |

|

8 |

Legere, John |

T-Mobile US, Inc. |

$66,538,206 |

$42,071,611 |

50% |

57% |

|

9 |

Iger, Robert |

The Walt Disney Company |

$65,645,214 |

$66,065,073 |

54% |

56% |

|

10 |

Steele, Gary |

Proofpoint, Inc. |

$64,730,296 |

$54,931,367 |

66% |

510% |

|

11 |

Charlès, Bernard |

Dassault Systèmes SE |

$51,098,970 |

$65,983,199 |

518% |

517% |

|

12 |

Alber, Laura |

Williams-Sonoma, Inc. |

$50,758,332 |

$28,830,401 |

51% |

63% |

|

13 |

Heppelmann, James |

PTC Inc. |

$49,969,163 |

$17,041,464 |

536% |

546% |

|

14 |

Freda, Fabrizio |

The Estée Lauder Companies Inc. |

$48,753,819 |

$9,387,109 |

53% |

56% |

|

15 |

Buckley, Henry |

Uni-Select Inc. |

$47,774,090 |

$47,012,426 |

630% |

634% |

|

16 |

Handler, Richard |

Jefferies Financial Group Inc. |

$44,674,213 |

$5,951,709 |

633% |

638% |

|

17 |

Kilroy, John |

Kilroy Realty Corporation |

$43,624,774 |

$18,204,958 |

614% |

610% |

|

18 |

Bird, Lewis |

At Home Group Inc. |

$43,089,790 |

$1,614,791 |

639% |

632% |

|

19 |

Lebda, Douglas |

LendingTree, Inc. |

$42,318,238 |

$164,584,011 |

636% |

628% |

|

20 |

MacMillan, Stephen |

Hologic, Inc. |

$42,040,142 |

$12,231,622 |

64% |

56% |

|

21 |

Hogan, Joseph |

Align Technology, Inc. |

$41,758,338 |

$69,763,660 |

66% |

61% |

|

22 |

Schulman, Daniel |

PayPal Holdings, Inc. |

$37,764,588 |

$41,295,115 |

514% |

517% |

|

23 |

Hastings, Reed |

Netflix, Inc. |

$36,080,417 |

$4,064,854 |

539% |

547% |

|

24 |

Roberts, Brian |

Comcast Corporation |

$35,026,207 |

$47,400,117 |

613% |

613% |

|

25 |

Jellison, Brian |

Roper Technologies, Inc. |

$34,931,318 |

$142,847,568 |

54% |

59% |

|

26 |

Wenig, Devin |

eBay Inc. |

$34,842,832 |

$19,946,164 |

626% |

628% |

|

27 |

Thiry, Kent |

DaVita Inc. |

$32,017,501 |

$13,983,054 |

629% |

632% |

|

28 |

Kotick, Robert |

Activision Blizzard, Inc. |

$30,841,004 |

$4,307,586 |

626% |

622% |

|

29 |

Wichmann, David |

UnitedHealth Group Incorporated |

$30,824,112 |

$22,558,157 |

515% |

518% |

|

30 |

Dimon, James |

JPMorgan Chase & Co. |

$30,033,745 |

$18,136,934 |

67% |

68% |

|

31 |

Lutnick, Howard |

BGC Partners, Inc. |

$29,694,152 |

$17,791,850 |

643% |

659% |

|

32 |

Stephenson, Randall |

AT&T Inc. |

$29,118,118 |

$21,606,548 |

622% |

69% |

|

33 |

Narayen, Shantanu |

Adobe Systems Incorporated |

$28,397,528 |

$67,297,455 |

529% |

534% |

|

|

Benioff, Marc |

salesforce.com, inc. |

$28,391,846 |

$44,183,075 |

534% |

549% |

|

35 |

Moghadam, Hamid |

Prologis, Inc. |

$28,201,397 |

$35,887,540 |

66% |

516% |

|

36 |

Gorman, James |

Morgan Stanley |

$28,168,639 |

$19,299,856 |

623% |

624% |

|

37 |

Florance, Andrew |

CoStar Group, Inc. |

$27,555,954 |

$18,644,383 |

514% |

520% |

|

38 |

Greenberg, Robert |

Skechers U.S.A., Inc. |

$27,361,406 |

$11,157,656 |

640% |

637% |

|

39 |

Umpleby, D. |

Caterpillar Inc. |

$27,289,513 |

$14,840,544 |

618% |

616% |

|

40 |

Fink, Laurence |

BlackRock, Inc. |

$26,543,344 |

$51,471,260 |

622% |

621% |

|

41 |

Schleifer, Leonard |

Regeneron Pharmaceuticals, Inc. |

$26,520,555 |

$117,840,017 |

61% |

56% |

|

42 |

Chenault, Kenneth |

American Express Company |

$24,208,661 |

$54,431,474 |

63% |

61% |

|

43 |

Holmes, Stephen |

Wyndham Worldwide Corporation |

$21,479,166 |

$50,161,004 |

629% |

669% |

|

44 |

Johnson, R. |

HCA Healthcare, Inc. |

$21,419,906 |

$109,050,692 |

543% |

544% |

|

45 |

Banga, Ajaypal |

MasterCard Incorporated |

$20,379,353 |

$60,704,447 |

525% |

528% |

|

46 |

Brown, Gregory |

Motorola Solutions, Inc. |

$20,348,558 |

$69,555,180 |

530% |

535% |

|

47 |

Minogue, Michael |

ABIOMED, Inc. |

$19,243,230 |

$123,043,867 |

573% |

585% |

|

48 |

Casper, Marc |

Thermo Fisher Scientific Inc. |

$18,607,103 |

$85,476,755 |

518% |

524% |

|

49 |

Meyer, James |

Sirius XM Holdings Inc. |

$17,633,953 |

$50,452,233 |

57% |

56% |

|

50 |

Fairbank, Richard |

Capital One Financial Corporation |

$17,333,796 |

$108,527,637 |

623% |

622% |